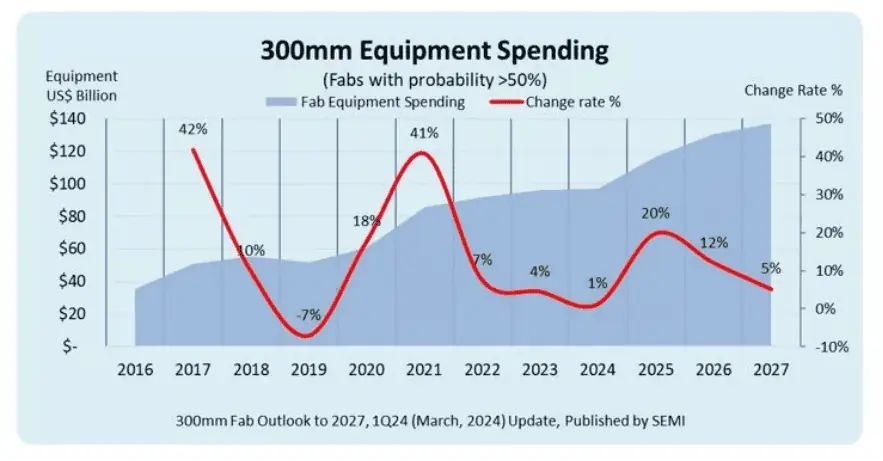

Global investment in 300mm wafer fab equipment applied to the front-end process is expected to exceed $100 billion in 2025 for the first time.

International Semiconductor Industry Association (SEMI) on March 19 released the “2027 300mm fab outlook report”. The report shows that due to the recovery of the memory market and the strong demand for high-performance computing, and automotive applications, the global application of the front-channel process of 300mm fab equipment investment, is expected to exceed $ 100 billion in 2025 for the first time in 2027 will reach a record $ 137 billion.

SEMI forecasts that global 300mm fab equipment investment will grow 20% to $116.5 billion in 2025, 12% to $130.5 billion in 2026, and will continue to grow 5% to $137 billion in 2027.

SEMI President and CEO Ajit Manocha said the forecast for a surge in spending on such equipment over the next few years reflects a new rush to meet the growing demand for electronics in different markets, as well as innovations in Artificial Intelligence (AI).SEMI’s latest report also emphasizes the importance of increased government investment in the semiconductor manufacturing industry to boost the global economy and security, a trend that is expected to significantly narrow the gap in equipment spending between emerging regions and the previously most developed regions in Asia’s semiconductor manufacturing industry.

Sub-regional perspective, SEMI said mainland China will continue to lead the wafer fab equipment spending, the next four years the annual investment will reach $ 30 billion. China, Taiwan, and South Korean manufacturers are also accelerating equipment investment, which is expected to 2027, China Taiwan equipment spending will increase from $ 20.3 billion in 2023 to $ 28 billion in 2027, ranking second. South Korea is expected to increase from $19.5 billion in 2024 to $26.3 billion in 2027, ranking third.

America’s 300mm fab equipment investment is expected to double from $12 billion in 2024 to $24.7 billion in 2027. While Japan, Europe and the Middle East, Southeast Asia, equipment spending, is expected to reach 11.4 billion U.S. dollars, 11.2 billion U.S. dollars, and 5.3 billion U.S. dollars in 2027, respectively.

In terms of segmentation, SEMI said that this year’s equipment spending in the field of wafer foundry is expected to decline by 4% to $56.6 billion, partly due to the greater than 10nm mature node investment slowdown. It is expected that by 2027, the wafer foundry market equipment spending will reach $79.1 billion.

