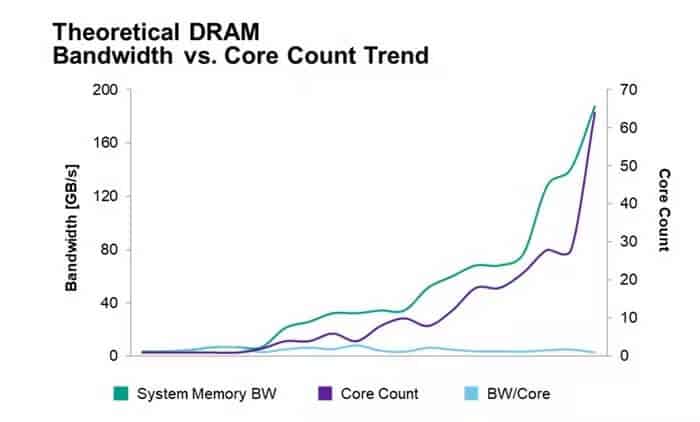

Supply chain sources reveal that not only are upstream original HBM orders fully booked for 2025, but order visibility extends into the first quarter of 2026. However, HBM is squeezing too much DRAM capacity, inevitably driving DDR5 prices gradually higher.

Major customer NVIDIA’s AI chips are in short supply. SK Hynix and Micron, successfully integrated into the supply chain, have sold out their HBM stock for 2024, with 2025 orders nearly full. It is estimated that the combined monthly HBM production capacity supplied to NVIDIA is about 60,000 wafers, necessitating new factory construction and capacity expansion.

SK Hynix previously announced that it would set up the M15X production line in Cheongju as a new DRAM production base and push forward the construction of a new plant in the Yongin Semiconductor Park.

Micron also plans to build a new DRAM plant in Hiroshima, scheduled to start construction in early 2026 and complete the building by the end of 2027 at the earliest. Although major DRAM manufacturers continue to invest heavily in capacity expansion, the overall capacity increase in 2025-2026 is very limited.

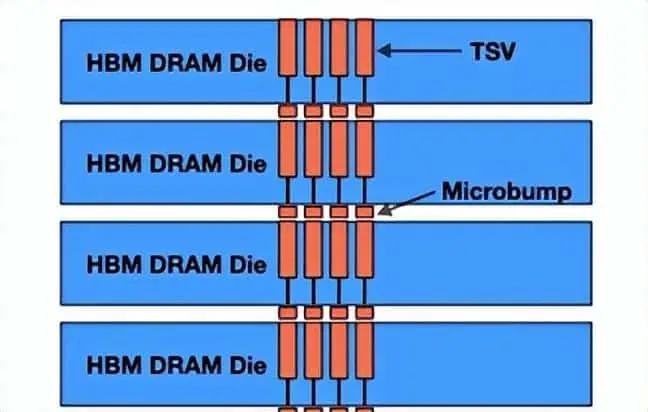

Industry insiders point out that the production cycle for HBM is 1.5 to 2 months longer than for DDR5, and the wafer bit consumption for HBM is much higher than for traditional DDR5. If the wafer consumption for HBM3E is more than three times that of DDR5, it could reach five times as much with the arrival of HBM4 in 2026.

Compared to NAND Flash, where production increases must consider market supply, demand, and industry competition factors, the industry is currently more cautious about expanding NAND production. However, the three major manufacturers are steadily increasing DRAM capacity.

Due to the massive HBM capacity consumption, although SK Hynix and Micron are splitting the HBM3E market, the lack of capital expenditure over the past two years has limited capacity. Micron’s monthly HBM production capacity is only about 3,000 wafers, equivalent to 1/20 of SK Hynix’s supply. To achieve Micron’s stated goal of a 20% HBM market share, subsequent capacity expansion will inevitably focus on HBM.

Given the challenges of the HBM stacking process and technical barriers, the yield ramp-up period is more difficult than traditional DRAM. The industry estimates that SK Hynix, leading in HBM3 mass production, maintains its market-leading position, with its yield performance setting the industry standard. In contrast, Micron will officially join the market battle with HBM3E in 2024, with a short-term yield of only about half that of SK Hynix.

Currently, Samsung Electronics is constrained by factors such as heat dissipation and power consumption, and has not yet entered NVIDIA’s HBM3E market. Without substantial shipping experience, the gap in yield improvement may continue to widen.

The general belief is that although Samsung has temporarily fallen behind and missed the initial advantage in HBM mass production, its long-term cooperation with NVIDIA and plans for a significant threefold capacity expansion will help alleviate NVIDIA’s order shortage. It is expected that by the end of 2024, Samsung may still catch up with NVIDIA’s supply pace.

However, if Samsung fails to meet the standards in time, the expansion efforts of SK Hynix and Micron will continue, potentially leading to a crowding-out effect. By progressing in both yield and capacity, they will further widen their lead over Samsung.

The international competition for the HBM market has significantly reduced the supply of standard DRAM. Module manufacturers believe that DDR5 prices are on a clear upward trend, expecting a 10-20% increase by the end of the year. However, if DDR5 prices become too high, it might delay the market penetration rate, affecting the willingness of downstream customers to adopt it.

Disclaimer: This article is created by the original author. The content of the article represents their personal opinions. Our reposting is for sharing and discussion purposes only and does not imply our endorsement or agreement. If you have any objections, please get in touch with us through the provided channels.