In January, a Murata inductor plant in Japan was severely affected by an earthquake, leading to a halt in production that triggered widespread stockpiling and panic buying. Many end-users were caught off guard and found themselves without supplies, causing a spike in inquiries for Murata’s models on various platforms and a dramatic increase in the market prices of Murata’s product series, with some prices surging tenfold or more.

As of now, three months post-earthquake, the fervor around the affected Murata products persists, with market prices reaching new highs. Some products that were priced at 5 yen in January have now soared above 20 yen. Readers report that Murata’s LQH and DLW series are still facing shortages, with significant demand from both end-users and traders.

Which products are still in shortage? Which ones are in demand? We’ve tracked the latest market situation for Murata’s products for your reference.

01

“Halting production” has kept prices high, with the original factory resuming order acceptance.

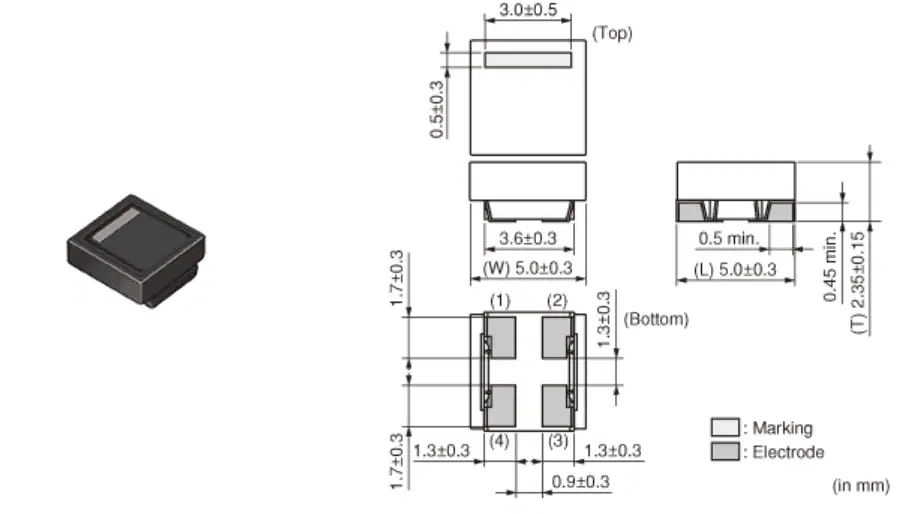

Since this year, Murata’s products, DLW5BTM501SQ2L, and LQH32CN4R7M33L have quietly climbed up the hot search lists on various platforms.

The current hottest product, DLW5BTM501SQ2L, surged from 5 yen in January to over 20 yen, maintaining a high popularity level. This product is a consumer-grade filter.

Core World noted that before the price hike, DLW5BTM501SQ2L was around 0.5 yen, but it started to rise to around 5 yen at the end of January due to high demand, and now the price has reached a new high.

