In February 2021, Pat Gelsinger officially took office as the new CEO of Intel Corporation. At that time, Intel was in a very passive position, facing numerous crises.

Firstly, Intel had been struggling to make breakthroughs in advanced chip processes, significantly lagging behind competitors TSMC and Samsung. Additionally, it faced enormous competitive pressure from AMD, whose consumer processors were highly cost-effective during that period, seizing a significant portion of Intel’s market share.

Gelsinger took office under such circumstances. Frankly speaking, the issues and difficulties Intel faced were deeply entrenched and hard to completely resolve and reverse in the short term. The measures taken might need at least a few years to show significant results.

Therefore, strictly speaking, it would be neither objective nor fair to judge Gelsinger’s performance and draw conclusions at this point; he should be given more time. However, since three years have passed, it is appropriate to review and summarize his performance so far. So, how has Gelsinger’s performance been over the past three years?

Firstly, regarding achievements, Gelsinger has been actively lobbying the US and European governments, securing substantial subsidies, and constructing many new chip manufacturing plants, constantly expanding capacity. This is an achievement.

Additionally, there have been reports of significant breakthroughs in Intel’s advanced chip processes over the past few years, including claims of having overcome 3nm and 2nm technologies, although the public has yet to see any conclusive evidence.

However, considering that Intel started receiving 2nm lithography machines last year, it seems fairly credible overall. Therefore, this can also be considered a significant achievement under Gelsinger’s leadership, although it may still take a long time before Intel’s advanced process chips (3nm, 2nm) are mass-produced and available to consumers.

Next, addressing the issues: In October 2021, Intel officially released its 12th generation Core processors, introducing a large-small core architecture for the first time, which sparked considerable controversy.

Overall, this generation of processors performed relatively steadily, generally gaining consumer and market approval, shifting from a passive to an active position in the fierce competition with AMD and reclaiming some market share. It was a good start.

However, the 13th and 14th generation Core processors did not continue this momentum. Due to issues with balancing processor voltage and frequency, these two generations of processors might experience instability during operation, significantly failing, and Intel has yet to provide a final investigation report, causing strong dissatisfaction and doubt among users. Moreover, Intel’s market value has been surpassed by its long-time rival AMD, which is quite embarrassing.

The above is a brief review of Gelsinger’s performance since taking office. However, these are not all the goals set by Gelsinger or the entirety of his work in these years. After taking office, Gelsinger also launched another ambitious “IDM 2.0” plan, which, simply put, involves using Intel’s chip manufacturing plants to provide chip foundry services for third-party customers.

This is the main topic of this article: How has the “IDM 2.0” plan progressed and what are the results since Gelsinger took office? Are the results below or above expectations?

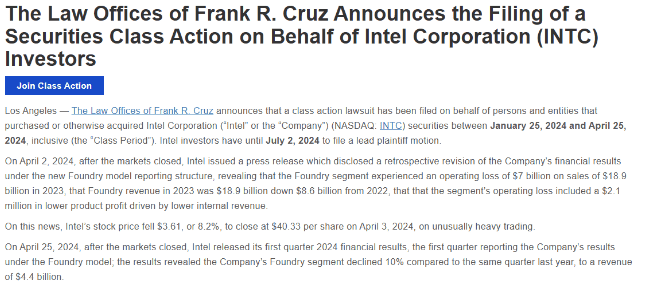

The answer is the former. The actual situation is worse and more severe than “below expectations,” resulting in severe losses and triggering a class-action lawsuit. See the image below.

The class-action lawsuit was initiated by some Intel investors, accusing Intel of failing to fully and accurately disclose the real performance data of its chip foundry division in its January 2024 performance report for 2023, deliberately avoiding and concealing the truth.

Starting from the first quarter of 2024, Intel adopted an “internal foundry” model, where both its own product divisions and third-party customers must purchase manufacturing and packaging services from Intel’s independent foundries.

However, before the first quarter of 2024, Intel did not separately disclose the performance of its chip foundry division, only disclosing the performance data of services provided to third-party customers.

It was not until April 2, 2024, that Intel disclosed complete data. The data showed that in 2023, the chip foundry division accumulated losses of about $7 billion, which was one of the main reasons for the significant drop in Intel’s stock price.

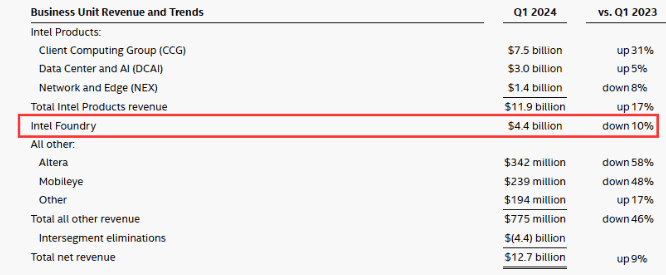

Entering 2024, the situation has not improved. On April 25, Intel announced its first-quarter performance for 2024, showing that the revenue of the chip foundry division was $4.4 billion, a 10% decrease compared to the same period last year, with losses of $2.5 billion.

These data have caused strong dissatisfaction among Intel shareholders, leading to a class-action lawsuit accusing Intel of deliberately concealing the true performance of its chip foundry service division and making seriously misleading false statements.

Currently, Intel faces serious “internal and external troubles.” The “external troubles” mainly refer to fierce competition from AMD, Qualcomm, and Nvidia, as well as the major variable of AI. Objectively speaking, Intel still holds a significant advantage in the consumer processor market, but these advantages are not overwhelming, and the future holds no guaranteed victories.

As for the “internal troubles,” some of Gelsinger’s reforms are criticized as overly optimistic and aggressive, with actual results falling short of expectations, causing strong dissatisfaction among investors, including the class-action lawsuit filed by shareholders.

As of now, Intel has not responded to or commented on this class-action lawsuit. The editor will share the latest updates as soon as possible, so stay tuned.

In summary, over the past three years, Gelsinger has worked diligently and conscientiously, but most of his work involves foundational and strategic adjustments, the effects of which require more time to evaluate. Despite facing various difficulties in the short term, it is premature to label this period as a failure.

Looking ahead to the next two to three years, Intel has two battles it cannot afford to lose:

- Advanced chip processes must catch up with competitors quickly; if the gap widens, Intel will become increasingly passive.

- AI, as NPUs will be widely integrated into consumer processors in the future. If Intel’s NPU performance significantly lags behind competitors (including AMD and Qualcomm), Intel will also become increasingly passive.

Intel cannot afford to lose either of these battles. Losing even one would result in its dominant position in the consumer processor market being overturned and surpassed by competitors, leading to significant, unfavorable changes in the market landscape. Therefore, Gelsinger’s task and mission are far from complete, with a long way to go. Hopefully, Gelsinger can lead Intel to steady and long-term progress.

Disclaimer: This article is created by the original author. The content of the article represents their personal opinions. Our reposting is for sharing and discussion purposes only and does not imply our endorsement or agreement. If you have any objections, please get in touch with us through the provided channels.