In the third quarter of 2022, AMD officially released the new generation of Ryzen 7000 series processors. Fairly speaking, the performance and cost-effectiveness of the Ryzen 7000 series processors are acceptable, but what is frustrating is the high price of the motherboards and memory that go with them.

It is reported that the chipset of the AMD 600 series motherboards has been redesigned, with high development and manufacturing difficulty and cost, so that the price of the mainstream B650 series motherboards from first-tier brands is around 1500 yuan. Another point of complaint is the exclusive support for DDR5 memory, which, in the past one or two years, was much more expensive than DDR4 memory.

On the other hand, Intel’s recent generations of new products do not have the above problems. The prices of the 600 series motherboards are more reasonable, they can support three generations of new processors, and they continue to support DDR4 memory, giving them a significant overall advantage.

Against this backdrop, the general consumer’s willingness to choose the AMD platform for building computers is not high, leading to widespread expectations of poor sales for the Ryzen 7000 series processors and a significant market share loss to Intel, with a very unclear outlook.

So, what is the actual situation? The well-known third-party statistical analysis agency Mercury Research recently released the latest data for reference.

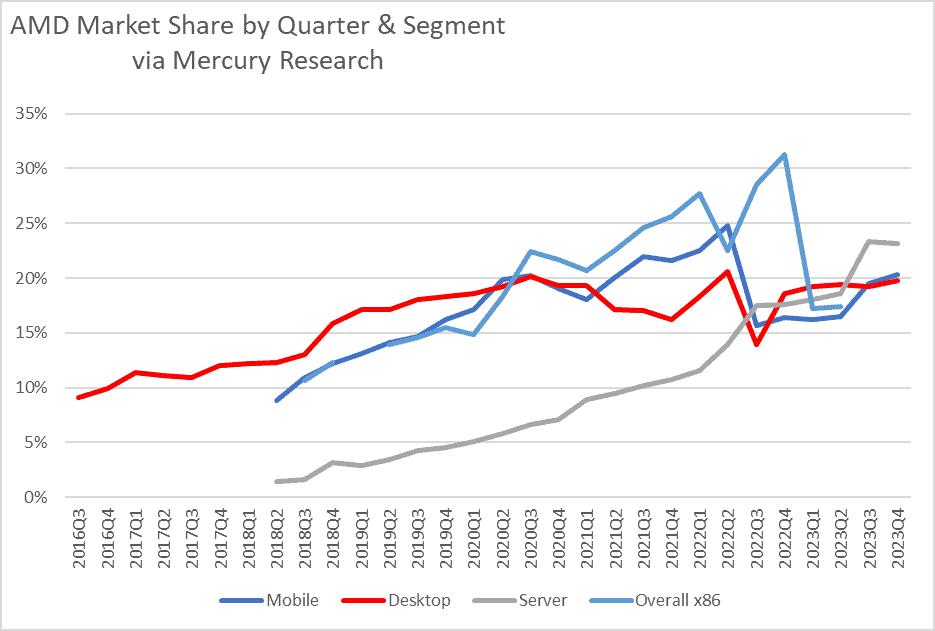

Mercury Research published a trend chart of AMD’s processor market share from the third quarter of 2016 to the fourth quarter of 2023, approximately seven years.

Overall, AMD’s desktop processor market share (red line) has been on an upward upward trend, with a significant decline in the second and third quarters of 2022, marking the most difficult period.

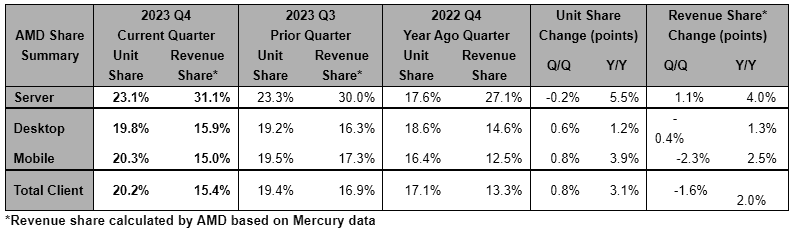

However, this trend did not last too long. By the fourth quarter of 2022, the market share had begun to recover and continued to grow slowly. As of the fourth quarter of 2023, AMD’s desktop processor market share was 19.8%.

In the laptop processor sector (dark blue line), the situation is somewhat worse, with the market share peaking at around 25% and the latest market share at 20.3%, a decline of nearly five percentage points.

AMD’s performance is more impressive in the server processor sector (grey line), with a counter-trend growth. Its market share trend is a straight line, steadily rising, with the latest market share at 23.1%, about a 5% increase from the same period last year.

Since there are only two main players in the server processor sector, Intel and AMD, it can be concluded that the market share AMD gained was taken from its old rival Intel, indicating the market’s high recognition of AMD’s several EPYC processors launched in recent years.

Mercury Research also published the revenue contribution ratio of AMD’s different types of processors. Revenue from the server processor product line accounts for 31.1%, nearly one-third, which is the absolute majority of AMD’s revenue in 2023.

Revenue from the desktop processor product line accounts for 15.9%, and revenue from the laptop processor product line accounts for 15.0%, with both being roughly equal. Together, the revenue from AMD’s consumer-grade processors and server processors are essentially equal.

Overall, AMD indeed faced some difficulties between the second and fourth quarters of 2022, but these negative impacts and effects were not as severe as the outside world expected. Throughout 2023, AMD’s overall performance was quite stable, essentially steadying the situation, which is commendable.

However, the current situation does not look optimistic for AMD. In the second half of 2024, AMD and Intel will once again face off directly, with competition expected to be extremely fierce.

Strictly speaking, the 12th Gen Core was the generation where Intel began its transformation, with significant changes in various aspects. The 13th and 14th Gen Cores are continuations and improvements based on the 12th Gen, while the 15th Gen Core may be a more perfected processor that Intel introduces.

For AMD as well, in addition to releasing the Ryzen 8000 series APU processors, AMD will also launch a new generation of processors in the second half of the year, with both companies’ next-generation processors incorporating artificial intelligence units.

Another significant variable is artificial intelligence. Rumors suggest Microsoft will release a Windows 12 operating system reconstructed with artificial intelligence this June, requiring higher hardware performance, expected to spur a wave of upgrades and replacements, which would benefit the sales of AMD’s new processors.

In summary, for AMD, 2024 presents both opportunities and challenges. It is not wise to be blindly optimistic or unduly pessimistic. A steady and strategic approach is the most robust development strategy. As for AMD’s outlook, the author holds a cautiously optimistic attitude.

Related: