A sudden earthquake has stirred up the recovering global semiconductor manufacturing industry.

On the morning of the 3rd, a strong earthquake occurred in Taiwan, China, causing widespread disaster reports. This led TSMC to shut down some of its plants preventively for employee evacuation. Fortunately, there were no significant impacts, and the employees have now been resettled to continue operations. However, experts reveal that this earthquake could potentially disrupt the entire Asian semiconductor supply chain to some extent.

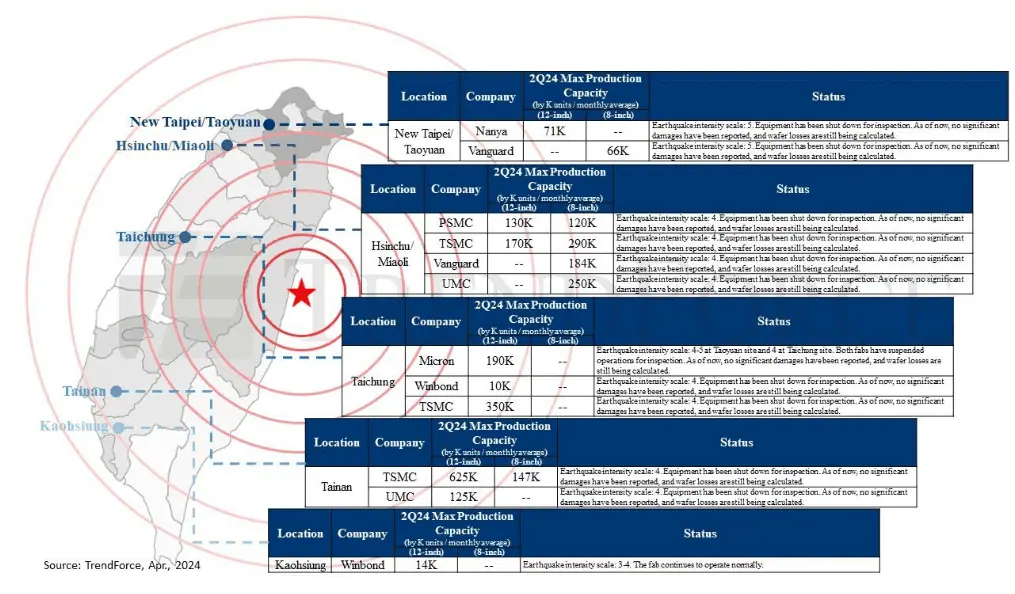

Although most wafer fabs are not located near the epicenter, several companies evacuated employees from some manufacturing plants and closed them for inspection as a precaution. TSMC stated that factory operations would resume after inspections, and the affected facilities are expected to continue production at night.

Isaiah Research reported that TSMC’s factories in Hsinchu, Tainan, and Taichung experienced varying degrees of interruption, which might delay shipments and increase wafer inputs to compensate for losses. They mentioned, “Mitigating the impact of the earthquake requires cautious measures and time to restore production and maintain quality standards, which will bring additional impacts and obstacles.”

TSMC’s multiple 6-inch and 8-inch plants, including Fab2/3/5/8, its R&D headquarters Fab12, and the new Baoshan plant Fab20, are all located in Hsinchu, which experienced an intensity of 4 on the earthquake scale. Only Fab12 experienced some water damage due to broken water pipes, mainly affecting the yet-to-be mass-produced 2nm process, so the short-term operations are not impacted. However, there might be a slight increase in capital expenditure due to the need for new equipment purchases.

TSMC’s other plants have gradually resumed operations after shutdowns for inspection, with no significant damage reported. Other areas also underwent employee evacuation or shutdown checks and have since gradually resumed operations.

Regarding TSMC’s advanced 5/4/3nm process plants, which have a high capacity utilization rate, no evacuations were necessary, and operations resumed to over 90% within 6-8 hours after the earthquake, keeping the impact within a controllable range.

