Japanese storage manufacturer Kioxia has proposed to its South Korean competitor SK Hynix to allow SK Hynix to produce in Kioxia’s factories in Japan. This move is hoped to change SK Hynix’s opposition to the merger between Kioxia and Western Digital, although SK Hynix’s opinion is not yet known.

The merger between Kioxia and Western Digital was blocked last year due to opposition from SK Hynix, which feared that the alliance between the Japanese and American companies would become a storage industry giant, thereby encroaching on SK Hynix’s market share.

Currently, in the global 3D NAND market rankings, Samsung leads with over 31% of the market share, followed by SK Hynix with 20%. Should Kioxia and Western Digital merge, their combined market share would exceed 30%, significantly surpassing SK Hynix.

To garner support, Kioxia has suggested allowing SK Hynix to use the jointly operated Japanese 3D NAND wafer factory by Kioxia and Western Digital for chip production. This proposal aims to add leverage for the future merger, suggesting that by using this factory, SK Hynix could significantly increase its 3D NAND production capacity without the need for further factory expansion. This appears to be an attractive proposal, though SK Hynix has yet to respond.

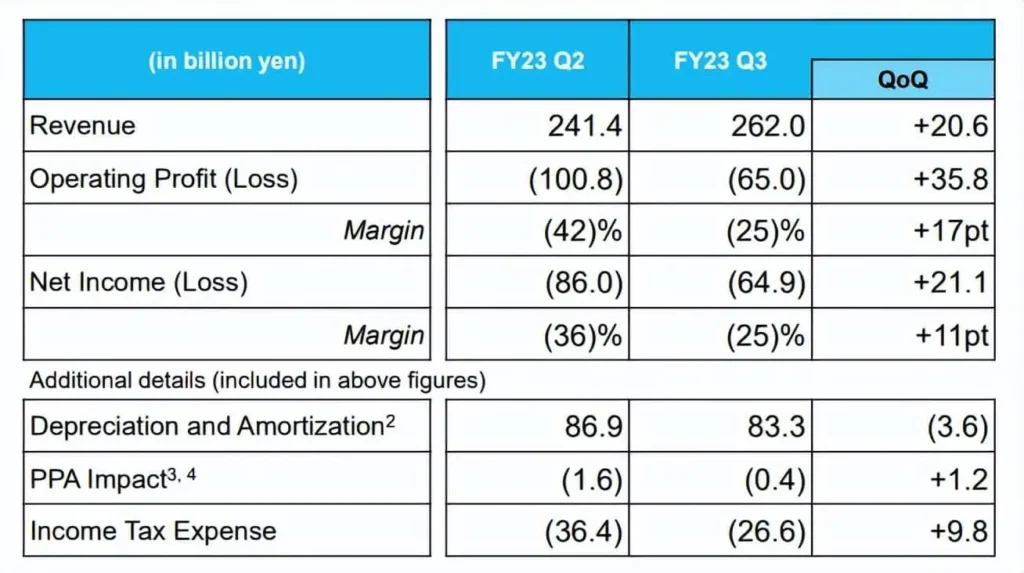

Kioxia’s latest financial report shows that last quarter’s revenue was 262 billion yen, a 21% increase quarter-over-quarter, with a net loss of 64.9 billion yen, also increasing by 21%.

The data indicates that the unit price of NAND Flash products is continuously rising, with Kioxia’s main focus being on high-profit product areas.

Related: