In the wave of the semiconductor industry, Japan is quietly becoming one of the biggest winners of this technological feast with a low-key and steady approach.

01

Japan’s Semiconductor Equipment: A Big Winner

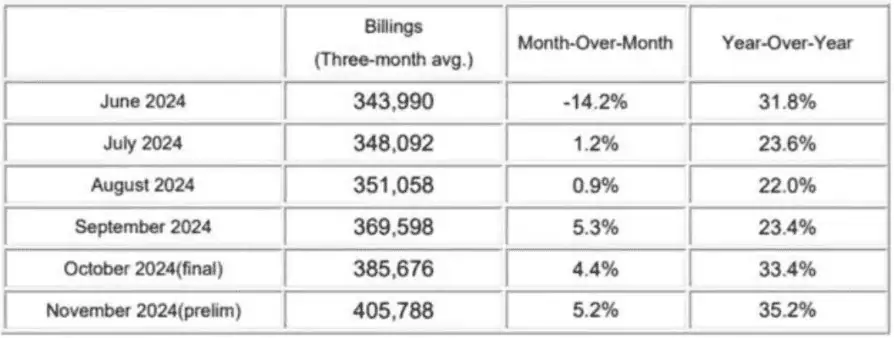

Recently, the Semiconductor Equipment Association of Japan (SEAJ) released statistical data showing that in November 2024, Japan’s chip equipment sales (3-month moving average, including exports) reached 405.788 billion yen, a significant increase of 35.2% compared to the same month last year.

To better understand the strong momentum of Japan’s semiconductor equipment sales, here are a few indicators:

- Japan’s semiconductor equipment sales have seen year-over-year growth for the 11th consecutive month.

- Year-over-year growth has remained in double digits (over 10%) for 8 consecutive months.

- November recorded the largest year-over-year growth in 26 months.

- Monthly sales have surpassed 300 billion yen for 13 consecutive months.

- November set the highest sales record since statistics began in 1986.

These five points highlight the booming status of Japan’s semiconductor equipment.

Looking at the cumulative data, from January to November 2024, Japan’s chip equipment sales reached a total of 3,992.235 billion yen, a significant 20.9% increase compared to the same period last year. When compared to previous years, this figure has surpassed 2022’s 3,545.102 billion yen, setting a new historical high.

02

Japan’s Semiconductor Equipment: Stagnation and Growth

In the global semiconductor landscape, Japan is well known for its strong position in the semiconductor materials sector. Many leading semiconductor materials and consumables suppliers are based in Japan, and many hold an absolute leadership position, with some products even showing monopolistic trends.

In the semiconductor equipment field, Japan also plays a critical role and exerts significant influence.

As shown in the chart, before 2010, Japan was in competition with the U.S. for the leading share of the equipment market. However, since 2012, Japan’s market share sharply declined, and by 2022, it had dropped to less than half of the U.S. market share, standing at 24%.

However, from the perspective of the global semiconductor equipment market, Japanese manufacturers still remain at the forefront.

The top 10 global semiconductor equipment manufacturers in 2023 were ASML, Applied Materials, Lam Research, Tokyo Electron, KLA, Dainippon Screen, ASM International, Advantest, Disco, and Teradyne.

Among these, ASML and ASM International are Dutch semiconductor equipment companies; Applied Materials, Lam Research, KLA, and Teradyne are American semiconductor equipment companies; and Tokyo Electron, Dainippon Screen, Advantest, and Disco are Japanese semiconductor equipment companies.

It is reported that in the global semiconductor market, Japan’s chip equipment has a global market share of 30%, second only to the U.S.

At present, the core bottleneck in AI chip manufacturing lies in the shortage of TSMC’s advanced packaging capacity. TSMC’s CoWoS capacity by the end of 2024 is 30,000–40,000 wafers per month. After acquiring the fourth plant of Innolux’s Southern Taiwan factory, by the end of 2025, CoWoS capacity will be increased from 60,000–70,000 to 90,000–100,000 wafers per month, with an estimated total annual capacity of 700,000 or more, double the 350,000 wafers expected in 2024.

At the same time, leading packaging and testing companies and integrated device manufacturers (IDMs) are actively developing their own 2.5D/3D packaging platforms and gradually accelerating capacity expansion. The global expansion of advanced packaging capacity will significantly drive growth in backend equipment orders, while also increasing demand for front-end equipment such as photolithography machines, coating and development equipment, and wet etching equipment in processes like RDL, TSV, and bumping.

During this process, front-end equipment such as photolithography machines, coating and developing equipment, and wet etching equipment are indispensable. On the backend equipment side, compared to traditional packaging, 2.5D/3D advanced packaging places higher requirements on equipment, especially in devices like pick-and-place machines, grinders, temporary bonding/debonding equipment, and testers.

Looking at the main products of each manufacturer, Japan’s Tokyo Electron offers coating and developing equipment, thermal processing equipment, dry etching equipment, chemical vapor deposition equipment, wet cleaning equipment, and testing equipment. Dainippon Screen covers etching, coating and developing, and cleaning equipment. Advantest’s products include backend testers and sorters. Disco specializes in various precision cutting, grinding, and polishing equipment for semiconductor processing.

It is reported that Disco holds a market share of about 75% in thinning and cutting equipment, while Advantest holds over 50% in testing machines.

03

China as a Major Export Destination

China is the primary export destination for Japan’s semiconductor equipment.

Japanese media, based on trade statistics from the Ministry of Finance, investigated the export proportion of semiconductor manufacturing equipment and components, as well as flat-panel display manufacturing equipment to China. They found that since July-September 2023, exports to China have consistently accounted for more than 50% for three consecutive quarters.

From the chart above, it can also be seen that, in terms of regions importing equipment from China, Japan has consistently held the top position since 2021. Later, from April 2023, the focus of the semiconductor equipment market in Mainland China shifted to photolithography, mainly due to significant increases in imports from Dutch equipment suppliers, which clearly surpassed Japan. However, by around December, the import amounts from the two regions were nearly equal, with Japan regaining the lead.

Now looking at the trend of Japan’s semiconductor equipment exports in 2024.

According to the SEAJ, the export value of related equipment to China from January to March 2024 reached 521.2 billion yen, a 82% increase compared to the same period in 2023.

From January to June 2024, exports to Mainland China accounted for nearly 50%. During this period, global semiconductor equipment sales grew 1% year-on-year, reaching $53.2 billion. Of this, Mainland China’s sales amounted to $24.73 billion, roughly 1.8 times the amount from the same period last year. Mainland China’s share in global total sales rose from 25% in the previous year to 46%, setting a new historical high. Sales in the Mainland China market began to surge in July-September 2023 and have continued with strong momentum.

These figures highlight two key points: First, China is the major export destination for Japan’s semiconductor equipment; second, the semiconductor equipment market in China is growing rapidly. The surge in Mainland China’s market sales is largely due to U.S. export controls on China.

It is worth mentioning that on May 23, 2023, Japan’s Ministry of Economy, Trade, and Industry published an amendment to the Foreign Exchange and Foreign Trade Act, adding 23 categories of semiconductor equipment required for advanced chip manufacturing to the export control list, which was implemented on July 23.

Currently, equipment not used for advanced product applications has not yet been subject to control, but the market’s expectation that export controls will extend to such equipment is steadily increasing. Tokyo Electron’s CEO, Toshiki Kawai, pointed out: “More and more orders are being placed in advance by Mainland China.”

ASML’s CEO, Christophe Fouquet, said: “Demand from Mainland China is very strong and will remain robust in the future.” From January to June 2024, the company’s sales in Mainland China accounted for 49%, tripling the previous year’s share.

On the other hand, sales outside Mainland China totaled $28.47 billion, a decrease of 27%. With a slow recovery in the smartphone and personal computer markets and the slowdown in the growth of the electric vehicle (EV) market, semiconductor manufacturers have shown a cautious investment attitude. While investment in advanced semiconductors for AI data centers has fully ramped up, it cannot fully offset the decline in other sectors.

04

How Do Semiconductor Equipment Companies View It?

The performance of Japan’s semiconductor equipment manufacturers also highlights the importance of the Chinese market.

Tokyo Electron derives nearly half of its revenue from Mainland China.

For example, according to regional revenue breakdowns, by the first quarter of 2024 (ending March), over 47% of Tokyo Electron’s revenue came from Mainland China, and by the second quarter (ending June), nearly 50% of its revenue came from Mainland China.

Tokyo Electron stated that compared to the previous fiscal year, its growth trend is strong due to the active investment in mature semiconductor technology by Mainland China.

Dainippon Screen’s second-quarter revenue from Mainland China skyrocketed 193%.

Dainippon Screen’s financial report also highlighted similar trends. In the second quarter of 2024, Dainippon Screen’s revenue from the Japanese market grew 21% year-over-year to 18.4 billion yen, accounting for 14% of total revenue (down from 15% last year). Revenue from Taiwan grew 9% to 22.7 billion yen, accounting for 17% of total revenue (down from 21% last year). Revenue from Mainland China surged 193% to 61.8 billion yen, accounting for 46%, up from 21% last year, leading all markets. Revenue from South Korea dropped 14% to 6.1 billion yen, accounting for 5% (down from 7% last year). Revenue from North America fell 35% to 14 billion yen, accounting for 11% (down from 22% last year). Revenue from Europe plunged 55% to 4.9 billion yen, accounting for 4% (down from 11% last year).

Advantest Raises Profit Forecast, Benefiting from the Chinese Market

In recent years, overseas business has become a major driver of Advantest’s revenue, with its overseas revenue share remaining above 95%, and China becoming its largest revenue source.

Recently, Advantest raised its 2024 fiscal year performance forecast, with expected revenue of 640 billion yen (approximately $4.19 billion), a 31.6% year-on-year increase.

Operating profit and net profit are projected to be 165 billion yen and 122 billion yen, respectively, both double the previous fiscal year. This upward revision is mainly due to the growth in semiconductor demand driven by generative AI (GenAI), as well as the smooth development of equipment related to SoC and HBM.

Advantest pointed out that investment in HPC and AI-related semiconductor equipment in Taiwan, as well as investment in memory, HPC, and AI-related SoC testing systems in South Korea, are the main reasons for its continued upward revisions.

05

Japanese Semiconductor Equipment: A New Uptrend?

Recently, SEAJ revised upwards its sales forecast for Japanese-made semiconductor equipment, projecting that in the 2024 fiscal year (April 2024 – March 2025), Japan’s semiconductor equipment sales will exceed 4 trillion yen for the first time, increasing by 15.0% to 4.2522 trillion yen, up by approximately 5.4% from the previous forecast of 4.0348 trillion yen, setting a new historical record.

SEAJ further stated that due to expected steady investments in logic/wave fab and memory chips, it will also revise upward its 2025 fiscal year (April 2025 – March 2026) forecast, increasing Japan’s semiconductor equipment sales from the previous estimate of 4.4383 trillion yen to 4.6774 trillion yen, reflecting a 10.0% year-over-year growth. Additionally, it expects AI-related semiconductors to continue to drive demand for semiconductor equipment, so Japan’s semiconductor equipment sales in 2026 are projected to grow 10.0% year-over-year to 5.1452 trillion yen, with annual sales exceeding 5 trillion yen for the first time in history.

It is expected that during the 2024-2026 period, Japan’s semiconductor equipment sales will have a compound annual growth rate (CAGR) of 11.6%. Japan’s chip equipment global market share (based on sales) stands at 30%, second only to the U.S.

SEAJ pointed out that besides servers, AI functions will accelerate their integration into PCs and smartphones. Toshiki Kawai noted that by 2027, 30%-40% of PCs and smartphones will feature AI, and the impact on semiconductor equipment demand will be even greater than that of servers.

Regarding the Mainland China market, Toshiki Kawai stated that since the self-sufficiency rate of semiconductor manufacturing equipment is still insufficient, demand for Japanese semiconductor equipment will continue to grow steadily.

At the same time, Chinese domestic semiconductor equipment companies are making great strides. In 2023, North China Innovation’s revenue reached 22 billion yuan, a 50% increase, with a net profit of 3.9 billion yuan, a 66% increase, ranking eighth in the world. This marks the first time a Chinese manufacturer has appeared in the top ten, reflecting not only North China Innovation’s own strength but also the rise of China’s semiconductor equipment industry as a whole.

From an industry perspective, the rise of Chinese domestic semiconductor equipment companies will help reduce the reliance on imported equipment in the domestic semiconductor industry, ensuring the security and stability of the industrial and supply chains. With continued technological breakthroughs and the gradual improvement of the industrial ecosystem, China’s semiconductor equipment industry will play an increasingly important role on the global stage. This ongoing trend will undoubtedly have a profound impact on the future development trajectory of Japan’s semiconductor equipment industry.

Disclaimer:

- This channel does not make any representations or warranties regarding the availability, accuracy, timeliness, effectiveness, or completeness of any information posted. It hereby disclaims any liability or consequences arising from the use of the information.

- This channel is non-commercial and non-profit. The re-posted content does not signify endorsement of its views or responsibility for its authenticity. It does not intend to constitute any other guidance. This channel is not liable for any inaccuracies or errors in the re-posted or published information, directly or indirectly.

- Some data, materials, text, images, etc., used in this channel are sourced from the internet, and all reposts are duly credited to their sources. If you discover any work that infringes on your intellectual property rights or personal legal interests, please contact us, and we will promptly modify or remove it.