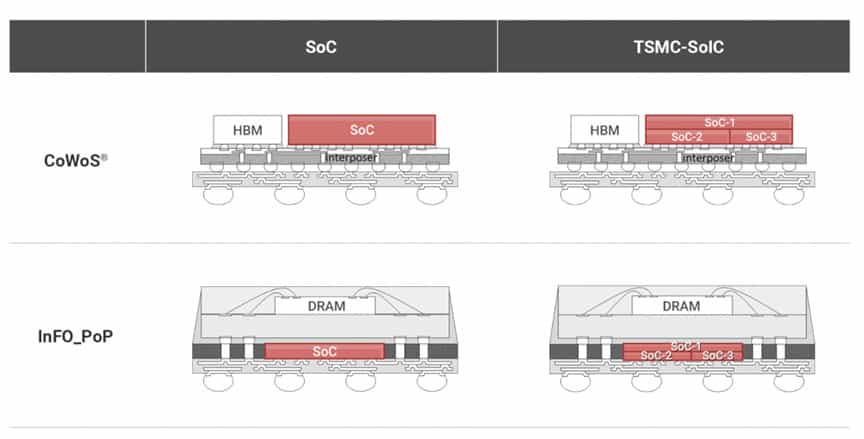

For CoWoS plants, the main operational sites, Longtan AP3, and Zhunan AP6, immediately evacuated personnel. After the shutdown and inspection, it was found that the chiller main unit suffered water damage, but the facility system has backup facilities, so the impact on operations is assessed to be minimal, and work has progressively resumed.

United Microelectronics Corporation (UMC) has one 6-inch and six 8-inch plants in Hsinchu, and another 12-inch plant in Tainan, primarily producing 90~22nm products. Powerchip includes 12-inch DRAM and 8-inch, 12-inch wafer fabs in the Hsinchu and Miaoli area, with DRAM focusing on 25/21nm niche products.

World Advanced has three 8-inch plants in Hsinchu and one in Taoyuan. Most of these plants have resumed operations after brief evacuations and shutdowns for inspections.

Barclays analysts mentioned that some highly complex semiconductor factories, which need to run 24 hours a day in a vacuum for weeks, will have their processes disrupted by the shutdown, potentially driving up product pricing.

They noted a potential “spillover effect,” causing “short-term stagnation” in economies focused on upstream products, such as Japan and South Korea, and those focused on downstream products, like mainland China and Vietnam.

The report highlighted that customers with less inventory might prompt Taiwan and Korean chip manufacturers to raise prices.

Micron suspended DRAM pricing, followed by Korean manufacturers

Regarding memory, Nanya Technology’s Fab3A in New Taipei and Micron’s Linkou plant were significantly affected by the earthquake. Nanya’s plant primarily produces 20/30nm process products, with the newest 1Bnm process under development.

Micron’s Linkou and Taichung plants are crucial DRAM production bases. The internal system has integrated both plant areas, with the latest 1betanm process already in production, along with the upcoming HBM, expecting a few more days for full operational recovery in Taiwan. Other plants have gradually resumed operations after shutdowns for inspections. Powerchip, Winbond, and others were unharmed.

Due to Micron’s DRAM capacity being primarily in Taiwan, the company notified customers on the 3rd to suspend DRAM pricing, including product lines like DDR4, DDR5, and HBM.