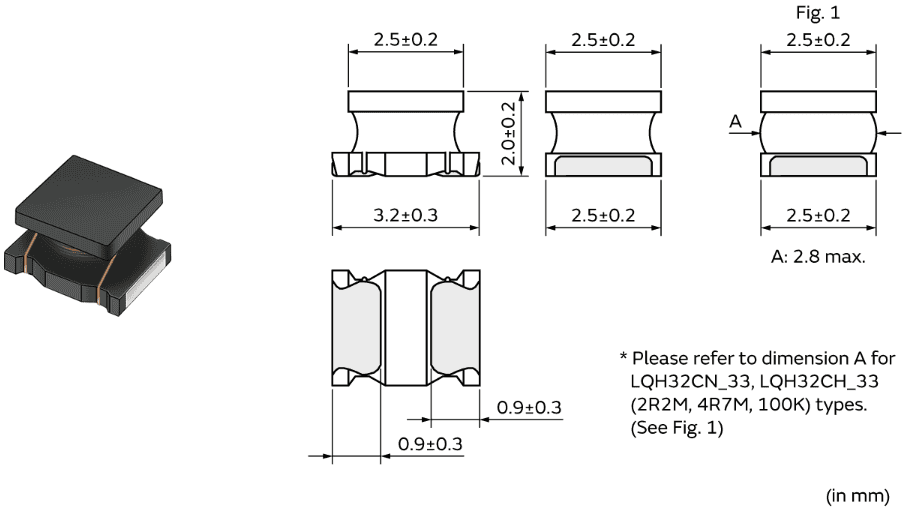

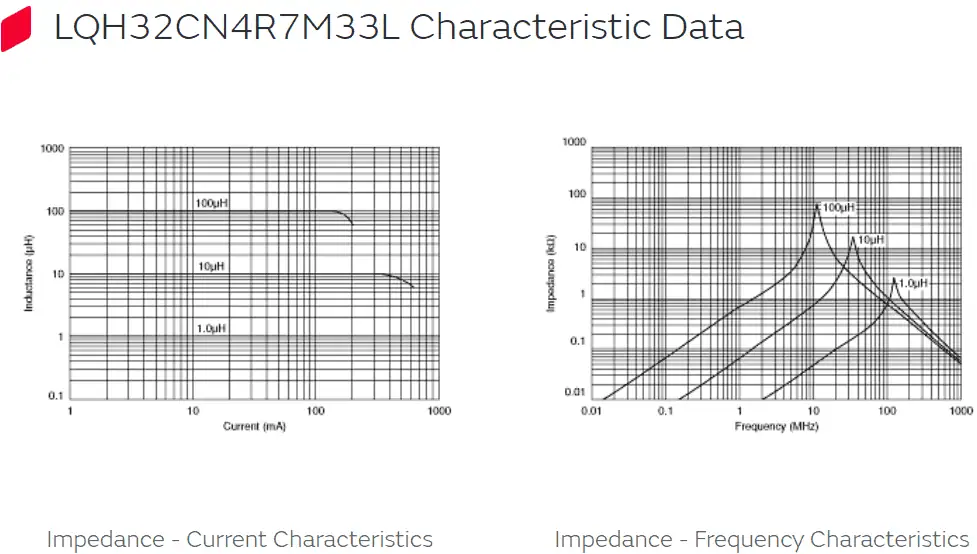

LQH32CN4R7M33L has seen a recent surge in popularity, with its price increasing from a few cents to over 1 yen. This is a consumer-grade inductor.

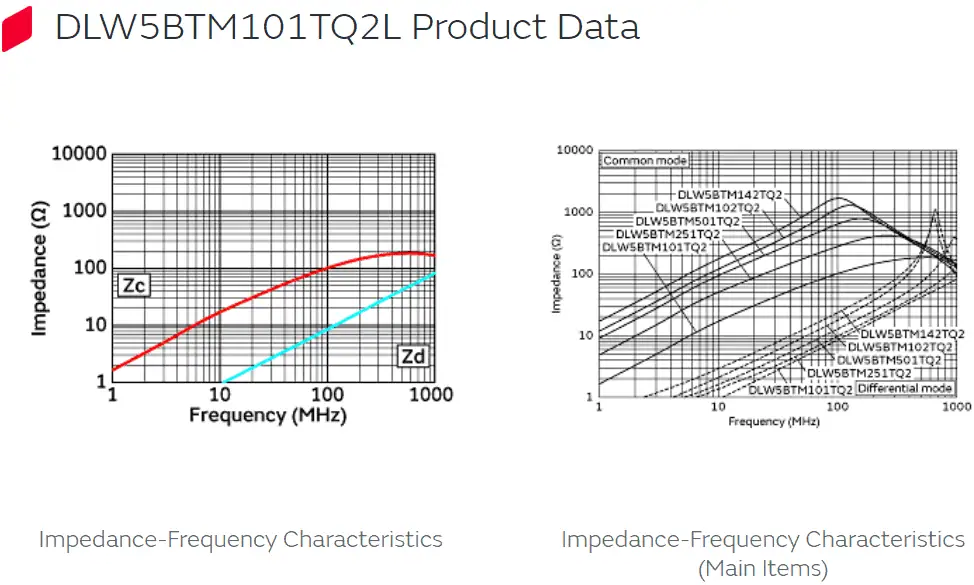

Additionally, the general-purpose material DLW5BTM101TQ2L was around 10 yen in January but rose to 20 yen by the end of March. The automotive-grade material DLW5BTH101TQ2L reportedly has seen a 30-fold price increase in the market.

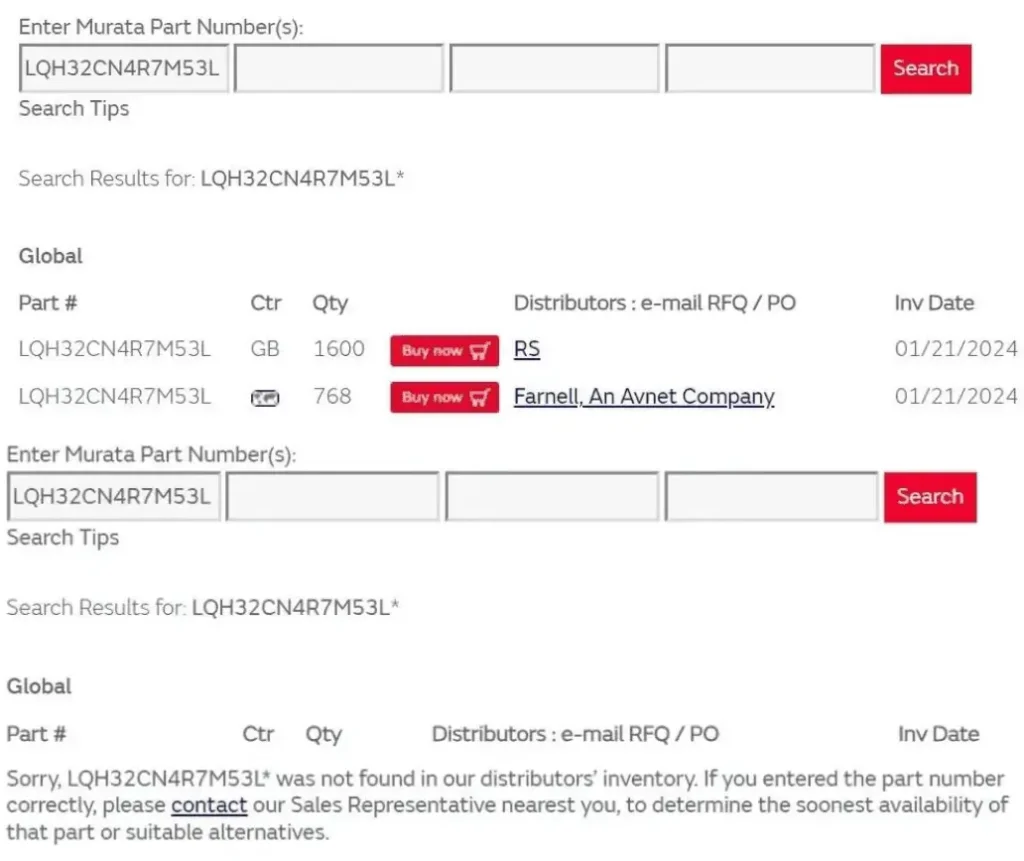

As of April 1, searching for DLW5BTM501SQ2L and LQH32CN4R7M33L on Murata’s official website shows zero stock for their distributors. Meanwhile, LQH32CN4R7M53L, LQH3NPZ101MMEL, and DLW5BSZ501TQ2L, which were in high demand in January, also show zero inventory.

When the shortage was first revealed in January, some distributors still had stock, but by April, it seemed to have been completely swept up. The panic-induced stockpiling due to the shortage rumor led to some end-users securing supplies for up to six months, depleting Murata’s inventory.

In various IC trading groups, there are quite a few transactions involving Murata’s LQH and DLW series.

A Murata associate mentioned, “These Murata products are still in shortage; perhaps there’s not much stock left, which is why everyone is searching for them, driving up their popularity.” Another person noted, “The shortage situation has eased slightly since January, but the scarce items remain so. Although production may resume in May, there’s still a significant material supply issue.”

