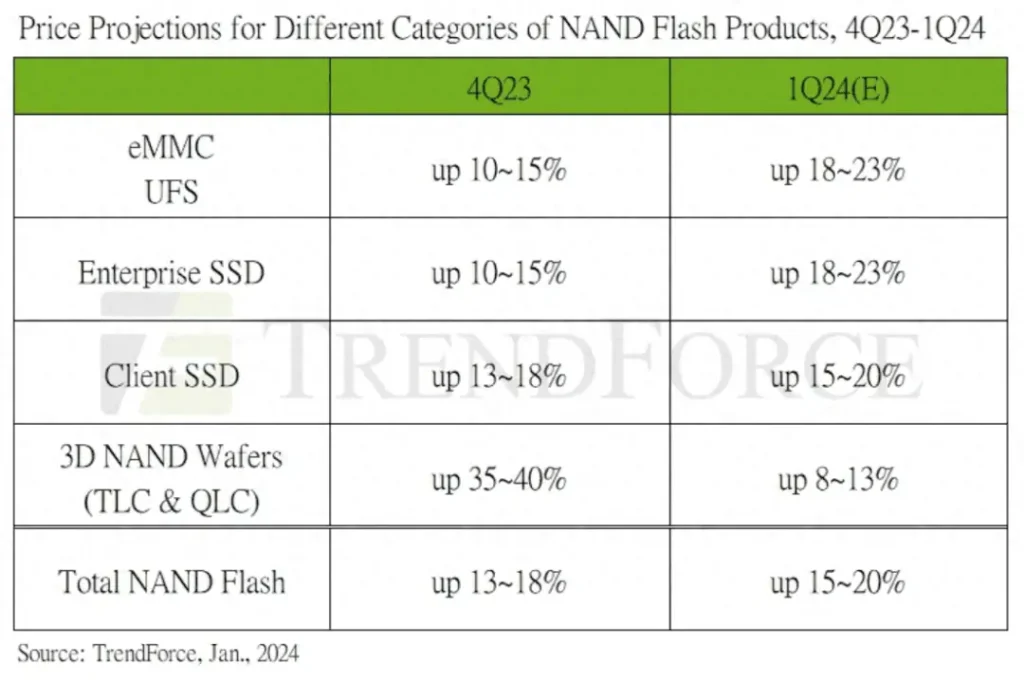

In the ever-evolving landscape of technology, TrendForce’s recent research has shed light on the intriguing dynamics within the NAND Flash and DRAM markets. Despite facing the traditional off-season demand, buyers are intensifying their purchases of NAND Flash products to establish secure inventory levels. This has triggered suppliers to implement a strategic move – raising prices to minimize losses. The first quarter of 2024 is expected to witness a significant 15%-20% increase in NAND Flash contract prices.

01

NAND Flash Price Dynamics

The surge in prices is a response to the concerted efforts of NAND Flash manufacturers aiming to offset losses. However, the future trajectory of price increases hinges on the recovery of enterprise-level SSD purchases. The challenge lies in matching demand with the rapid growth rates experienced. Suppliers are adopting different production strategies in the first quarter, with some increasing output in anticipation of rising demand.

02

Client SSD Market

In the realm of Client SSDs, PC OEMs are poised to reach their peak procurement in the first quarter of 2024. With PCIe 4.0 SSDs gaining popularity, suppliers are upgrading processes and securing substantial orders. The catch? Suppliers have significantly raised the prices of PCIe 4.0 products, paving the way for an expected 15%-20% increase in PC client SSD contract prices.

03

Enterprise SSD Demand

While demand from North American CSPs has not surged, Chinese CSPs and server brands are filling the gap, keeping the market unexpectedly active in the first quarter. The dynamics of eager buyers seeking to increase orders, coupled with suppliers’ firm pricing strategies, are expected to cause an approximately 18%-23% increase in enterprise SSD contract prices.

04

eMMC Industry Dynamics

The eMMC industry is undergoing a pricing revolution. Stabilizing demand for smartphones and Chromebooks has emboldened manufacturers and wafer factories to raise eMMC prices significantly. Ongoing production cuts have tightened the supply of small-capacity products, compelling buyers to accept price increases. In the first quarter of 2024, eMMC contract prices are poised to rise by about 18%-23%.

05

UFS and Smartphone Industry

The UFS market is witnessing manufacturers limiting supply and substantially raising prices, leading to extremely low inventory levels for smartphone clients, especially the sought-after UFS 4.0. Smartphone OEMs are expanding orders to address this shortage. Despite seller inventory meeting market demand, price increases for all UFS series products are expected to exceed 30%, with an anticipated 18%-23% increase in UFS contract prices in the first quarter of 2024, driven by the smartphone industry.

06

NAND Flash Wafers

The NAND Flash wafer market is marked by a significant short-term price increase and uncertain demand recovery. Module factories are selling off wafer inventories to ensure profits, weakening buyers’ enthusiasm for higher prices. Although manufacturers plan to raise prices, moderate increases of about 8%-13% are expected in NAND Flash wafer contract prices in the first quarter of 2024.

07

Dramatic Surge in DRAM Memory Prices

In the DRAM sector, a significant upward trend is evident. Major memory giants such as Samsung Electronics and Micron are planning to raise DRAM prices by 15%-20% in the first quarter of this year. This strategic move aims to prompt customers to plan their future usage needs. The industry anticipates a shift from NAND to DRAM in terms of upstream factory price increases, with DDR4 and DDR5 expected to be the next focal points for price adjustments.

08

Focus on DDR4 and DDR5

The industry anticipates DDR4 and DDR5 to be the next focal points for price adjustments. The stability in production capacity and demand for DDR3 results in a relatively moderate expected price increase. Memory module manufacturers, in response to upstream factories preparing to raise DRAM prices, have initiated stocking up. Contracted prices for supplying OEM factories are expected to reflect the full extent of the DRAM price increase starting from the second quarter, with a one-quarter delay.

09

Market Anticipation and Response

As memory module manufacturers stock up in anticipation of the DRAM price hike, the contracted prices for supplying OEM factories are expected to fully reflect the DRAM price increase from the second quarter onward, with a one-quarter delay.

10

DRAM and NAND Market Comparison

The terminal market exhibits a cautious atmosphere. The market performance in the first two quarters is deemed crucial. If the demand for major applications smoothly connects with international demand, the outlook for the memory market will be more certain. Reports suggest a cautious approach in the terminal market, with market performance playing a pivotal role in shaping the trajectory of the memory market in the first two quarters.

11

Supply Side Insights

On the supply side, the industry points out that the supply situation for both DRAM and NAND in Q4 2023 is not scarce. However, a key condition is that buyers must accept the prices proposed by the original factories. As long as the price aligns with expectations, and the original factories have sufficient stock to sell, a balance is maintained between supply and demand.

12

DRAM Production Capacity in 2024 Q1

Looking ahead to 2024 Q1, the overall DRAM production capacity supply tends to be cautious. Future suppliers are expected to continue reducing production in mature processes and shift towards advanced process technology. This strategic move aligns with the industry’s adaptation to technological advancements, ensuring a balance between supply and demand.

13

Industry Cycle Perspective

From the perspective of the industry cycle, overseas major factories are seen to be in control of operations. This dynamic has gradually improved the balance between storage supply and demand. Mainstream storage prices have witnessed a steady rise since 2023 Q3, driving niche storage prices to bottom out and rebound in Q4. The increase in wafer prices since the end of August last year has begun to transmit to the module end.

14

Conclusion

In conclusion, TrendForce’s research provides valuable insights into the complex dynamics of the NAND Flash and DRAM markets in 2024. The anticipated price increases, strategic shifts in production, and the delicate balance between supply and demand underscore the industry’s resilience and adaptability. As the memory market navigates uncertainties, stakeholders must stay vigilant and responsive to market cues for informed decision-making.

15

FAQs

-

Q: How will the expected increase in NAND Flash prices impact consumers?

A: Consumers may witness higher prices for devices incorporating NAND Flash, potentially affecting the overall cost of electronics.

-

Q: What factors contribute to the cautious atmosphere in the terminal market?

A: Uncertain demand, coupled with cautious buyer behavior, creates an atmosphere of anticipation and careful market observation.

-

How are memory module manufacturers preparing for the DRAM price hike?

A: Memory module manufacturers are stocking up in anticipation of the DRAM price hike, ensuring they have ample inventory.

-

Q: Why are DDR4 and DDR5 expected to be the focal points for price adjustments?

A: Major players in the industry are anticipating a shift from NAND to DRAM, with DDR4 and DDR5 likely to see strategic price adjustments.

-

Q: What role do overseas major factories play in the industry cycle?

A: Overseas major factories control operations, contributing to the gradual improvement in the balance between storage supply and demand.

Related: