When it comes to Qorvo, it’s TriQuint, and when it comes to TriQuint, it’s WJ—Watkins-Johnson, Inc.

(U.S. wireless telecommunication and defense industry semiconductor manufacturing equipment, electronics companies)

01

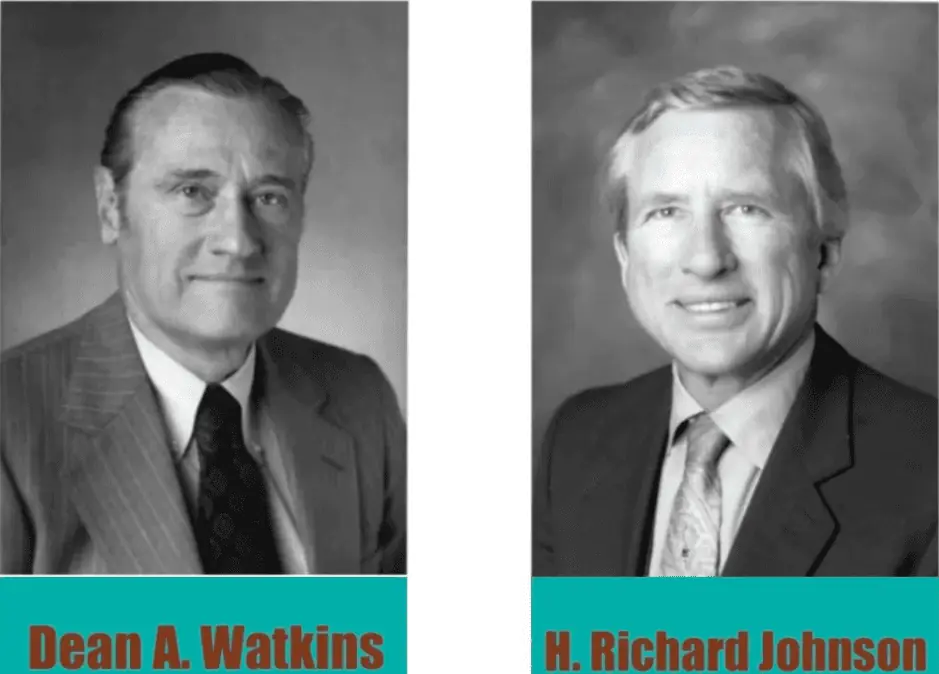

Watkins and Johnson

Back in 1957, two young men, Dean A. Watkins (Watkins) and H. Richard Johnson (Johnson), decided to start a new company. Watkins was a professor of electrical engineering at Stanford University, while Johnson worked for Hughes Aircraft Company as head of the company’s microwave laboratory in Southern California.

Two industry professionals came together with a clear goal – to enter the electronic components field and start a new company. The company specializes in the development and manufacture of microwave tubes and microwave solid-state devices, and from there, they are diversifying into related electronic systems and equipment components.

Watkins-Johnson, an electronics company named after the combination of the two men’s names, was officially founded. Because of the nature of the products, the company’s products were mostly military and could be said to be exclusively for the U.S. Department of Defense. It wasn’t until the 1980s that Watkins-Johnson began to move away from its reliance on military contracts and gradually moved closer to semiconductor equipment. Another 10 years, to the 1990s, Watkins-Johnson has a new image – chemical vapor deposition (CVD) equipment manufacturers shine!

and completed a magnificent turnaround.

The time came in 2008 when Watkins-Johnson sold the company to TriQuint, an RF device company

02

TriQuint Semiconductor

TriQuint is younger than WJ, having been founded in 1985 as a Tektronix subsidiary spin-off.

There’s also a little story about its name, when the founders ran a name contest to name the new company, and an engineer who named TriQuint after the Periodic Table of Elements won the contest, receiving a $50 prize.

Tri is from the Greek language, meaning “3”; Quint is derived from the Latin language, meaning “5”, together is 3-5 – a because TriQuint is to do GaAs devices start, 3-5 refers to the periodic table of elements in the home and the position of the element arsenic, GaAs is also known as 3-5 semiconductors.

Before the acquisition of WJ, TriQuint also acquired several RF companies and related businesses: including in 1998, the acquisition of Texas Instruments (TI) arsenical monolithic microwave integrated circuit (MMIC) business and Raytheon Defense Systems and Electronics Group; in 2000, the acquisition of a state-of-the-art manufacturing facility in Texas; in 2001, through the acquisition of Infineon’s GaAs In 2001, Infineon’s GaAs business was acquired to open a design center in Munich, Germany; and in 2004, Oregon-based TFR Technologies was acquired, among others.

2008 was a banner year for TriQuint, first absorbing WJ’s RF products. In 2010, TriQuint’s sales exceeded $800 million for the first time. However rapid growth was often followed by a major downturn, and TriQuint suffered huge losses over the next few years due to overcapacity.

