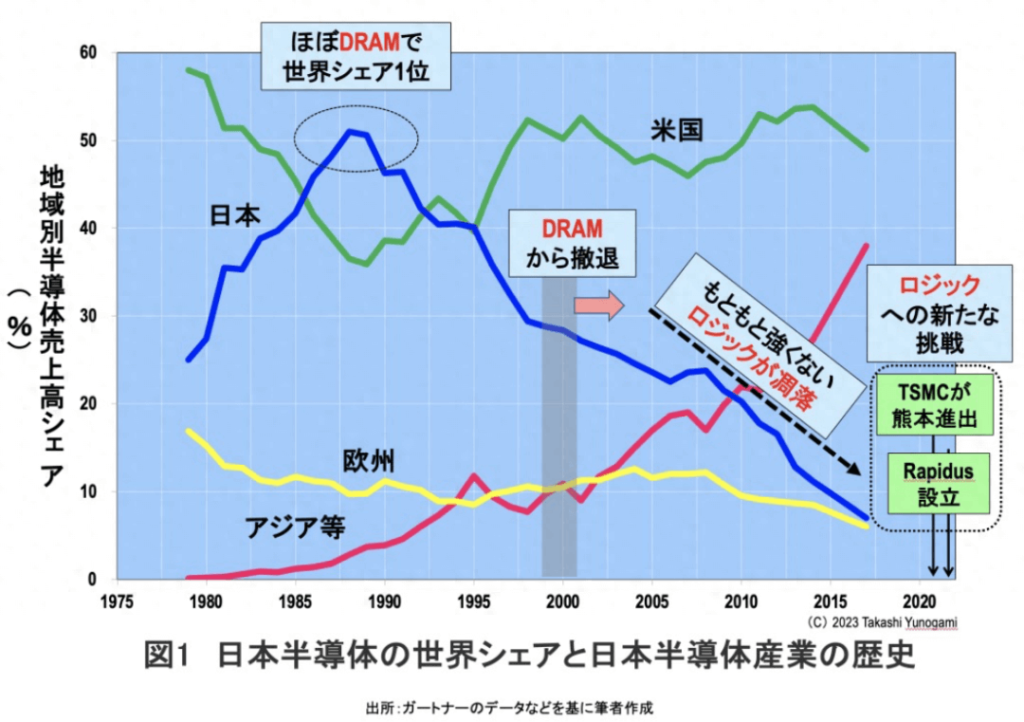

The spotlight is beginning to shine on the semiconductor field, once a representative of Japan’s declining industry. The public opinion that ‘the Japanese semiconductor industry will revive’ is increasingly prevalent. However, Relevant practitioners disagree with this view and believe that the idea of its ‘reviving’ is incorrect (Figure 1).

In the mid-1980s, Japan once held a 50% share of the global semiconductor market. At that time, Japan nearly monopolized 80% of the global market share in semiconductor memory DRAM. In other words, the “50% global market share” in the mid-1980s primarily came from DRAM.

However, in the 1990s, Japan’s market share in DRAM rapidly declined, and by around 2000, Japan withdrew from the DRAM market, except for a joint venture called Elpida, formed by Hitachi and NEC. Elpida declared bankruptcy in 2012 and was acquired by the American company Micron.

After retreating from DRAM, the Japanese semiconductor industry shifted its focus to logic semiconductors for applications like computing. However, even the logic semiconductor sector faced significant challenges. As a result, the Japanese semiconductor industry became a declining one.

In this context, the chip foundry company TSMC (Taiwan Semiconductor Manufacturing Company) announced in October 2021 that it would establish a factory in Kumamoto. Additionally, a new company called Lapidus announced plans in November 2022 to mass-produce 2-nanometer logic semiconductors by 2027. These announcements have generated widespread interest in the Japanese semiconductor industry.

Hence, the prevailing opinion is that the “Japanese semiconductor industry will revive.” However, it’s important to note that the TSMC Kumamoto factory and the products planned by Lapidus are not DRAM, which once dominated 80% of the market in the mid-1980s. Instead, they focus on advanced logic semiconductors, a field that wasn’t historically strong in Japan.

Therefore, the current enthusiasm in Japan is not so much a “revival” but rather a new challenge to the (previously relatively weaker) logic semiconductor sector. So, will this challenge succeed?

01

The Origin of the Semiconductor Boom

In 2020, as the global pandemic spread, and in 2021, due to a global semiconductor shortage, the production of automobiles and other products was severely affected. Consequently, governments in countries with a core automotive industry, such as Japan, the United States, and Germany, called on TSMC (Taiwan Semiconductor Manufacturing Company) to increase its production of semiconductors for automotive use.

