01

Overall Layout: Four Major Cluster Regions

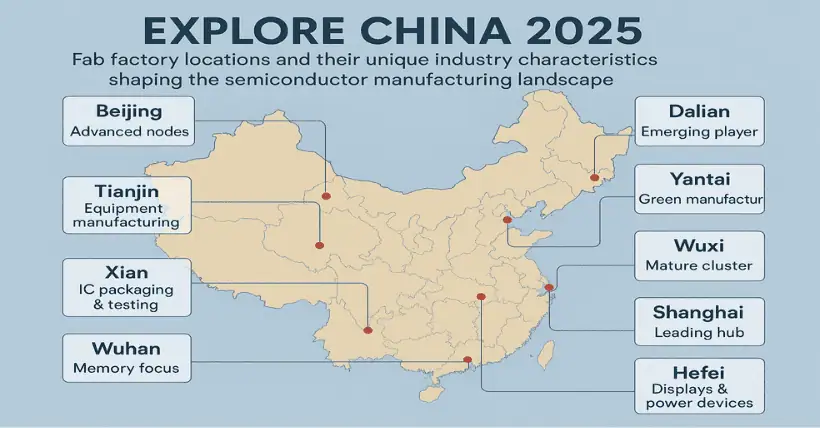

Mainland China’s wafer fabrication (Fab) industry exhibits a pattern of “core concentration along the eastern coastal belt with multi-point centralized distribution,” primarily divided into:

- Bohai Rim Region (represented by Beijing, Tianjin, Qingdao)

- Yangtze River Delta Region (Shanghai, Jiangsu, Zhejiang)

- Pearl River Delta Region (Guangdong, especially Shenzhen and Guangzhou)

- Central-West and Northeast Supplementary Areas (Wuhan, Hefei, Chengdu, Chongqing, Dalian, etc.)

02

Regional Distribution and Industrial Focus

1. Bohai Rim Region: Led by the Capital Economic Circle

Beijing: Hosts leading foundries (e.g., SMIC Beijing, Yandong Micro), advanced nodes (e.g., 28nm, 22nm FinFET), specialized processes (e.g., BCD, GaN, SiC), supporting automotive electronics and AI chip demands.

Qingdao: Emerging fabs (e.g., Xinen Qingdao), focus on power devices (e.g., MOSFETs, IGBTs), analog chips, automotive-grade MCUs, with collaboration from downstream OEMs like Haier and Hisense.

Dalian: Primarily focused on memory chips; the former Intel facility was acquired and upgraded by SK Hynix as a global 3D NAND hub.

Key Features

- Strong R&D capacity, attractive to policy support, aimed at high-end international markets.

- Local support ecosystem improving (e.g., cooperation with equipment maker NAURA).

2. Yangtze River Delta Region: The Strongest High-End Manufacturing Hub in China

Shanghai: Hosts key players (e.g., SMIC, Hua Hong), multiple-node deployment including 14nm/28nm/40nm FinFET, RF-SOI, specialty NVM/MCU, balancing advanced processes and niche applications.

Wuxi: Covers memory (SK Hynix), power devices (e.g., CR Micro, CR Advanced, Hua Hong), smart cards, MCUs. Infineon Wuxi also strong in back-end packaging/testing, with both international and domestic giants present.

Nanjing: TSMC focuses on 16nm, serving the local smart vehicle market, gradually expanding to 28nm capacity.

Hangzhou/Shaoxing/Ningbo/Huai’an/Yangzhou: Focus on power devices, sensors, display drivers, CIS, with players such as Chiplink, SMIC Ningbo, Rongxin Semiconductor, Jihai Semiconductor, Silan Micro, Yangjie Tech, Fuxin Semiconductor, Haixinwei, Huaxin Jiechuang.

Suzhou/Jiaxing: Hosts fabs like Hejian (Suzhou), Innoscience (GaN), focuses on back-end packaging/testing, supporting system integration with 8″/12″ fabs.

Key Features

- Concentrated large-scale projects and advanced node capacity, full industry chain (design, manufacturing, testing, materials, equipment).

- High market share with numerous innovative domestic and international enterprises.

3. Pearl River Delta Region: Application-Oriented Innovative Manufacturing

Shenzhen: Evolved from traditional IC design center to include wafer manufacturing, power devices, and third-generation semiconductors (SiC/GaN), with rapid monthly capacity expansion.

Guangzhou: Led by Cansemi and Giga Semiconductor, focuses on CIS, display chips, 55–22nm logic, and aggressive third-gen semiconductor expansion (e.g., Chipower, Chipunion).

Emerging Fabs like Pengxinwei and Pengxin Xu: Focus on mature logic manufacturing for automotive, renewable energy, imaging applications.

Key Features

- Strong market orientation, forming a closed-loop of “design–manufacturing–application” close to South China’s consumer electronics and automotive base.

- Fast innovation, rich variety, supporting regional high-end manufacturing upgrades.

4. Central-West and Northeast Regions: High-End Memory and Supply Chain Completion

Wuhan, Hefei: YMTC and CXMT achieved breakthroughs in NAND Flash and DRAM, forming China’s “twin stars” in memory ICs. CR Micro Integrated becomes the third-largest domestic fab.

Chengdu, Chongqing: Specialty process fabs fill western gap; align with local EVs, 3C industries, e.g., MGT Semiconductor (Chongqing) for mid/low-voltage MOS, TI Chengdu, Hua Hong Chengdu, BYD Chengdu, CR Micro Chongqing, ST & Sanan JV.

Xiamen/Fujian: Includes Sanan Optoelectronics, Silan Jike, Jinhua Integrated Circuits, Fulian IC, Jishunxin.

Xi’an: Early 12″ NAND Flash investments by Micron and Samsung.

Changsha/Zhuzhou: Third-gen semiconductors (e.g., Sanan, Tyco Tianrun), CRRC Times Semiconductor.

Shenyang, Dalian (Northeast): Strong historical base; continued NAND Flash upgrades and international collaboration hubs.

Key Features

- Focus on memory and power devices, supporting domestic supply chain autonomy.

- Drives regional upgrades in IC design, testing, equipment.

03

Technology Focus and Industry Specialties

- Advanced Logic Processes: Centered in Shanghai, Nanjing, Beijing, with strong clusters at 28nm, 16/14nm, 22/14nm FinFET, moving toward smaller nodes.

- Specialty Processes (Power, BCD, RF, MEMS, etc.): Densely located in Bohai Rim and Pearl River Delta, strongly supporting local auto, industrial, and consumer electronics.

- Third-Generation Semiconductors (GaN, SiC): Leading setups in Guangzhou, Shanghai, Shenzhen; boost capabilities in high-voltage, high-frequency applications.

- Memory Chips: Wuhan and Hefei are leading NAND/DRAM domestic breakthroughs.

- RF, CIS, MCU, etc.: Rapid development in Yangtze and Pearl River Deltas, supporting IoT and smart terminals.

04

Industrial Cluster Effect and Collaborative Synergy

- Interregional complementarity (e.g., memory vs logic, automotive vs consumer, specialty vs general processes), enabling regional interconnectivity.

- Significant upstream-downstream synergy across fabs, equipment, materials, IC design (e.g., with NAURA, CAS, etc.).

05

Conclusion Analogy

China’s semiconductor fab layout can be likened to a “multi-branched tree”:

- Roots: Yangtze River Delta (deepest industrial foundation, most energy)

- Trunk: Bohai Rim/Beijing-Tianjin-Hebei (innovation hub, connecting regions)

- Branches: Pearl River Delta and Central-West (application-driven innovation, flourishing ecosystem)

- Leaves: Various fab types and specialized process branches forming a self-sufficient, domestically controllable platform.

In short, the distribution of fabs across mainland China shows multi-regional collaboration, a complete industry chain, and a balanced emphasis on advanced and specialty manufacturing, forming a national network covering logic, specialty, memory, and third-gen semiconductors. This lays a solid foundation for China’s continuous IC industry upgrade and global competitiveness.

Disclaimer:

- This channel does not make any representations or warranties regarding the availability, accuracy, timeliness, effectiveness, or completeness of any information posted. It hereby disclaims any liability or consequences arising from the use of the information.

- This channel is non-commercial and non-profit. The re-posted content does not signify endorsement of its views or responsibility for its authenticity. It does not intend to constitute any other guidance. This channel is not liable for any inaccuracies or errors in the re-posted or published information, directly or indirectly.

- Some data, materials, text, images, etc., used in this channel are sourced from the internet, and all reposts are duly credited to their sources. If you discover any work that infringes on your intellectual property rights or personal legal interests, please contact us, and we will promptly modify or remove it.