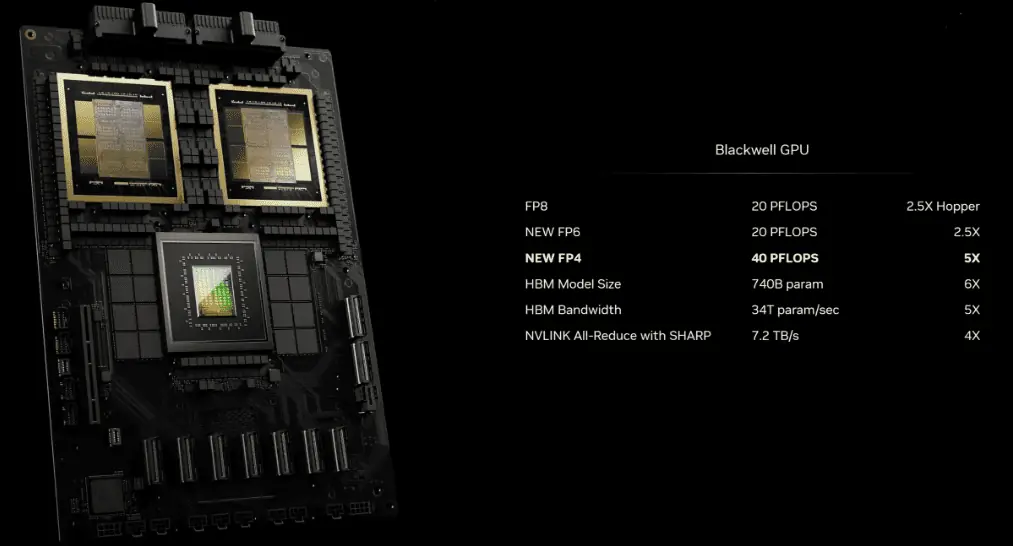

NVIDIA’s new generation platform, Blackwell, includes the B series GPUs and the GB200 that integrates NVIDIA’s own Grace Arm CPU. TrendForce consultancy points out that the GB200’s predecessor was GH200, both are CPU+GPU solutions, primarily featuring the NVIDIA Grace CPU and H200 GPU. However, for GH200, the shipments are estimated to account for only about 5% of NVIDIA’s overall high-end GPU shipments. Currently, the supply chain has high expectations for NVIDIA’s GB200, predicting that its shipments could break through one million units by 2025, accounting for nearly 40-50% of NVIDIA’s high-end GPUs.

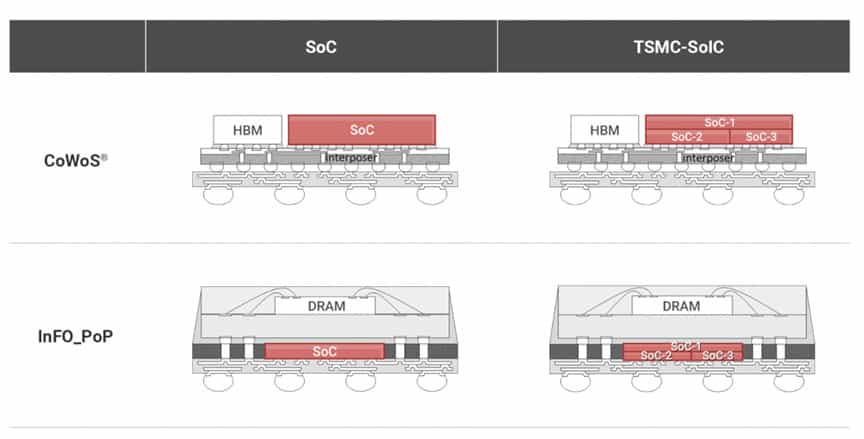

Although NVIDIA plans to launch products like the GB200 and B100 in the second half of this year, the upstream wafer packaging needs to adopt the more complex and precise CoWoS-L technology, which will make the verification and testing process time-consuming. Moreover, for the AI server system, the B series will also need more time to optimize aspects such as network communications and cooling performance, with products like the GB200 and B100 expected to begin volume shipping in the fourth quarter of this year to the first quarter of 2025.

Regarding CoWoS, NVIDIA’s B series including GB200, B100, and B200 will consume more CoWoS capacity. TSMC has also increased the CoWoS capacity demand for the whole year of 2024, estimating that the monthly capacity by the end of the year will approach 40k, a more than 150% increase compared to 2023. The planned total capacity for 2025 could nearly double, with NVIDIA’s demand expected to account for over half. Meanwhile, companies like Amkor and Intel are currently focusing on CoWoS-S, mainly targeting NVIDIA’s H series. Short-term technological breakthroughs are difficult, hence recent expansion plans are conservative unless they can secure more orders from other companies like cloud service providers (CSP) developing their ASIC chips, at which point their expansion attitude may turn more aggressive.

NVIDIA and AMD’s AI development will accelerate, with HBM3e becoming mainstream in the market by the latter half of the year.

Regarding HBM, given the recent progression and HBM specification plans of NVIDIA and AMD’s main GPU products, TrendForce consultancy sees three major trends after 2024.

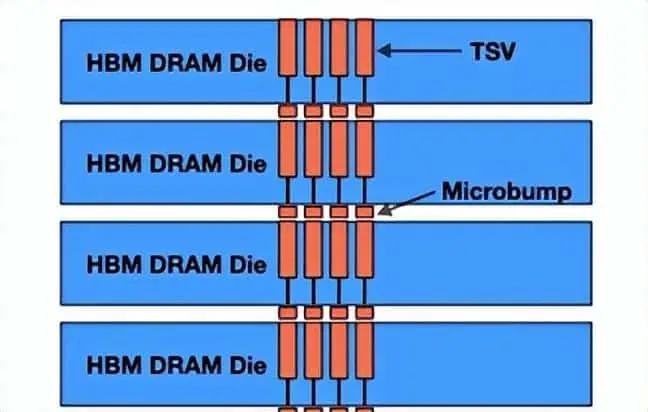

First, “HBM3 advancing to HBM3e,” NVIDIA is expected to start expanding shipments of H200 equipped with HBM3e in the latter half of this year, replacing H100 as the mainstream. Subsequently, products like GB200 and B100 will also adopt HBM3e. AMD plans to launch the new MI350 by the end of the year, potentially experimenting with transitional products like MI32x in the interim to compete with H200, also using HBM3e.

Second, “Continuous expansion of HBM capacity,” to enhance the overall computational efficiency and system bandwidth of AI servers, the capacity will increase from the currently mainly used NVIDIA H100 (80GB) to 192-288GB by the end of 2024; AMD will also increase the HBM capacity of its new GPU products from 128GB in the original MI300A to 288GB.

Third, “Expansion of the GPU product line equipped with HBM3e,” from 8hi to 12hi development. NVIDIA’s B100 and GB200 mainly use 8hi HBM3e, reaching 192GB, and by 2025, they plan to launch the B200, equipped with 12hi HBM3e, reaching 288GB; AMD is expected to launch the MI350 by the end of this year or the MI375 series in 2025, also expected to use 12hi HBM3e, reaching 288GB.

Related:

Disclaimer: This article is created by the original author. The content of the article represents their personal opinions. Our reposting is for sharing and discussion purposes only and does not imply our endorsement or agreement. If you have any objections, please contact us through the provided channels.