The turning point for semiconductor attention came here. The Japanese government and the Ministry of Economy, Trade and Industry, which had largely overlooked the semiconductor industry until 2020, had a significant change in attitude. The Ministry of Economy, Trade and Industry expressed growing concerns, stating that if developments continued as they were, Japan’s global share of the semiconductor industry would plummet to 0% by 2030. As a result, legislation supporting the establishment of advanced semiconductor factories received parliamentary approval on December 20, 2021. Subsequently, a series of subsidy programs for semiconductor factories were announced based on this legislation (see Figure 2).

So, will this policy increase Japan’s market share in the semiconductor industry?

02

Will the Market Share of the Japanese Semiconductor Industry Increase?

Firstly, Sony and Denso Corporation will have capital participation in TSMC. TSMC’s Kumamoto factory will engage in contract manufacturing (foundry) of 12/16 to 22/28-nanometer logic semiconductors and will receive a subsidy of 467 billion Japanese yen from the Japanese government.

However, the TSMC Kumamoto factory will not prioritize producing semiconductors for the Japanese market. Additionally, Japan has almost no dedicated semiconductor manufacturers involved in design (commonly referred to as “fabless” companies). Therefore, even with the establishment of the TSMC Kumamoto factory, Japan’s market share is unlikely to significantly increase.

Next, the American company Micron acquired the bankrupt Elpida and received a total subsidy of 246.5 billion Japanese yen for its Hiroshima factory. However, since this factory is under an American corporation, even if it produces DRAM there, its contribution to Japan’s market share can be considered strictly 0%.

Furthermore, Kioxia and Western Digital (WD) jointly operate the Yokkaichi and Kitakami factories for NAND flash memory production, which will receive 92.9 billion Japanese yen. However, Western Digital appears to be acquiring Kioxia. If this acquisition is completed, both the Yokkaichi and Kitakami factories will fall under American ownership, and all NAND produced there will be manufactured in the United States, resulting in a 0% contribution to Japan’s market share.

Finally, in November 2022, Lapidus announced plans to mass-produce 2-nanometer logic semiconductors by 2027 and received a total subsidy of 330 billion Japanese yen. However, as explained below, achieving mass production of 2-nanometer logic semiconductors for Lapidus is almost impossible. Therefore, despite the financial support provided to Lapidus, its contribution to Japan’s market share can still be considered 0%.

03

Why can’t Lapidus Mass-Produce 2nm?

Firstly, the development of 2-nanometer technology requires approximately 500 exceptionally talented engineers, while mass production of 2-nanometer technology necessitates around 1,000 experienced production technicians. These 1,500 super-elite engineers are not readily available in Japan, making it unlikely for Lapidus to attract them.

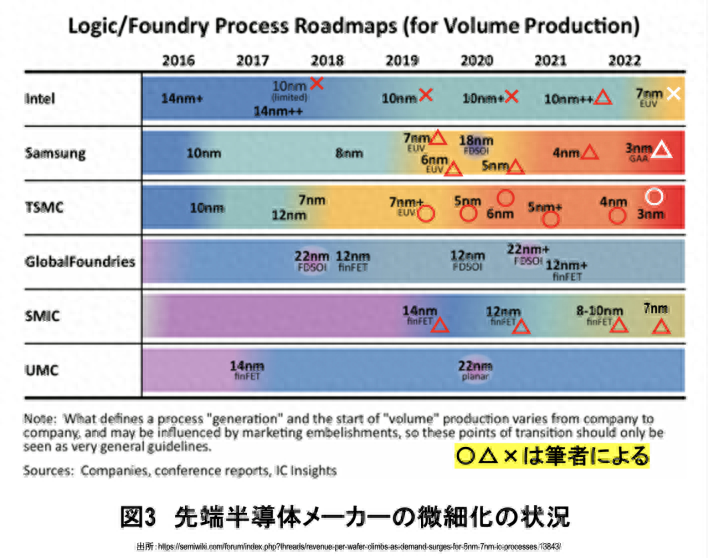

Secondly, the development and mass production of 2-nanometer technology requires access to the most advanced exposure equipment, EUV, provided exclusively by the Dutch company ASML. However, Lapidus is not set to introduce EUV technology until late 2024, and there may be challenges in mastering it proficiently. The basis for this viewpoint can be seen in Figure 3.

Firstly, TSMC, at the forefront of technology, conducted approximately one million EUV (Extreme Ultraviolet) exposure practices in 2018 and first applied EUV technology to mass production in 2019. Samsung Electronics, attempting to catch up with TSMC, conducted around 300,000 EUV exposure practices using large-scale DRAM production lines. However, due to insufficient practice, their yield decreased. Additionally, Intel introduced EUV technology in 2021 but has not yet mastered it proficiently as of 2023.

Considering the challenges that these advanced semiconductor manufacturers have faced with EUV technology, it can be assumed that Lapidus will encounter significant difficulties in mastering EUV technology.

Secondly, when it comes to contract manufacturing, there are no semiconductor foundries partnering with Lapidus. Foundries typically operate based on existing contract manufacturing demands. For instance, TSMC annually receives contracts from Apple in excess of 200 million new iPhone processors, each priced at over $100. Before signing contract manufacturing agreements with clients, TSMC invests in development and equipment to ensure profitability.

However, Lapidus claims to begin mass-producing 2-nanometer logic semiconductors by 2027 but currently has no contract or plan for contract manufacturing. Therefore, it can be said that Lapidus may not understand the essence of foundries.

In conclusion, due to the aforementioned reasons, Lapidus may not achieve mass production of 2-nanometer logic semiconductors. Consequently, Japan’s new challenge in logic semiconductors may end in failure. So, what actions should Japan take?

04

Japan’s Role in the Global Semiconductor Industry

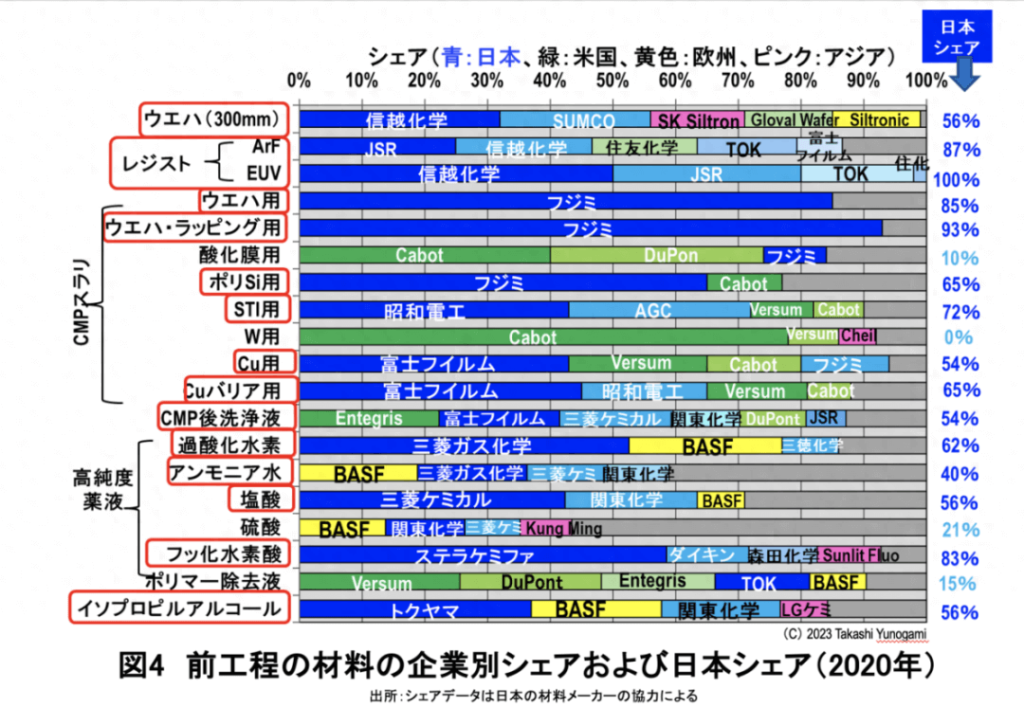

In a statement delivered to the House of Representatives on June 1, 2021, the author argued that the primary policy should be to ‘make the strong even stronger.’ The ‘strong’ elements refer to manufacturing equipment and materials.

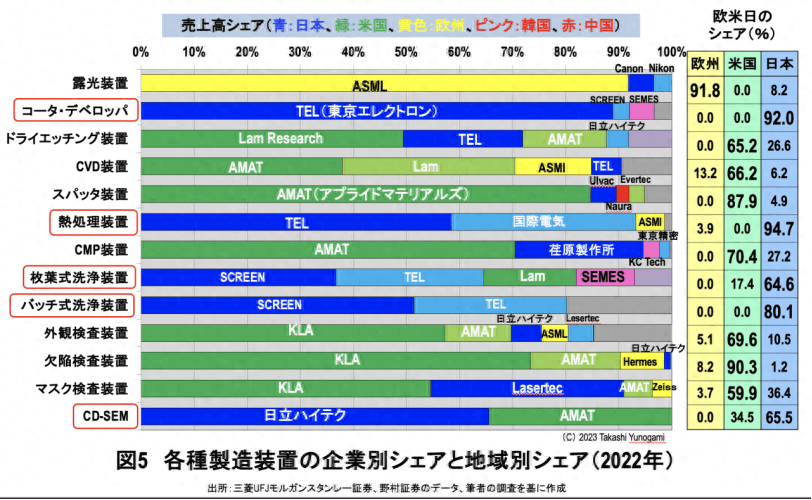

In the field of semiconductor materials, Japan holds a very high market share in the production of materials substrates required for semiconductor chip manufacturing, such as silicon wafers, photoresist materials, various CMP polishing fluids, and various chemical agents (see Figure 4). Additionally, in the equipment sector, though not in all areas, Japan also has a significant market share in fields like photoresist coating and developing equipment, heat treatment equipment, batch cleaning equipment, and Critical Dimension Scanning Electron Microscopes (CD-SEM) (see Figure 5).

Thus, Japan holds a significant market share in the equipment and materials sectors, playing an extremely crucial role in the global semiconductor industry.

In this context, South Korea boasts Samsung Electronics and SK Hynix, making it a semiconductor storage powerhouse. Taiwan, China, holds around 60% of the global market share through TSMC (Taiwan Semiconductor Manufacturing Company), establishing itself as the global infrastructure for logic semiconductor production. Furthermore, mainland China absorbs over one-third of the world’s semiconductors, with major factories under the Hon Hai Precision Industry Co., Ltd. (Foxconn) producing PCs, smartphones, and various household appliances.

Against this backdrop, Japan exports equipment and materials to South Korea, Taiwan China, mainland China, as well as Europe and the United States. In other words, the global semiconductor industry cannot sustain operations without Japan’s equipment and materials. However, Japan’s equipment industry is currently facing a crisis.

05

The Crisis in Japan’s Equipment Industry

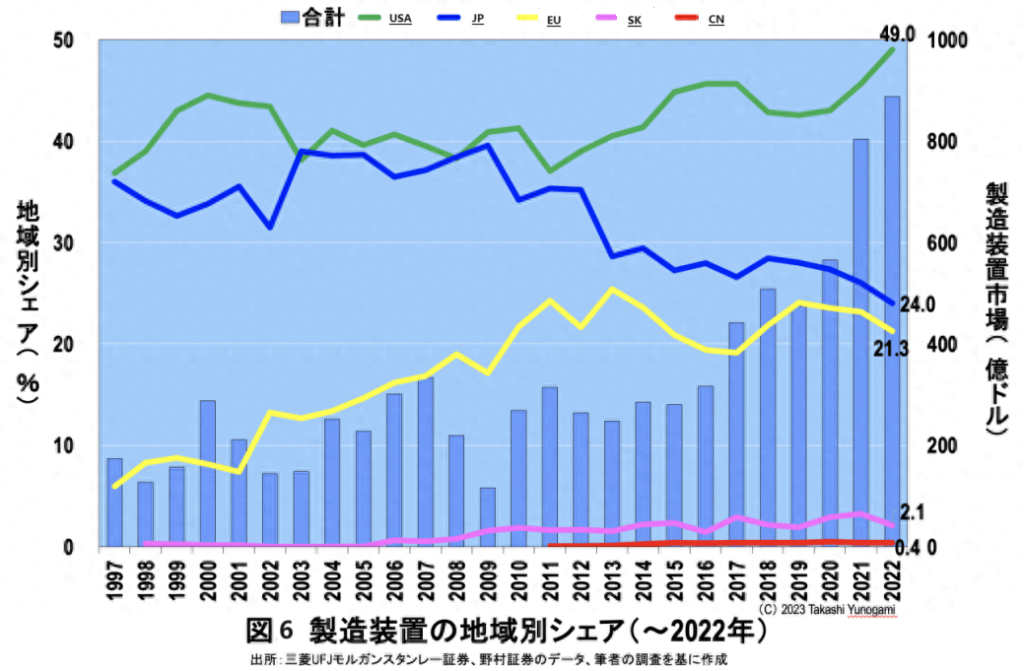

As shown in Figure 6, the regional equipment market share data indicates that Japan maintained a leading position in the equipment market share competition with the United States until around 2010. However, since 2012, Japan’s market share has sharply declined, plummeting to less than half of the U.S. market share by 2022, standing at only 24%.

Analyzing the reasons behind this situation, it becomes evident that over the past decade, the market share of almost all equipment has been decreasing. This is a very serious issue that appears to be challenging to address.

In this scenario, it is increasingly difficult to claim that ‘Japan’s manufacturing equipment is robust.’ Furthermore, if the market share continues to decline, Japan will find it increasingly challenging to supply equipment to the global market. The current situation is highly precarious, and without immediate action, Japan’s equipment industry may follow the same path as the semiconductor storage industry. Therefore, substantial funds should not be invested in projects like Lapidus that may not yield results.

Disclaimer: This article is created by the original author. The content of the article represents their personal opinions. Our reposting is for sharing and discussion purposes only and does not imply our endorsement or agreement. If you have any objections, please contact us through the provided channels.