The start of 2024 has been slow, but preparations for growth are already in place.

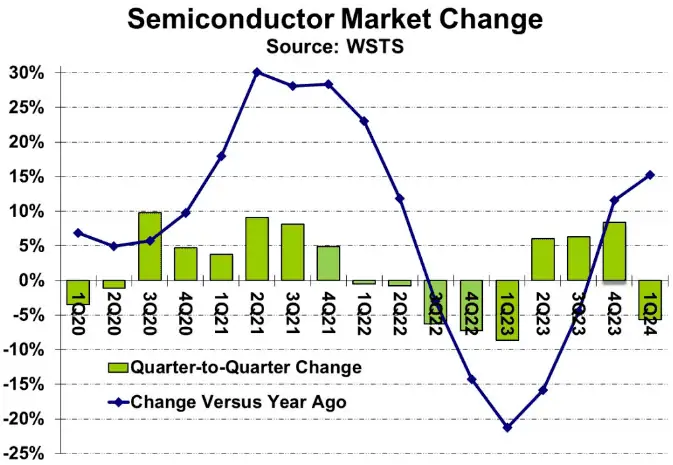

According to data from WSTS, the global semiconductor market size in the first quarter of 2024 was $137.7 billion. This represented a 5.7% decline from the fourth quarter of 2023 but a 15.2% increase compared to the same period last year. The first quarter of each year typically experiences a seasonal decline compared to the fourth quarter of the previous year. However, the 5.7% decline in the first quarter of 2024 was worse than expected.

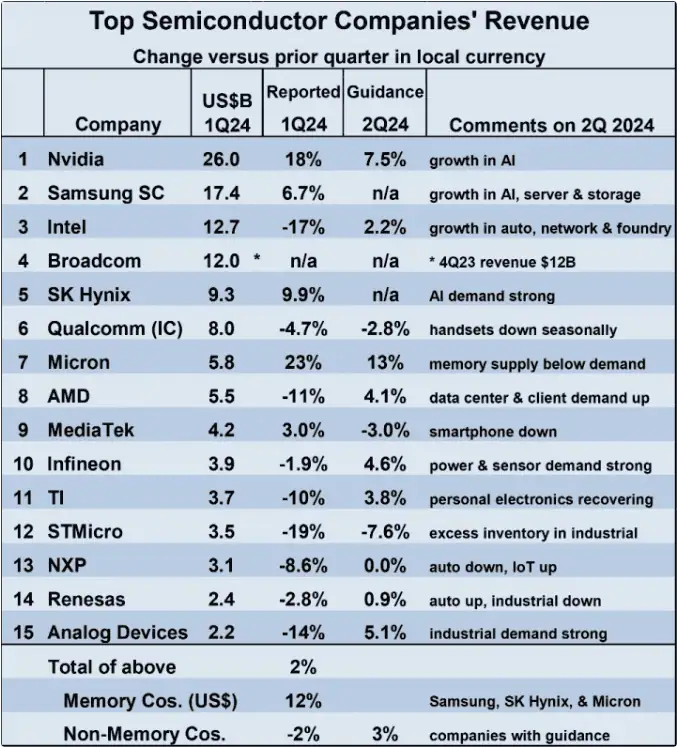

Major semiconductor companies had mixed performance in the first quarter of 2024. Revenue changes from the fourth quarter of 2023 to the first quarter of 2024 varied from a 23% increase reported by Micron Technology to a 19% decrease reported by STMicroelectronics. Five companies saw revenue growth compared to the previous quarter, while nine companies experienced a decline. Nvidia continued to be the largest semiconductor company with revenues of $26 billion. Total revenues for leading companies increased by 2%, with memory chip manufacturers growing by 12% and non-memory manufacturers declining by 2%.

Companies provided different revenue guidance for the second quarter of 2024. Micron expects strong demand for memory chips to continue, projecting a 13% revenue growth in the second quarter of 2024 compared to the first quarter. Seven other companies anticipate an increase in revenue in the second quarter of 2024. Artificial intelligence (AI) is cited as a major growth driver by Nvidia, Samsung, and SK Hynix. NXP Semiconductors expects its revenue in the second quarter of 2024 to be flat compared to the first quarter. Three companies anticipate a decline, with Qualcomm and MediaTek experiencing seasonal declines in smartphone sales. STMicroelectronics provided the lowest revenue guidance, expecting a 7.6% decline due to surplus inventory in the industrial sector. The combined outlook for the second quarter of 2024 from the 12 companies providing guidance is a 3% growth.

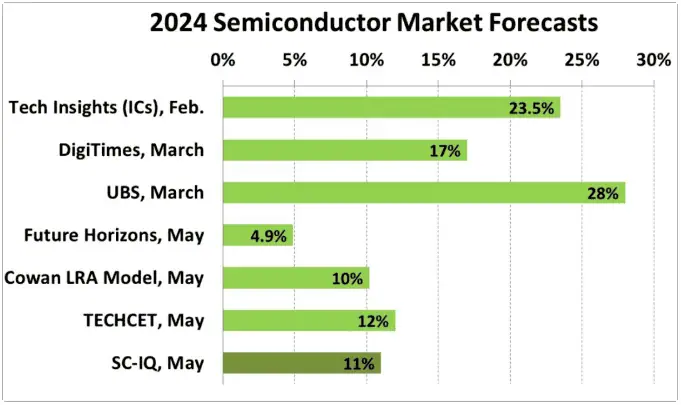

Recent estimates for the growth rate of the semiconductor market in 2024 range from 4.9% to 28%. However, forecasts since the release of WSTS’s first-quarter data in early May differ significantly from previous ones. Forecasts released in February and March ranged from 17% by DigiTimes to 28% by UBS. Based on WSTS data for the first quarter of 2024, Future Horizons revised its forecast from 16% in January to 4.9% in May. Other May forecasts include 10% by Cowan LRA model and 12% by TECHCET. Semiconductor Intelligence (SC-IQ) revised its expected growth rate for 2024 from 18% in February to 11% in May.

In our April newsletter for 2024, we pointed out that there should be robust growth in key end markets such as PCs and smartphones. Some markets that have seen growth in recent years, such as automotive and industrial, appear to be weakening. Artificial intelligence is an emerging growth driver. According to data from the International Monetary Fund, global economic growth is expected to stabilize at 3.2% over the next two years. These factors should support healthy growth in the semiconductor market in 2024 and 2025. However, earlier forecasts of 20% or higher growth for 2024 are unlikely to be proven correct.

Semiconductor capital expenditures are expected to decline in 2024.

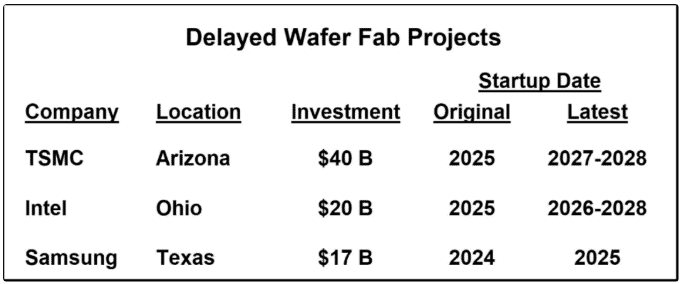

In March of this year, President Biden announced an agreement to provide Intel with $8.5 billion in direct funding and $11 billion in loans under the “Chip and Science Act.” The Act allocates a total of $52.7 billion to the U.S. semiconductor industry, including $39 billion for manufacturing incentives. Prior to Intel’s funding, the Act had announced grants totaling $1.7 billion to GlobalFoundries, Microchip Technology, and BAE Systems, according to data from the Semiconductor Industry Association (SIA).

Grants obtained under the Act have been slow to materialize, with the first batch announced over a year later. Due to slow disbursements, some large semiconductor fab projects in the United States have been delayed. TSMC also noted difficulties in finding qualified construction workers. Intel stated that delays were also due to slowing sales.

Other countries and regions have also allocated funds to promote semiconductor production. In September 2023, the EU passed the “European Chip Act,” which provides €43 billion (approximately $47 billion) in public and private investments for the semiconductor industry. In November 2023, Japan allocated ¥2 trillion (approximately $13 billion) for semiconductor manufacturing. In March 2023, South Korea passed a law providing tax breaks for strategic technologies, including semiconductors. Taiwan, China, enacted a law in January 2024 providing tax breaks for semiconductor companies.

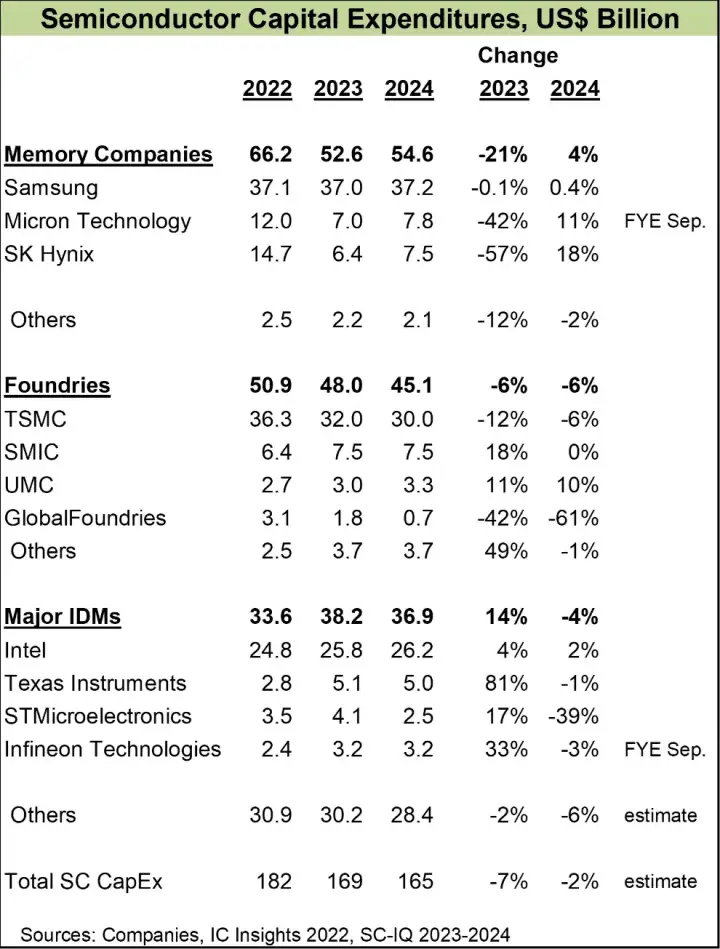

What are the prospects for semiconductor industry capital expenditures (CapEx) this year? While the “Chip Act” aims to stimulate CapEx, most of the impact is expected to occur after 2024. After a disappointing 8.2% decline in the semiconductor market last year, many companies are cautious about CapEx for 2024. Semiconductor Intelligence estimates total semiconductor CapEx for 2023 was $169 billion, down 7% from 2022. We predict CapEx will decrease by 2% in 2024.

With the recovery of the memory market, major memory companies are generally increasing CapEx in 2024, with expectations of increased demand from new applications like artificial intelligence. Samsung plans to maintain relatively flat spending in 2024 at $37 billion, without cutting CapEx from 2023 levels. Micron Technology and SK Hynix significantly reduced CapEx in 2023 and plan for double-digit growth in 2024.

The largest foundry, TSMC, plans to spend approximately $28 billion to $32 billion in 2024, with the mid-range of $30 billion down 6% from 2023. SMIC plans to maintain CapEx, while UMC plans to increase by 10%. GlobalFoundries expects to cut CapEx by 61% in 2024 but will increase spending over the next few years with the construction of a new fab in Malta, New York.

On the IDM front, Intel plans to increase CapEx by 2% to $26.2 billion in 2024. Intel will increase capacity for foundry customers and internal products. Texas Instruments’ CapEx remains roughly flat. TI plans to spend approximately $5 billion annually until 2026, primarily for its new fab in Sherman, Texas. STMicroelectronics will cut CapEx by 39%, while Infineon Technologies will reduce by 3%.

The top three spenders, Samsung, TSMC, and Intel, will account for 57% of semiconductor industry CapEx in 2024.

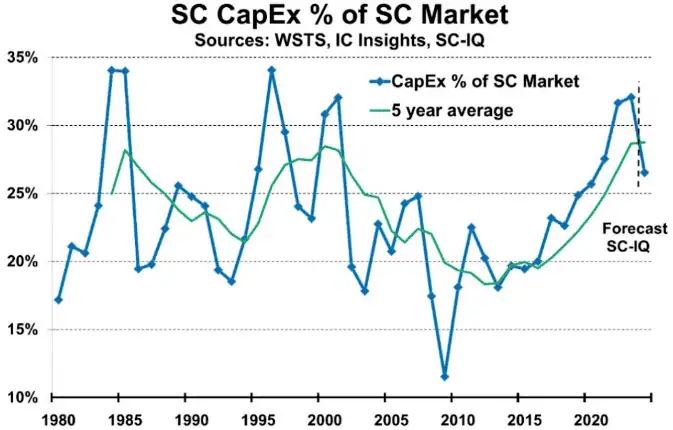

What is the appropriate level of capital expenditures in the semiconductor market? It is well known that the semiconductor market is highly volatile. Annual changes have ranged from a 46% increase in 1984 to a 32% decrease in 2001. Although volatility has decreased as the industry has matured, it was up 26% in 2021 and down 12% in 2019 over the past five years. Semiconductor companies need to plan their capacity over several years. Building a new fab takes approximately two years, plus additional time for planning and financing. Therefore, the ratio of semiconductor CapEx to the semiconductor market varies widely, as shown in the figure below.

The ratio of semiconductor CapEx to market size ranges from a high of 34% to a low of 12%. The five-year average ratio ranges from 28% to 18%. From 1980 to 2023, total CapEx accounted for 23% of the semiconductor market. Despite fluctuations, the long-term trend of this ratio has been fairly consistent. Based on expected strong market growth and decreased CapEx, we expect the ratio to decrease from 32% in 2023 to 27% in 2024.

Most forecasts for semiconductor market growth in 2024 range from 13% to 20%, with Semiconductor Intelligence forecasting 18%. If 2024 proves to be as strong as expected, companies may increase their CapEx over time. Then, we can expect positive changes in semiconductor CapEx in 2024.

Disclaimer: This article is created by the original author. The content of the article represents their personal opinions. Our reposting is for sharing and discussion purposes only and does not imply our endorsement or agreement. If you have any objections, please contact us through the provided channels.