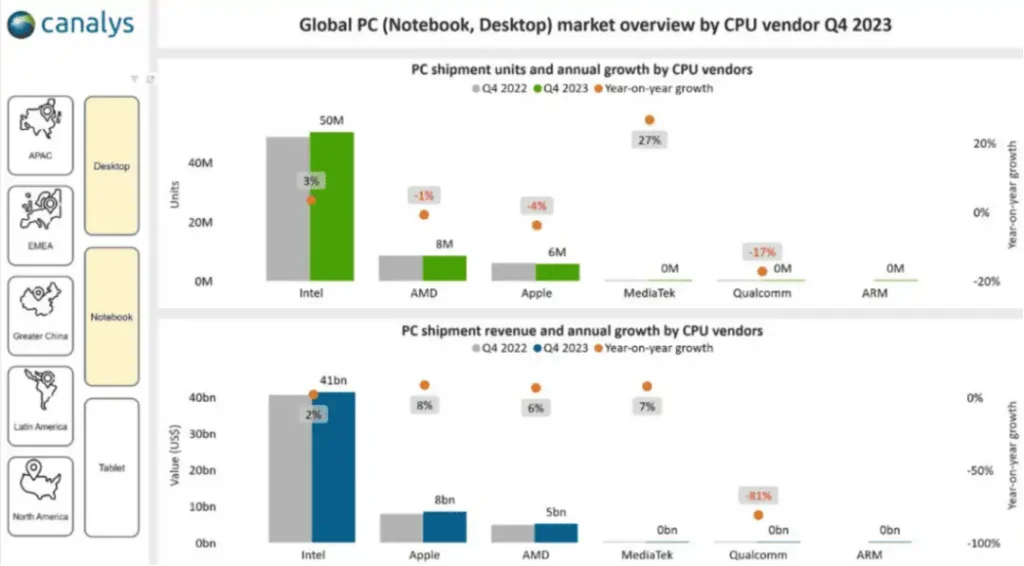

In the ranking of total personal computer shipments and CPU manufacturers’ annual growth rates, Intel dominated the majority share with 50 million units shipped, marking a year-over-year growth of 3%.

In the fourth quarter of 2023, Intel’s CPU shipments for desktops and laptops reached 50 million units, far exceeding those of AMD and Apple, showcasing strong performance. The latest statistical data was provided by Canalys, who released the latest infographics and reports on the global PC (laptop and desktop) CPU market for Q4 2023. In addition to CPU shipments and revenue, the report included interesting statistics on popular PC submarkets across different regions.

The report indicated that the desktop market was vibrant in the Asia-Pacific (APAC) and Europe, the Middle East, and Africa (EMEA) regions. The laptop submarket performed strongly in China and Latin America, while the North American audience showed a preference for the tablet market.

On the leaderboard of total PC shipments and CPU manufacturers’ annual growth rates, Intel led with 50 million units, holding the vast majority share and growing 3% year over year. AMD followed with 8 million units (a 1% decline) and Apple with 6 million units (a 4% decline). The research firm highlighted that Intel maintained a 78% market share, while AMD held 13%.

Revenue-wise, Intel’s PC CPU shipment revenue grew by 2%, reaching $41 billion, followed by Apple with $8 billion (an 8% increase) and AMD with $5 billion (a 6% increase). The report also covered other manufacturers like MediaTek, Qualcomm, and ARM, which haven’t yet reached the level of the top three giants, though Qualcomm is expected to make significant strides in the PC market this year with its Snapdragon X Elite and X Plus chips.

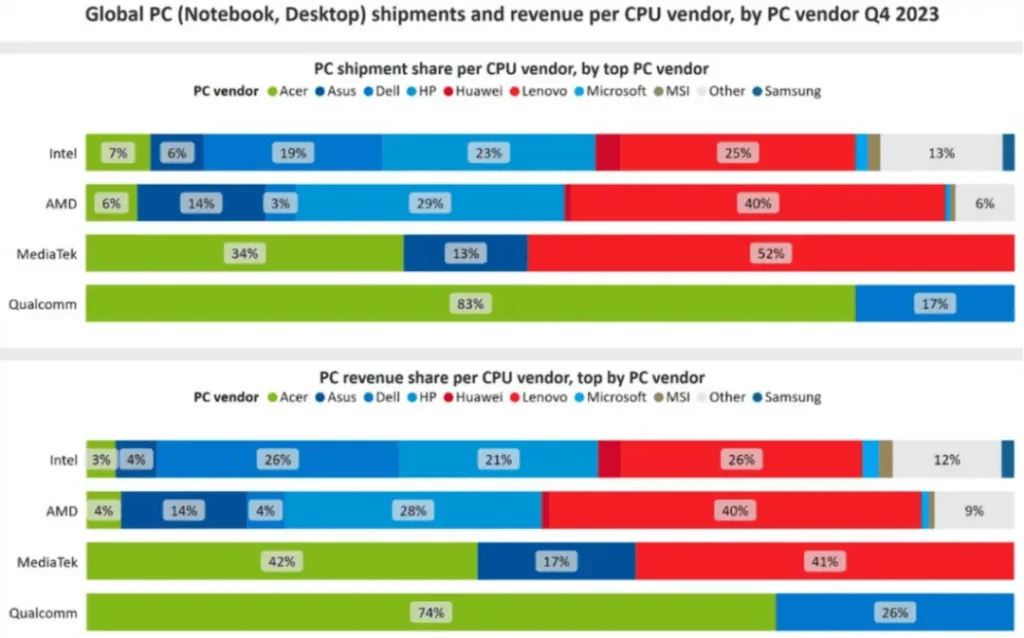

Breaking down shipments by PC manufacturer, Lenovo was Intel’s largest distributor, accounting for 25% of total shipments, followed by HP (23%), Dell (19%), ACER (7%), and ASUS (6%). For AMD, Lenovo was again the top PC vendor, making up 40% of total shipments, with HP at 29%, ASUS at 14%, and ACER at 6%. Revenue distribution was similar to the overall shipment figures. According to Jon Peddie Research, laptops remain the most popular CPU choice for personal computers, nearly accounting for 69% of the market. The report mentioned that desktops would hold a 31% share in Q4 2023.

PassMark’s statistics also showed that, across desktops, laptops, and servers, Intel’s market share continued to expand in all subsegments.

Beyond the CPU market, Jon Peddie Research’s earlier report stated that the PC market in Q4 2023 continued its recovery momentum, with GPU and CPU shipments growing 20% and 24% year over year, respectively. Although the quarter-over-quarter growth wasn’t as pronounced at 6% and 9%, it still maintained strong momentum. Overall, the market was back to growth, though it was still relatively weak.

The PC market in 2023 ended its slump from 2021 and 2022. Even though GPU shipments hit a record low at the beginning of the year, robust quarterly growth for the remainder of the year significantly boosted GPU and CPU sales. Jon Peddie Research noted that while GPU shipments typically remain flat from Q3 to Q4, there was a 6% increase this year, suggesting a strong recovery.

The graphics card market still has a significant gap from its peak during the pandemic in 2020 and is even lower compared to the 2010s. From 2013 to 2019, Q4 shipments were at least 90 million, while Q4 2023 didn’t even break 80 million.

Additionally, the GPU shipment statistics covered all types of graphics processors: standalone and integrated GPUs for desktops and laptops. While Q4 desktop GPU shipments grew nearly 7% from Q3, they were down 1% year over year. The main source of GPU shipment growth was laptops, with a significant 32% increase year over year.

The overall market’s signs of recovery are quite evident, with rapidly increasing demand for CPUs and GPUs in desktops.

At MWC 2024, Intel executives revealed their ambitious plans. As the tech industry seeks new growth areas, Intel has set a clear goal: to supply processors for over 100 million AI PCs by 2025, thereby securing over 20% of the global PC market share.

In an interview, Feng Dawei, vice president of Intel’s Client Computing Group and general manager of the Client Segment Division, detailed this strategy. He expects the company to deliver about 40 million AI PCs this year and increase to 60 million next year. This growth momentum is expected to continue until 2025, by which time AI PCs will become a significant force in the market.

Disclaimer:

- This channel does not make any representations or warranties regarding the availability, accuracy, timeliness, effectiveness, or completeness of any information posted. It hereby disclaims any liability or consequences arising from the use of the information.

- This channel is non-commercial and non-profit. The re-posted content does not signify endorsement of its views or responsibility for its authenticity. It does not intend to constitute any other guidance. This channel is not liable for any inaccuracies or errors in the re-posted or published information, directly or indirectly.

- Some data, materials, text, images, etc., used in this channel are sourced from the internet, and all reposts are duly credited to their sources. If you discover any work that infringes on your intellectual property rights or personal legal interests, please contact us, and we will promptly modify or remove it.