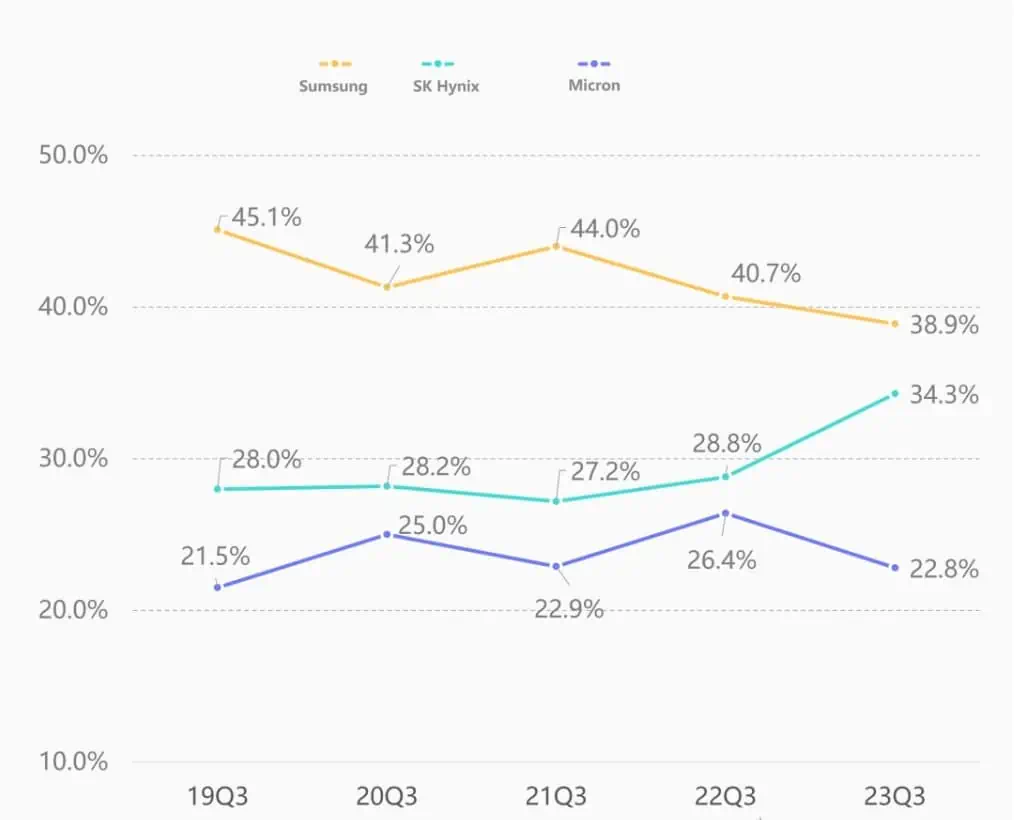

Korean giants Samsung and SK Hynix also paused their pricing.

Market surveys indicate that Taiwan accounts for 20% of global DRAM, and the current impact is limited due to sufficient spot market supply, which is beneficial for memory manufacturers’ DRAM pricing negotiations in the second quarter.

Micron Taiwan confirmed all employees are safe and are assessing the impact on production and the local supply chain, continuing communication with customers regarding supply, though the company has not formally responded to the suspension of pricing.

According to TrendForce, Micron’s suspension of DRAM pricing, due to its significant capacity in Taiwan, was a first step, with second-quarter contract price negotiations to resume after assessing the post-disaster losses.

Samsung and SK Hynix also paused pricing, even though they do not have DRAM production in Taiwan, preferring to observe the market before taking action.

Additionally, due to the DRAM and NAND Flash spot market showing weak demand for weeks, despite the earthquake causing shutdowns at Micron and Nanya, the ample spot supply has kept spot prices stable with only minor increases, and buying interest remains low.

TrendForce predicts a slight increase in short-term DRAM spot prices, but the weak demand trend remains, with the sustainability of price increases uncertain. With DRAM suppliers generally pausing pricing, module manufacturers like ADATA are also following suit.

TrendForce notes that future changes in DRAM contracts and spot prices will be highly related to Micron’s post-earthquake assessment in Taiwan. The earthquake damage is expected to delay second-quarter pricing negotiations, especially for DRAM.

For NAND, the impact on supply is considered limited, as Taiwan NAND manufacturers primarily focus on niche (SLC) products and only account for 2% of global capacity.

According to the information obtained by the editor, after the earthquake in Taiwan, serious damage and disruption occurred in the operation of wafer fabs, and production at some factories was interrupted. As a result, Taiwanese memory manufacturers have temporarily suspended announcing and providing quotations for DRAM in the second quarter of 2024 to customers. They may need to reconfirm prices, which means that there is a high probability that prices of DRAM (and NAND) will increase.

Disclaimer: This article is created by the original author. The content of the article represents their personal opinions. Our reposting is for sharing and discussion purposes only and does not imply our endorsement or agreement. If you have any objections, please contact us through the provided channels.