Based on the amount added over the past 12 months, data centers are accelerating development on a larger scale.

Due to the end of the financial reporting season, this article will provide a detailed analysis of NVIDIA’s Q2 financial report.

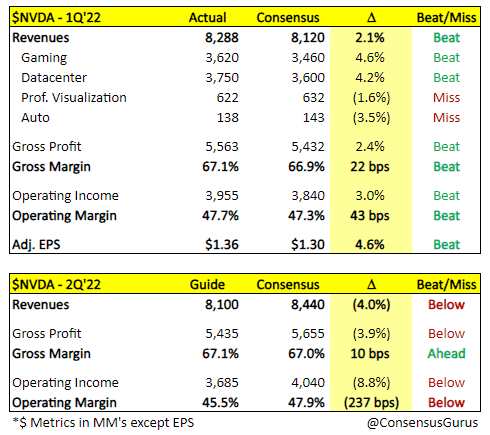

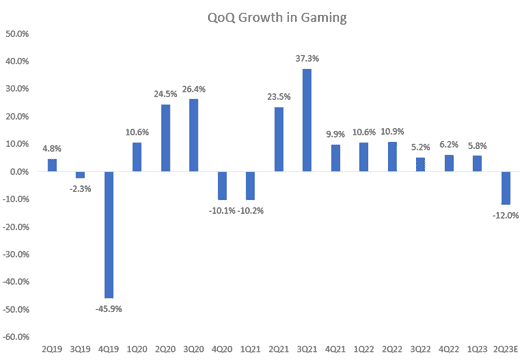

As seen in the table, the revenue for this quarter is actually very good and follows the typical distribution pattern for NVIDIA. However, it is worth noting that the gaming sector is the main cause of the significant decrease in revenue this quarter. NVIDIA expects revenue to be approximately $8.1 billion (±2%), representing a decline compared to the previous quarter.

From the table above, three conclusions can be drawn:

- The gaming sector appears to be weak, and cryptocurrencies may be even weaker.

- There seem to be difficulties in generating revenue from the automotive sector.

- Data centers continue to exhibit strong growth, following the product cycle and a simple combination as in the past.

In the Gaming and Cryptocurrency Sectors

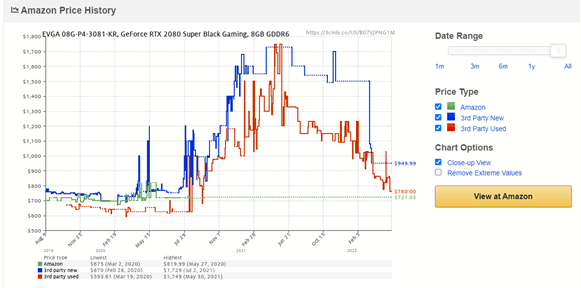

With Ethereum 2.0 transitioning to Proof-of-Stake (POS), there will be a significant influx of GPU inventory into the market. One way to measure this impact is through GPU pricing. This means that newly manufactured GPUs will become widely available and return to their manufacturer’s suggested retail prices. Current GPUs seem to be following this trend. Taking the example of the RTX 2080, the manufacturer’s suggested retail price is $700, and it is currently available on Amazon for $720.

Apart from widespread availability, NVIDIA’s CFO also stated that predicting the contribution of cryptocurrency mining to gaming demand is nearly impossible for them.

NVIDIA’s CFO said, “It’s challenging for us to quantify with any reasonable precision how much cryptocurrency mining contributes to gaming demand. The slowdown in the growth rate of the Ethereum network’s hash rate may reflect reduced mining activity on GPUs. We expect the contribution to decrease in the future.”

While the market temperature has yet to cool down, we can already see scalpers returning a large number of their GPUs.

NVIDIA has also made predictions about future channel inventory: “As we anticipate some ongoing effects as we prepare for the transition to the new architecture later this year, we expect gaming revenue to decline sequentially in Q2. Channel inventories are approaching normal levels, and we expect to maintain around these levels in Q2.”