Several buyers have received numerous requests from Murata customers, with demands coming from both end-users and traders. For example, LQH32DZ470K53L is an automotive-grade product, and LQH32DN470K53L is a consumer-grade product. Although the official website shows critical inventory levels, “there are still spot goods available in the market, albeit at higher prices.”

Several insiders, including distributors, informed us that the original factory can currently accept orders, but the lead time has been extended.

After the recent stockpiling, the inventory of Murata’s affected materials at distributors has been depleted, leading to a shortage. There is some stock available in the spot market, but prices are higher than before, driven by demand from both end-users and traders.

02

The inventory crisis of inductor products continues amidst persistent demand

The temporary supply shortage hasn’t stopped some end-users from seeking products. “Since January, we’ve had clients continuously searching for spot goods, but they’re mostly unavailable.”

The earthquake in Japan earlier this year significantly impacted a Murata factory, causing market turmoil. While other factories have resumed production, this particular plant, mainly producing automotive and industrial inductors, is expected to restart production in mid-May or later. Murata’s internal assessment indicates that equipment and buildings require repairs. Murata has advised customers to consider alternative inductor products from competitors and has provided a list of substitutes.

Initially, the market’s purchasing demand focused on the affected inductor products from the LQH series and the filter products from the DLW series, especially automotive-grade materials.

Months later, the market demand for Murata’s products remains strong, especially for general consumer products. Mobile communication, a significant application market for inductors, has driven the demand for compact laminated inductors in smartphones. Japanese manufacturers dominate the global inductor market, with a nearly 50% share, followed by Taiwanese and mainland Chinese manufacturers.

In the industrial sector, some customers have tested Sunlord products as substitutes post-earthquake. Sales personnel noted the absence of equivalent models from Chilisin, causing difficulty in finding replacements for DLW5B.

Another salesperson observed that the affected products can generally be substituted, but the situation varies by customer. Domestic end-users might slightly modify their designs to use other brands, while international clients are less inclined to switch.

Murata’s temporary production halt has not led to a line shutdown, prompting considerations of replacement costs.

For products like inductors, which have strong customer customization attributes, the certification cost and time are significant when switching, especially for automotive-grade inductors. Replacing consumer-grade inductors is easier, and Murata doesn’t have a price advantage in consumer electronics. Murata is a leading manufacturer of EMI noise filters, holding over 30% of the global market, and is a top manufacturer of SAW filters, highlighting customer dependency.

Overall, some of Murata’s demand has shifted to alternative brands, while customers with hard-to-replace needs continue to pay premium prices for the limited available Murata stock, leading to a supply-demand imbalance.

03

Conclusion

As the passive component industry recovers, coupled with replenished consumer electronics inventories and new AI demands, Murata’s product demand is gradually increasing. Murata’s MLCC BB value broke 1 for the first time in seven quarters during the last fiscal quarter (October-December 2023) and is expected to rise further in the current quarter (January-March 2024). Murata is optimistic about the MLCC market’s resurgence, making its statements a bellwether for the industry.

Regarding the earthquake-affected factory that continues to halt operations, Murata’s president, Haruo Murata, stated in February that the company would compensate for production gaps using inventory or alternative factories, minimizing the impact on customers.

A Murata distributor observed that post-earthquake, only a few small-usage inductors (automotive, industrial) were affected, with extended lead times for the DLW/LQH series. These series cater to relatively smaller application markets and volumes, and the lead times for other materials were not impacted.

“Overall, we believe that not many customers are affected, resulting in more middlemen searching for products, but not an increase in actual end-user demand.”

In the sensitive spot market, any fluctuation can cause significant price volatility. For niche products like Murata’s LQH series, even a slight shortage can double prices once hyped, forcing genuine buyers into a constant price negotiation battle.

Disclaimer: This article is created by the original author. The content of the article represents their personal opinions. Our reposting is for sharing and discussion purposes only and does not imply our endorsement or agreement. If you have any objections, please contact us through the provided channels.