TSMC’s latest financial report brings good news, with chip stocks making a strong rebound. AMD and Nvidia’s stock prices both hit new highs.

On January 18th, TSMC’s Q4 financial report showed that the company achieved a net profit of 238.7 billion Taiwan dollars in the fourth quarter, a year-over-year decrease of 19% but a sequential increase of 13%; revenues reached 625.5 billion new Taiwan dollars, both exceeding expectations.

Boosted by the optimistic outlook for AI chip demand, overnight chip stocks overall rebounded strongly, outperforming the broader market and approaching historic closing highs. The Philadelphia Semiconductor Index and the Semiconductor Industry ETF SOXX both closed up approximately 3.4% and 3.3% respectively.

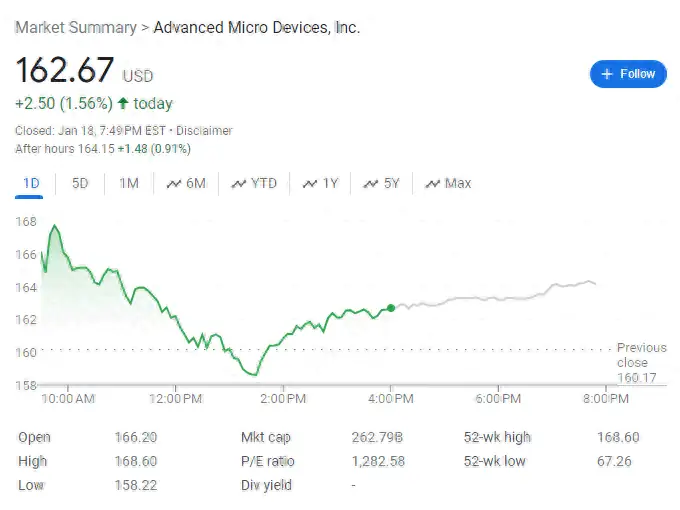

As a major downstream supplier of TSMC, AMD closed up over 1%, with its stock price at one point increasing more than 3%, joining hands with Nvidia to reach all-time high stock prices.

Chip demand soars returns to growth after the first quarter After the earnings release, TSMC surged by 9.8%, leading the semiconductor sector.

In terms of business divisions, TSMC’s fourth-quarter revenue from high-performance computing (HPC) increased by 17%, while smartphones grew by 27%.

TSMC indicated that it expects strong demand for HPC applications (including generative AI) in the first quarter of 2024, but the smartphone business might be weak.

TSMC’s Vice President and Chief Financial Officer, Wendell Huang, stated:

“Entering the first quarter of 2024, we expect our business to be affected by the seasonal impact of smartphones, but this will be partly offset by the continued growth in demand related to HPC.”

As the demand for high-performance computing increases, the competition for advanced chip manufacturing processes, including those from TSMC and Samsung, has gradually spread from 5nm to 3nm.

Previously, analysts at Jefferies wrote in a research report:

“TSMC is collaborating with almost all smartphone suppliers on 3nm technology.”

“The company reiterated that its involvement in 2nm is much higher than at a similar stage in 3nm, partly driven by applications related to artificial intelligence.”

The financial report also shows that TSMC’s 3nm chip business accounted for 15% of its quarterly wafer revenue, significantly higher than the previous quarter’s 6%. Chips of 7nm and below made up 67% of the revenue.

In terms of performance guidance, TSMC expects its first-quarter revenue to decrease to around $18-18.8 billion, but anticipates growth in each subsequent quarter, with HPC being a key driving factor.

This means that the chip demand, which was weak last year, is expected to rebound in the coming quarters due to the ongoing AI wave, with prospects for industry recovery.

Tim Ghriskey, a senior industry figure, commented:

“I think you will continue to hear discussions about artificial intelligence, which will translate into significant input growth for many companies like TSMC.”

“For the semiconductor industry, it’s a market determined by supply and demand.”

Boosted by optimistic prospects, AMD’s stock price reaches a new high

As the main supplier for chip giants AMD and Nvidia, TSMC’s better-than-expected performance and positive guidance drove both companies’ stock prices to record highs.

Bernstein analyst Mark Li stated that TSMC expects artificial intelligence chips to account for more than ten percent of its revenue by 2027.

UBS analyst Jordan Klein wrote in a report to clients on Thursday morning:

“Within the semiconductor industry, it is expected that the development of artificial intelligence will drive further buying waves in top chip manufacturers like AMD, NVDA, and MRVL.”

Cowen & Co. analyst Matthew Ramsay remains bullish on AMD, raising its target stock price from $130 to $185, and states that the company’s AI-focused MI300 chip “is poised for substantial growth”:

“After AMD’s official launch of the MI300 in December, we are more confident that the MI300 product line will enable the company to achieve long-term growth in the AI computing field.”

Nvidia remains firmly seated in the top position. Ramsay notes that the MI300 is becoming an increasingly powerful alternative in the generative AI market, where Nvidia is the absolute market leader.

Related: