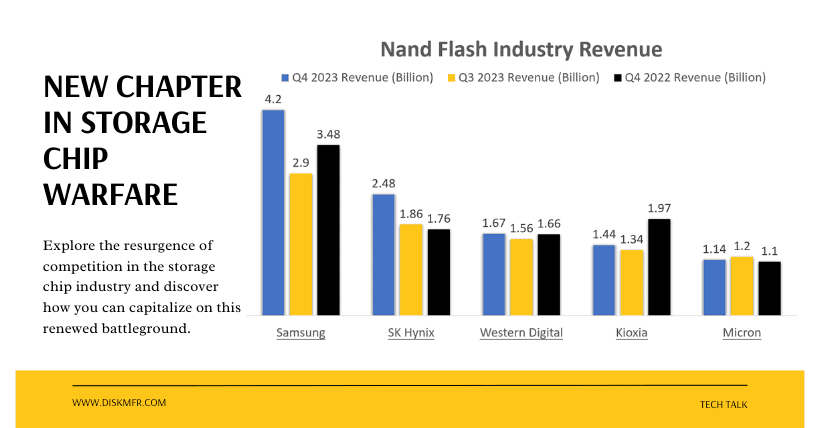

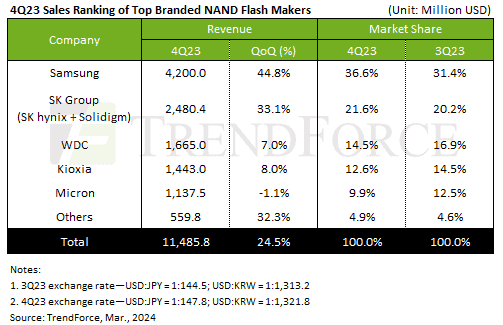

According to TrendForce’s statistics, the global NAND flash market’s total revenue reached $11.49 billion in the fourth quarter of 2023, marking a significant increase of 24.5% quarter-over-quarter.

A key reason for this surge was the major production cuts by various manufacturers during previous years when inventory levels were high, which successfully reduced the stockpile and led to a buoyant flash memory market, making SSD prices less affordable.

During the quarter, the average contract price for NAND flash soared by approximately 25%, with Samsung’s average selling price increasing by 12% and Western Digital’s by 10%.

As an industry leader, Samsung saw a robust demand for its server, laptop, and mobile flash memory products, resulting in a supply shortage. The company earned $4.2 billion in revenue for the quarter, a whopping increase of 44.8% quarter-over-quarter, and captured 36.6% of the market share, gaining 5.2 percentage points.

SK Hynix (including Solidigm) also saw its revenue rise to $2.48 billion, up 33.1% quarter-over-quarter, with its market share increasing to 21.6%.

Western Digital and Kioxia experienced modest gains of 7.0% and 8.0%, respectively, with current market shares at 14.5% and 12.6%.

Micron was the only one among the top five giants to see a decline, with a more than 10% reduction in shipment volume due to reduced supply, leading to a slight revenue decrease of 1.1% and a market share falling below 10%.

Smaller manufacturers also fared well, collectively achieving a revenue increase of 32.3%.

TrendForce forecasts that the NAND flash industry’s revenue will rise by approximately 20% in the first quarter of 2024.

Related:

Disclaimer:

- This channel does not make any representations or warranties regarding the availability, accuracy, timeliness, effectiveness, or completeness of any information posted. It hereby disclaims any liability or consequences arising from the use of the information.

- This channel is non-commercial and non-profit. The re-posted content does not signify endorsement of its views or responsibility for its authenticity. It does not intend to constitute any other guidance. This channel is not liable for any inaccuracies or errors in the re-posted or published information, directly or indirectly.

- Some data, materials, text, images, etc., used in this channel are sourced from the internet, and all reposts are duly credited to their sources. If you discover any work that infringes on your intellectual property rights or personal legal interests, please contact us, and we will promptly modify or remove it.