03

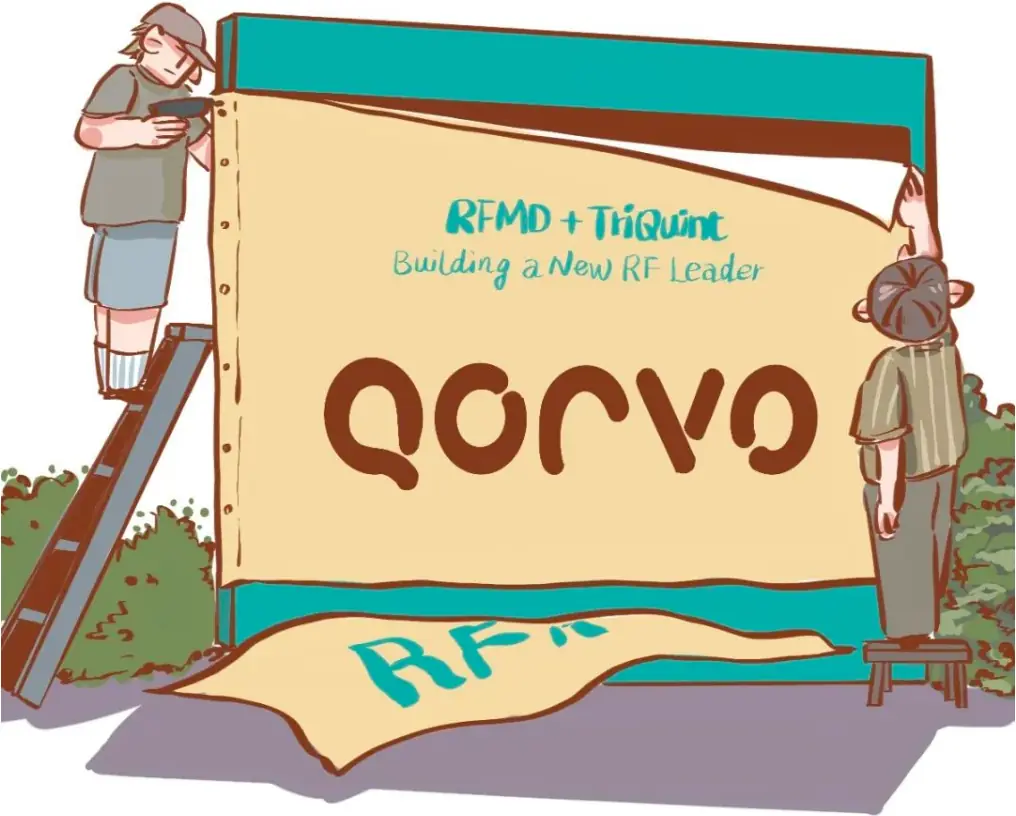

Birth of a major RF manufacturer

So in February 2014, TriQuint announced that it would be merging with another company, RF Micro Devices (RFMD), which also started with gallium arsenide (GaAs).

RFMD was founded on February 27, 1991, by several engineers who jumped ship from ADI to start their own business. The company quickly made a name for itself in the global GaAs space.

In 2000, RFMD was recognized by Fortune Magazine as the second fastest-growing company in the U.S. In 2001, a wholly owned subsidiary was established in China, Wisers United Semiconductor (Beijing) Co.

In 2004, RFMD became the first semiconductor company to ship 1 billion cellular power amplifiers. 08 after the financial crisis, again with reduced end market demand and excess inventory, RF component shipments declined and RFMD faced losses.

So the two companies swaying in the storm decided to embrace the warmth, on January 1, 2015, RFMD and TriQuint merged to form a new company – RF front-end IDM major Qorvo (Wisdom) was officially born.

After the company was founded, it went on an M&A spree, acquiring IoT solutions provider GreenPeak, Irish semiconductor company Decawave, and more. According to Yole, Qorvo’s RF front-end market share will reach 15% in 2022, behind Broadcom (19%) and Qualcomm (17%).

Disclaimer:

- This channel does not make any representations or warranties regarding the availability, accuracy, timeliness, effectiveness, or completeness of any information posted. It hereby disclaims any liability or consequences arising from the use of the information.

- This channel is non-commercial and non-profit. The re-posted content does not signify endorsement of its views or responsibility for its authenticity. It does not intend to constitute any other guidance. This channel is not liable for any inaccuracies or errors in the re-posted or published information, directly or indirectly.

- Some data, materials, text, images, etc., used in this channel are sourced from the internet, and all reposts are duly credited to their sources. If you discover any work that infringes on your intellectual property rights or personal legal interests, please contact us, and we will promptly modify or remove it.