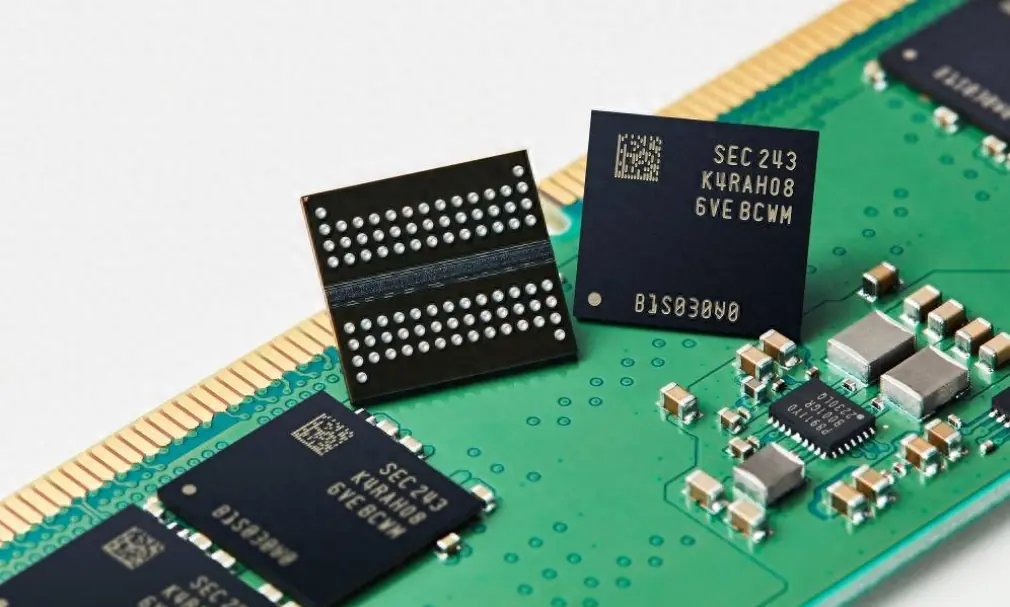

The memory manufacturing equipment segment accounts for the second largest share, with SEMI, indicating that increased demand for data throughput from AI servers is driving strong demand for memory chips such as HBM and spurring increased investment in the segment. Memory manufacturing equipment investment is expected to reach $79.1 billion in 2027, a compound annual growth rate of 20% compared with 2023. Among them, equipment spending on DRAM will reach $25.2 billion by 2027, and 3D NAND equipment spending will reach $16.8 billion.

In addition, SEMI expects that by 2027, analog chips, optoelectronics, and discrete components in the field of 300mm equipment spending will increase to $5.5 billion, $2.3 billion, and $1.6 billion, respectively.

According to SEMI’s previous report, global semiconductor manufacturers are expected to increase 300mm fab capacity to an all-time high of 9.6 million wafers per month (wpm) in 2026. SEMI President and CEO Ajit Manocha said, “While the pace of global 300mm fab capacity expansion is slowing, the industry remains focused on adding capacity to meet strong long-term demand for semiconductors.” “The foundry, memory, and power sectors will be the main drivers of the new record capacity growth expected in 2026.”

Chipmakers that are expected to add 300mm wafer fab capacity to meet demand growth during the 2022 to 2026 forecast period include GlobalFoundries, Hua Hong Semiconductor, Infineon, Intel, Armor, Micron, Samsung, SK Hynix, SMIC, STMicroelectronics, Texas Instruments, TSMC, and UMC. The companies plan to build 82 new facilities and production lines between 2023 and 2026.

According to the SEMI 300 mm Fab Outlook To 2026 update released on March 14, 2023 lists 366 facilities and production lines – 258 in operation and 108 planned for future construction.

From the application point of view, the demand for 300 mm wafers mainly comes from the three major fields of storage, logic chips, and CIS, with storage DRAM, 3D NAND, and 2D NAND together accounting for 55% of the total, making it the largest application field for 300 mm. From the downstream terminal point of view, mainly to cell phones, computers, servers, communications, industrial, automotive and other high-end fields.

As 300 mm wafers have higher production efficiency, lower cost, more high-end application areas, and other excellent features, driven by numerous downstream demands, the current supply has exceeded demand. According to SUMCO’s data, the demand for 300 mm wafers in 2021 is about 7.5 million pieces/month, which is expected to maintain a compound annual growth rate of 8.4% over the next five years, to 2026 the global demand for 300 mm wafers is expected to reach 10 million pieces/month. But even so, due to fab expansion lagging fab, in terms of supply, the fab’s new capacity in the next five years can only maintain a compound annual growth rate of 5.3% growth, so the global 300 mm wafer supply and demand gap will continue to exist.

The semiconductor wafer industry belongs to the manufacturing post-cycle industry, wafer companies will greatly benefit from the dividends brought by the wafer fab capacity. Especially in the wafer market supply is limited, and the new capacity has not been released under the background of the foundry expansion making the semiconductor wafer dosage demand rise linearly, resulting in the wafer supply exceeding demand, volume, and price rise. Taking into account that the wafer fab capacity expansion cycle is more than 2 years, a long time in the future, the wafer supply and demand gap will continue to exist.

Related:

- 2024 Semiconductor Giants: Annual Performance Breakdown

- 2024 GPU Market Revenue Surpasses $98.5 Billion Worldwide

- Chip Market Buzz: Apple and Samsung Pursue Intel Buyout!

- 2023 Top 10 Auto Semiconductor Giants: Who Earns the Most?

- Revealed: China Semiconductor Boom, 40% Rise in Q1 2024!

- Insights into Semiconductor Industry Development Trends 2024

- Intel Halts Italy Test Plant, French R&D Investments

- The Global Chip War: What’s Behind the Fierce Competition?

Disclaimer:

- This channel does not make any representations or warranties regarding the availability, accuracy, timeliness, effectiveness, or completeness of any information posted. It hereby disclaims any liability or consequences arising from the use of the information.

- This channel is non-commercial and non-profit. The re-posted content does not signify endorsement of its views or responsibility for its authenticity. It does not intend to constitute any other guidance. This channel is not liable for any inaccuracies or errors in the re-posted or published information, directly or indirectly.

- Some data, materials, text, images, etc., used in this channel are sourced from the internet, and all reposts are duly credited to their sources. If you discover any work that infringes on your intellectual property rights or personal legal interests, please contact us, and we will promptly modify or remove it.