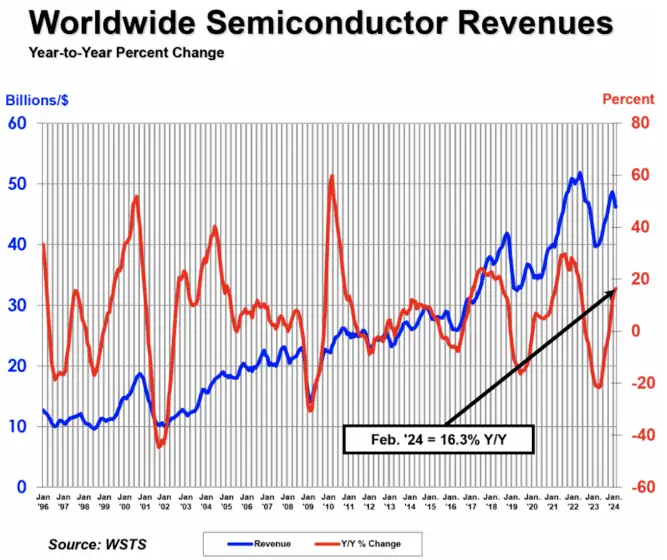

Despite a slight decline in monthly sales, global semiconductor sales in February were still significantly higher than the total sales of the same month last year.

The day before yesterday, the Semiconductor Industry Association (SIA) announced that the total global semiconductor industry sales in February 2024 amounted to $46.2 billion, an increase of 16.3% compared to the total of $39.7 billion in February 2023, but a 3.1% decrease from the $47.6 billion total in January 2024. The monthly sales figures are compiled by the World Semiconductor Trade Statistics (WSTS) organization and represent a three-month moving average. In terms of revenue, the SIA accounts for 99% of the U.S. semiconductor industry and nearly two-thirds of non-U.S. chip companies.

John Neuffer, President and CEO of SIA, stated, “Although there is a slight decline in monthly sales, global semiconductor sales in February were still significantly higher than the total sales of the same month last year, continuing the strong year-on-year growth the market has seen since the middle of last year. The year-on-year growth in sales in February is the largest percentage since May 2022, and the market is expected to continue to grow for the remainder of the year.”

Regionally, year-on-year sales increased in China (28.8%), the Americas (22.0%), and Asia Pacific/all other regions (15.4%), but decreased in Europe (-3.4%) and Japan (-8.5%). Monthly sales declined across all markets: Asia Pacific/all other regions (-1.3%), Europe (-2.3%), Japan (-2.5%), the Americas (-3.9%), and China (-4.3%).

In 2023, the global semiconductor industry experienced a “low run” for the entire year, with high inventory, low demand, reduced investment, and reduced capacity continuing to rotate among various sub-sectors. Fortunately, at the end of the fourth quarter of 2023, there seemed to be the dawn of a new boom cycle. Facing 2024, global analysis institutions unanimously predict a year-on-year increase, with the most optimistic expecting growth of over 20% and the average growth rate forecast also exceeding double-digit percentages.

However, it must be acknowledged that, under the influence of weak purchasing power demand, inflation, and a series of other factors, the global semiconductor industry cannot “bounce back quickly” in the short term. In 2024, it is highly likely to show a “steady overall recovery with structural differentiation adjustments in sub-sectors.”

Below is IDC’s analysis and prediction for the development trends of the global semiconductor industry in 2024.

The global semiconductor market will show eight major development trends in 2024.

According to the latest research by market research firm IDC, with the explosive growth in global demand for artificial intelligence and high-performance computing (HPC), as well as the rebound in demand in the markets for smartphones, personal computers, servers, and automobiles, the semiconductor industry will welcome a new round of growth. The agency predicts that in 2024, the semiconductor market will exhibit eight major development trends.

The semiconductor market will recover in 2024. In 2024, the reduction in the memory market will drive product price increases, and the rising penetration rate of high-cost, high-bandwidth memory (HBM) will be a driving force for market growth. With the gradual rebound of the terminal market and the demand for AI chips exceeding supply, it is expected that the semiconductor market’s sales in 2024 will show a growth trend, with an annual growth rate reaching 20%.

Advanced driver assistance systems and automotive infotainment systems drive the development of the automotive semiconductor market. Although the overall automotive market’s growth rate is limited, the trend toward vehicle intelligence and electrification injects momentum into the semiconductor market. It is expected that the annual compound growth rate of advanced driver assistance systems will reach 19.8% by 2027, accounting for 30% of the automotive semiconductor market that year. Driven by vehicle intelligence and connectivity, the annual compound growth rate of this sub-sector will reach 14.6% by 2027, accounting for 20%. More and more automotive systems will rely on chips, leading to stable growth in demand for semiconductors.

Semiconductor AI applications extend to personal terminals. With the advancement of semiconductor technology, it is expected that in 2024, more AI functions will be integrated into personal terminals, leading to the emergence of AI smartphones, AI personal computers, and AI wearable devices. Personal terminals will have more innovative applications after the introduction of AI, further increasing the demand for semiconductors.

The “de-stocking” of IC design will gradually end. The IC design products in the Asia-Pacific region are diverse and widely used globally. Although the market was relatively flat in 2023 due to the lengthy “de-stocking” process, the industry still showed resilience under multiple pressures and actively explored innovative and breakthrough paths. In addition to continuing to deepen in the smartphone field, companies are entering the AI and automotive application tracks to adapt to the rapidly changing market environment. With the gradual recovery of the global personal terminal market, this sub-sector will have new growth opportunities, with an expected market growth rate of 14% in 2024.

The demand for advanced wafer foundry processes is growing rapidly. The wafer foundry industry was significantly affected by market inventory adjustments in 2023, with a substantial decline in capacity utilization rates, especially for mature processes above 28nm. However, partly due to the rebound in demand for certain consumer electronics and the boost from the explosion in AI demand, 12-inch wafer factories have gradually recovered in the second half of 2023. With the accelerated development of leading companies and the gradual return of end-market demand, this sub-sector will achieve double-digit growth in 2024.

Competition in mature process pricing will intensify. From the second half of 2023 to the first half of 2024, there will be a short-term “de-stocking” demand for industrial control and automotive chips, which are mainly produced in large quantities using mature processes. This will give mature process wafer foundries more bargaining power.

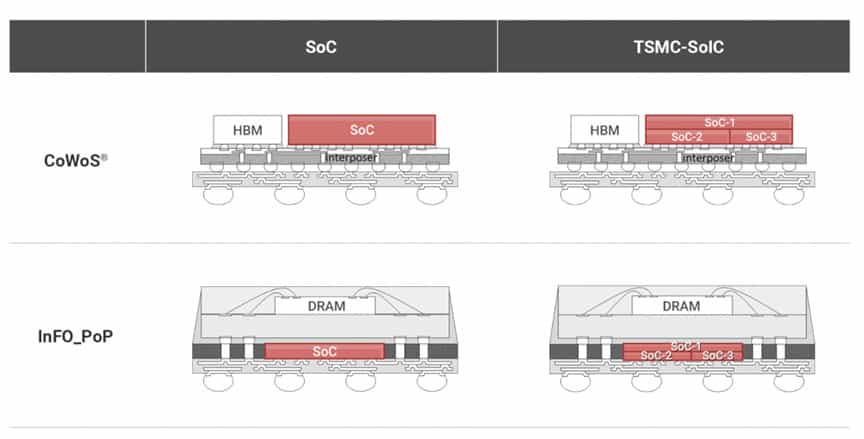

The 2.5/3D packaging market will experience explosive growth. With continuous improvements in semiconductor chip performance, advanced packaging technology has become increasingly important. Advanced packaging complements advanced process technology, continuously pushing the industry to break through Moore’s Law boundaries, resulting in qualitative improvements in the semiconductor industry and rapid market growth. The annual compound growth rate of the 2.5/3D packaging market is expected to reach 22% from 2023 to 2028, a key focus in the semiconductor packaging and testing field.

Expansion of the wafer-level packaging (CoWoS) supply chain capacity will ensure ample supply of AI chips. The AI wave is driving server demand, with advanced packaging technology CoWoS playing a crucial role. Currently, there is still a 20% gap between supply and demand for CoWoS. By the second half of 2024, CoWoS capacity will increase by 130%, with more manufacturers actively participating in the CoWoS supply chain. These factors will ensure a more ample supply of AI chips in 2024, becoming an important driving force for AI chip development.

Related:

Disclaimer: This article is created by the original author. The content of the article represents their personal opinions. Our reposting is for sharing and discussion purposes only and does not imply our endorsement or agreement. If you have any objections, please contact us through the provided channels.