On Wednesday during trading, chip giant Nvidia’s stock price dropped more than 10% from its recent historical closing high, entering a correction phase. However, Bank of America advised investors not to worry about the recent decline, as the chip giant still holds a dominant position.

Bank of America analysts, led by Vivek Arya, said in a report on Wednesday that despite Nvidia’s stock price falling 11% since the end of March, they remain optimistic about the company and expect it to maintain its position as a leading chip manufacturer in the industry, powering the booming field of artificial intelligence.

The analysts pointed out that since the launch of ChatGPT in November 2022, this has been the ninth time Nvidia’s stock has experienced a correction of more than 10%.

Bank of America maintained a target price of $1100 for Nvidia, which is about 26% higher than the closing price of $870.39 on Wednesday.

The analysts wrote in the report, “Although Nvidia’s stock may experience short-term consolidation in the summer (as we saw from August to December last year), we believe the fundamentals are stable, and the consolidation period often prepares for a subsequent strong trend.”

They added that Nvidia’s recent stock price decline can be attributed to several factors, such as resurgent inflation, intensified competition from other chip manufacturers, market volatility, AI stock fatigue, rotation into cyclical industries, and possible position reductions before the earnings season. However, these factors have not changed the company’s narrative.

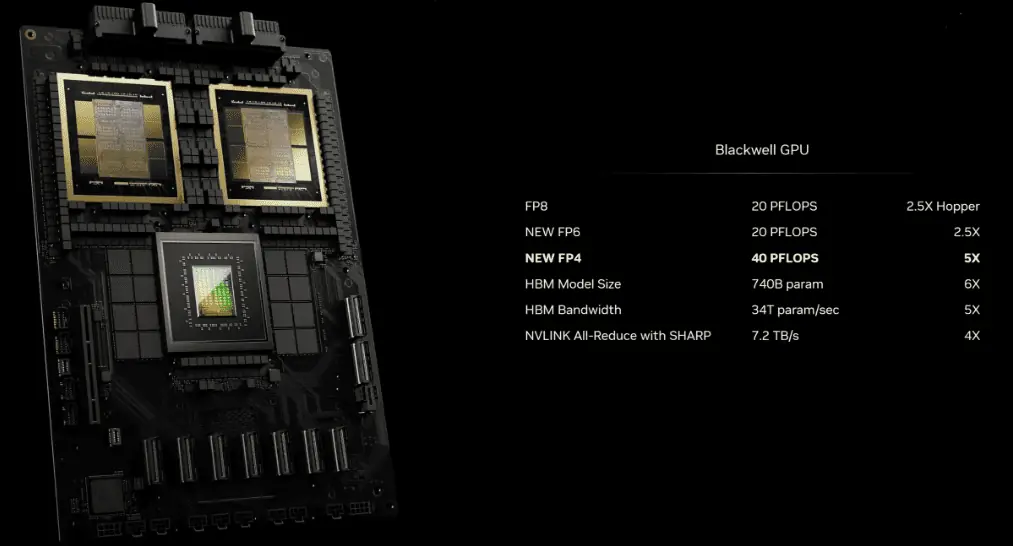

Nvidia’s latest Blackwell chip has increased AI performance by five times, aiming to reduce AI inference costs and energy consumption by up to 25 times. This, combined with Nvidia’s strong foothold in the enterprise sector, gives Bank of America analysts more confidence in the company’s ability to maintain and expand its market share in the chip sector.

Although Nvidia faces competition from Google and Intel, Bank of America believes that the processors from these two companies pose a limited threat to Nvidia’s dominant position.

Disclaimer: This article is created by the original author. The content of the article represents their personal opinions. Our reposting is for sharing and discussion purposes only and does not imply our endorsement or agreement. If you have any objections, please contact us through the provided channels.