There is now meaningful channel inventory and new products are set to launch this fall. The worst-case scenario could happen in NVIDIA’s gaming sector. When they introduce new products, they will be forced to heavily discount the older ones, while cryptocurrency miners will offload their used GPUs. The end result is that the new generation of products may face real problems in the secondary market, where they are discounted. This is exactly what happened in 2018.

The three-year GPU (Exploring GPU Servers vs. CPU Servers in Data Centers) market shortage is likely to turn into an oversupply soon, especially with the convergence of these events. Ethereum 2.0 with Proof-of-Stake has already launched and is progressing smoothly, with a full merge potentially taking place in August. All signs indicate a gradual cooling of the market.

In the Automotive Sector

It’s an odd situation for a company that has been touting its design wins and talking about how important the automotive field will become, but the revenue from the automotive sector has nowhere to go.

Let’s compare the promotional claims with the actual rolling revenue over the past 12 months.

Here is NVIDIA’s promotion:

“Turning towards automotive. Q1 revenue was $138 million, representing a 10% sequential growth and a 10% year-on-year decline. Our DRIVE Orin SoC is now in production and has started a major product cycle as automotive customers increase in the second quarter and beyond. Orin has garnered significant interest in the market, winning over 35 automotive manufacturers, truck manufacturers, and robot taxi companies as customers.”

In the first quarter, China’s largest electric vehicle manufacturer, BYD, and the award-winning electric vehicle pioneer, Lucid, have recently announced their plans to build the next generation of fleets on DRIVE Orin. Our automotive design wins have now exceeded $11 billion in channel revenue over the next six years, surpassing the $8 billion figure from a year ago.

These promotions may not seem like billions in revenue; instead, they resemble those of a newly established company. However, the actual revenue in April 2019 was higher than the revenue in April 2022. This has surprised me greatly, and from this perspective, NVIDIA’s automotive development seems to have not reached the expected level, compared to the demonstrations during STM Investor Day.

In the Data Center Sector

While the outlook for the gaming sector may be pessimistic, it cannot be denied that the results from the data center segment are extremely promising. Looking at the absolute amount added over the past 12 months, data centers are accelerating their growth on a larger basis.

Data centers show no signs of slowing down in the short term, and NVIDIA’s data center results have been impressive. They sold the A100 before the product cycle refresh and then introduced the brand-new H100. The H100 is an exceptional product chip, and its customers continue to purchase more chips within the product cycle.

A careful examination of NVIDIA’s financial report reveals that spending from major customers is increasingly important to them. NVIDIA reported record-breaking revenue of $3.8 billion from data centers, representing a 15% sequential growth and an 83% year-on-year growth. Revenue from hyperscale and cloud computing customers more than doubled year-on-year due to strong demand for external and internal workloads. Customer infrastructure needs are still constrained by supply limitations, and efforts are underway to keep up with demand while increasing capacity.

NVIDIA is also optimistic about their new Spectrum-4 network switch and highlights the launch of PCIe 5 as a new major cycle, in conjunction with the introduction of new products such as the Grace CPU.

“In networking, we introduced Spectrum-4, the world’s first 400Gb per second end-to-end Ethernet networking platform, including Spectrum-4 switches, ConnectX-7 SmartNICs, BlueField-3 DPUs, and DOCA software. NVIDIA Spectrum-4 is built for AI, coming at a time when data centers are experiencing exponential growth and require extreme performance, advanced security, and powerful capabilities for large-scale, high-performance advanced virtualization and simulation. In our business, we will be launching multiple new GPU, CPU, DPU, and SoC products in the coming quarters and increasing supply to support customer demand.”

Furthermore, the geometric stack is becoming increasingly easier to compute, so data centers are likely to continue growing stronger. NVIDIA is still experiencing growth at a faster pace, with artificial intelligence being the fastest-growing segment within the cake and becoming a significant portion of capital expenditure budgets.

Recommended Reading: