01

TSMC’s 3nm process technology is very popular.

TSMC’s 3nm process accounted for 15% of the company’s revenue in the fourth quarter of 2023. At that time, only one customer of TSMC was using it, and that was Apple. However, a report from ICSmart stated that as more customers adopt this technology, the 3nm process node will account for a larger share of TSMC’s revenue.

The report mentioned that TSMC’s N3 series nodes (including N3B and N3E) will account for more than 20% of the foundry’s revenue in 2024. Currently, Apple exclusively uses TSMC’s N3B to manufacture the A17 Pro System on Chip (SoC) for smartphones, as well as the M3 series processors for iMac desktops and MacBook laptops. Later this year, AMD and Intel are expected to adopt TSMC’s N3E and N3B in their upcoming processors, hence it’s understandable that 3nm will occupy a higher proportion of TSMC’s revenue.

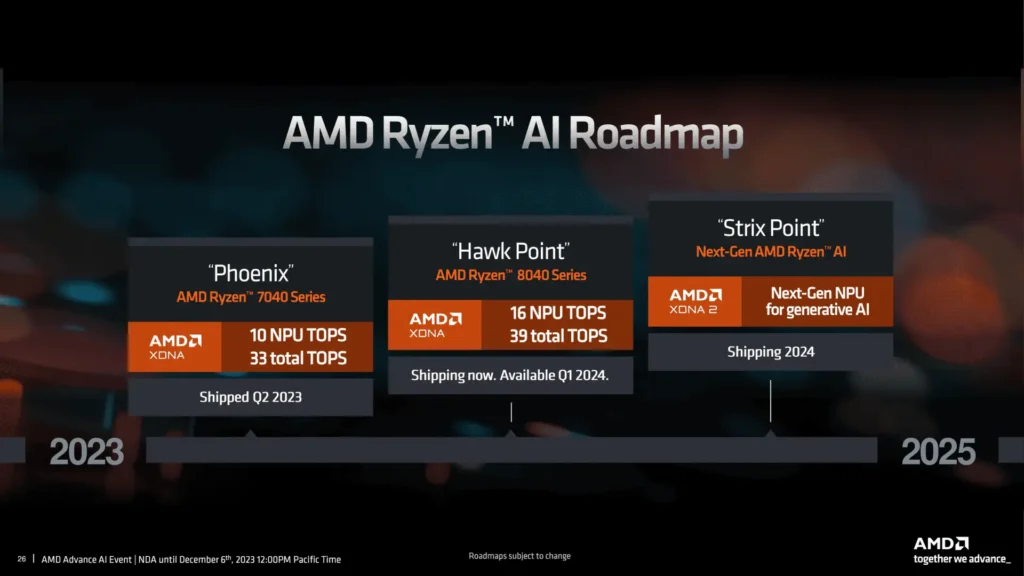

AMD is preparing to launch new processors based on the Zen 5 architecture later this year, which will use 3nm and 4nm process technologies. The platform codenamed Nirvana will also use TSMC’s 3nm technology and is expected to be released in the second half of this year.

Reports indicate that the upcoming iPhone 16 series from Apple will feature the A18 series processor, and the forthcoming Mac PC M4 series processors will also be manufactured using TSMC’s 3nm technology. ICSmart mentioned that production of these two major chips would start in the second quarter of this year, indicating Apple’s continued reliance on TSMC’s N3 series process.

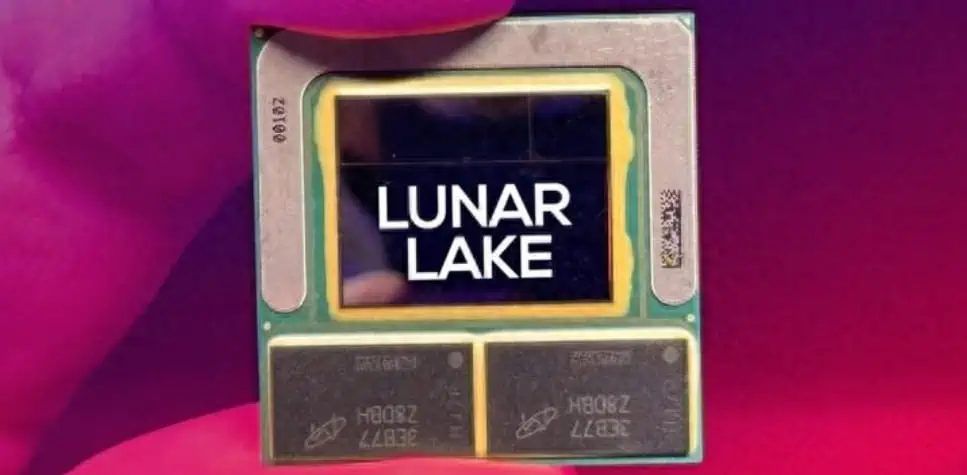

Intel is also expected to utilize TSMC’s 3nm process on its Lunar Lake MX SoC and plans to start mass production in the second quarter. The report notes that this marks Intel’s first time outsourcing the production of a full range of chips for its mainstream consumer platform to TSMC, highlighting TSMC’s increasing role in serving Intel, which is also a competitor in the foundry market.

With three major customers using TSMC’s 3nm series process technology, this node will occupy a larger proportion of TSMC’s revenue this year. By 2025, more companies are expected to adopt TSMC’s N3 process, including the performance-enhanced N3P, indicating that 3nm will account for more than 30% of TSMC’s earnings by then.

02

TSMC has become the world’s most profitable semiconductor manufacturer.

TSMC’s financial report for 2023 showed that the annual revenue was $69.298 billion, with NT$2,161.74 billion in revenue, a decrease of 4.5% year-on-year but better than expected, with a gross margin of 54.4%, a decrease of 5.2% year-on-year, an operating margin of 42.6%, a decrease of 6.9% year-on-year, and a net income of $31.389 billion, approximately NT$979.171 billion, a 14.4% decrease year-on-year, with earnings per share of NT$32.34.

Financial analyst Dan Nystedt tweeted that TSMC became the world’s largest semiconductor manufacturer for the first time in 2023 based on revenue, with TSMC’s revenue reaching $69.3 billion, surpassing Intel’s $54.23 billion and Samsung’s $50.99 billion.

York University Associate Professor Shen Rongqin stated that it took TSMC, established in 1987, 36 years to become the world’s largest semiconductor manufacturer, not just the largest foundry.

According to TSMC’s financial forecast released in January this year, the expected revenue for the first quarter of the year is between $18 billion and $18.8 billion, which is approximately NT$559.8 billion to NT$584.68 billion, a decrease of about 6.3% quarter-on-quarter; the gross margin is estimated to be between 52% and 54%, level with the last quarter of the previous year; the operating margin is expected to be between 40% and 42%.

Looking ahead to this year’s performance, TSMC President Wei Zhejia stated that despite the global economic uncertainties that may put pressure on consumer sentiment and market demand, the overall semiconductor industry’s output value (excluding memory) is expected to grow by 10% annually, and the foundry industry is expected to grow by about 20% annually. TSMC’s annual revenue in US dollars is likely to increase by 21% to 25% driven by AI and high-performance computing (HPC) demands.

Wei’s judgment indicates that TSMC is focusing this year’s revenue on AI and HPC, while the automotive chip foundry business, which previously saved many semiconductor giants during the semiconductor cycle, was not mentioned.

From the perspective of revenue structure, the share of IoT and automotive businesses in TSMC’s total revenue is declining. In the fourth quarter of 2023, the automotive business accounted for 5% of TSMC’s total revenue, flat quarter-on-quarter and down by one percentage point year-on-year. The IoT business accounted for 5% of the total revenue in the fourth quarter, down by four percentage points quarter-on-quarter and three percentage points year-on-year.

Counterpoint analysts believe that after inventory adjustments in the automotive and industrial applications in the third quarter of 2023, the inventory adjustment period will continue until the first quarter of 2024. TSMC will face challenges in 2024, including slow growth in non-AI and HPC sectors and weak demand in the automotive industry.

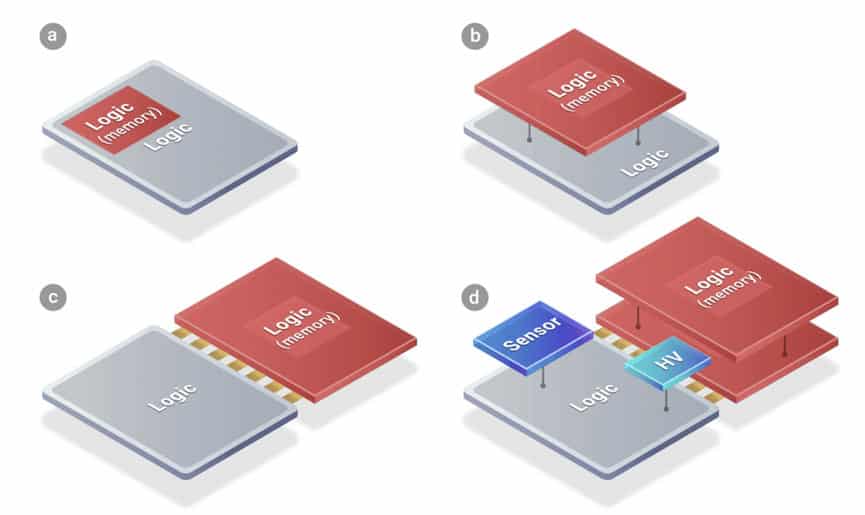

Regarding artificial intelligence, TSMC is actively increasing its System-on-Integrated-Chips (SoIC) production capacity plans, aiming to boost the monthly capacity to 5,000-6,000 by the end of 2024 to meet the strong future demand for AI and HPC. Currently, AMD and Apple are very interested in TSMC’s SoIC products, with the former being the first customer and the latter planning to integrate SoIC chips with thermo-plastic carbon fiber composite molding technology for use in Macs, iPads, and other products.

Counterpoint Research Assistant Director Brady Wang believes that TSMC’s strong growth in the 3nm process and AI applications makes it a major beneficiary in the AI semiconductor field. The market expects strong growth in AI applications in 2024, highlighting TSMC’s key role in providing advanced 5nm and 3nm technologies for enhancing AI computing devices, reinforcing its leadership and best position in the field.

Disclaimer: This article is created by the original author. The content of the article represents their personal opinions. Our reposting is for sharing and discussion purposes only and does not imply our endorsement or agreement. If you have any objections, please contact us through the provided channels.