2023 is already halfway through. In the first half of the year, the entire electronic semiconductor industry has shown a sluggish performance. What is even more concerning is that the supply and demand situation in the second quarter fell short of expectations, casting a shadow over the industry’s development in the second half of the year. Although a year-on-year negative growth trend is inevitable, people hope that the market performance in the second half of the year will improve significantly compared to the first half, reflecting strong signals of recovery. However, recent market conditions seem to be undermining this desire.

Based on the current market conditions and prospects for the second half of the year, two sentiments have emerged in the industry: one is pessimistic, believing that the decline will continue into the second half of the year, and the recovery trend will only emerge in the first half of 2024. The other is optimistic, stating that there are already multiple signs of recovery at present, albeit slower than previously anticipated. The situation is expected to become more apparent in the fourth quarter, thereby laying the foundation for overall growth in early 2024.

Now, let’s take a look at what has already happened and what changes are expected in the main aspects of the electronic semiconductor industry, namely applications (primarily focused on mobile phones and data center servers), chips (with a focus on memory), IC design, and wafer fabrication. This will give us an insight into the trends of the second half of 2023.

Decline Argument

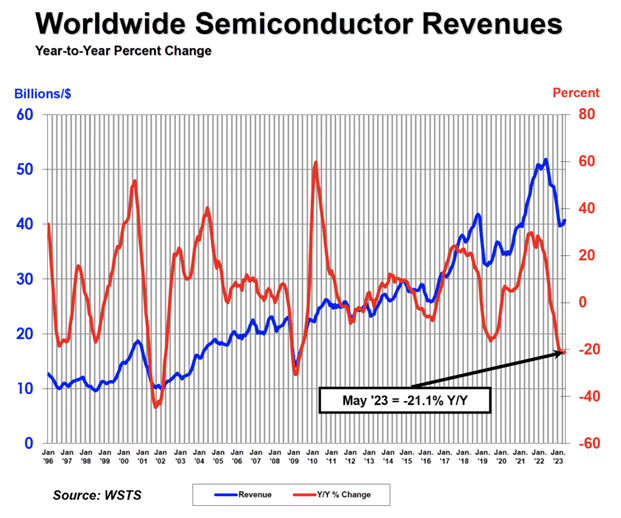

Major authoritative industry analysis institutions predict a year-on-year decline in global semiconductor sales in 2023, with some forecasts indicating a decline of over 10%. The World Semiconductor Trade Statistics (WSTS), recognized by the Semiconductor Industry Association (SIA), estimates a 4.1% decline in the global semiconductor industry in 2023. IDC predicts a 5.3% decline in global semiconductor total revenue due to inventory adjustments and weak demand.

The weakest performance is observed in the mobile phone and PC segments, as these consumer-oriented applications have a significant impact on the upstream of the industry chain.

Despite the release of new Android devices in the mobile phone sector since March, there hasn’t been a noticeable recovery in demand as of May. Taiwanese mobile phone industry chain manufacturers experienced a year-on-year revenue decline of 9.9%, but a 5.2% increase compared to the previous month. MediaTek, a leading mobile phone SoC company, saw a continuous year-on-year decline in revenue, with a 39.38% decrease in May and an 11.35% increase compared to the previous month. According to IDC statistics, during the “618” e-commerce festival, although there were promotional activities, the sales of smart terminals were lower than expected, and in the first week of June, the sales volume in the Chinese mobile phone market declined by 6.5% year-on-year. Overall, the mobile phone market remained sluggish throughout the second quarter.

The situation in the PC segment is very similar and will not be further elaborated here.

Regarding data centers and servers (excluding AI servers), the expected growth has also been hindered by insufficient driving force. Even AMD, which has experienced substantial revenue growth in recent years, witnessed a significant decline in revenue in the first half of the year. Not only PC CPUs and GPUs but also the sales of processors for data centers were weak. NVIDIA faced a similar situation, with its revenue growth primarily supported by GPU sales for AI servers.

According to TrendForce’s prediction, the global server shipments for this year will be revised down to 13.835 million units, a 2.85% decrease compared to the previous year.

In the chip (Unveiling the Mystery: Why Chips Keep Shrinking) sector, particularly for memory, the overall spot prices of standard DRAM and NAND Flash models experienced an expanded month-on-month decline in May. The average price drop for 16Gb and 8Gb DDR4 was between 4% and 6%, which is about two percentage points larger than the average drop in April.

The MCU market, known for its intensifying competition, remains challenging for related manufacturers. Nuvoton from Taiwan stated that while there were some urgent orders, the terminal demand fell short of expectations, and the inventory adjustment cycle was longer. Holtek estimated that the consumer-oriented MCU market will reach its bottom in the fourth quarter of this year, and currently, customers are still expecting lower prices. Likewise, Holtek expressed a pessimistic outlook for the MCU market in the second half of the year, stating that current orders are still insufficient.

Despite some positive signals of recovery mentioned earlier, the overall industry analysis indicates a challenging landscape for the semiconductor market in the second half of 2023.

The downturn in downstream applications has already been transmitted to the upstream IC design and wafer foundry sectors.

According to Digitimes analysis, due to the uncertain market conditions in the second half of the year, IC design companies are adopting a conservative wafer start strategy, especially in mature processes. Many companies are considering delaying their wafer starts, which puts pressure on wafer foundries. Except for a few high-demand mature processes, the capacity utilization rates for most nodes in the second half of the year are expected to be suboptimal.

Some IC design practitioners revealed that due to the introduction of more favorable policies by mainland Chinese wafer foundries, the pressure on Taiwanese wafer foundries has increased significantly. Some foundries are willing to negotiate “quantity for price” deals as a way to indirectly reduce prices.

Regarding rumors of indirect price reductions, United Microelectronics Corporation (UMC) stated that they do not comment on specific models and adopt a mutually supportive approach with customers, providing support when needed. UMC believes that strong signals of a robust recovery have not yet been observed in the market for the second half of the year. Powerchip Semiconductor Manufacturing Corporation (PSMC) also maintains a conservative attitude towards the market conditions in the second half of the year.

Some IC design industry insiders revealed that due to better order situations, they have recently negotiated special procurement cases with mature process wafer foundries on both sides of the Taiwan Strait for tens of thousands of wafers. It is expected that the wafer starts will be completed within a year, and the larger the wafer volume, the greater the price discount. In addition to offering special prices, wafer foundries may indirectly reduce prices through other means. For example, even though the quotation remains the same, the foundries may produce 100 wafers but only charge for 80 wafers.

The challenging market conditions and the pressure on prices in the IC design and wafer foundry sectors reflect the overall impact of the sluggish downstream applications in the semiconductor industry.

Recovery Argument

On July 6th, the Semiconductor Industry Association (SIA) released the revenue data for the global semiconductor industry in May. It showed a year-on-year decline of 21.1%, but a month-on-month growth of 1.7%. It is worth noting that this marks the third consecutive month of slight increase, sparking optimism for a market rebound in the second half of the year.

Looking at the regions, although the year-on-year growth remains mostly negative, there are clear signs of warming on a month-on-month basis. China saw growth of 3.9%, Europe grew by 2.0%, Japan grew by 0.4%, and the Americas grew by 0.1%. Europe even achieved year-on-year growth of 5.9%.

In the application market, as mentioned earlier, the consumer electronics market, led by smartphones, experienced a slump in the first five months of this year. However, in the past two months (May and June), there have been positive signals of recovery.

Taking the performance of the leading wafer foundry company for smartphone RF front-end PA chips, Skyworks Solutions, as an example, their capacity utilization rate dropped to 20% in the first quarter of this year. However, in the second quarter, they saw sequential revenue growth of 37.9%. Although their June revenue decreased year-on-year by 7.9%, it increased by 10.3% compared to the previous month. This performance is mainly attributed to the increased demand for mid-to-low-end smartphone PAs in the second quarter, along with rising demand in emerging markets such as the Middle East, South Asia, and Africa. Skyworks Solutions expects its capacity utilization rate to further improve to over 40% in the third quarter. With the launch of new Apple and Android products in the third quarter, the market demand for smartphone PAs is expected to steadily recover. The company anticipates better performance in the second half of the year compared to the first half.

As a leading RF front-end chip company for smartphones, Qorvo predicts that Android channel inventory will continue to decrease in the second half of the year and return to normal levels by the end of the year. They estimate a sequential revenue growth of -2.05% to +4.27% in the second quarter, indicating a promising recovery outlook. Qorvo expects strong sequential revenue growth in the third quarter.

Overall, according to IDC, the global smartphone market is projected to experience a 1.1% year-on-year decline in overall shipments in 2023. However, it is expected to exhibit a trend of low in the first half and high in the second half of the year. There is potential for a rebound in the global market, particularly in China, during the second half of this year.

In the PC market, although there was an overall decline in the first half of the year, the recent rate of decline has been narrowing. According to Canalys statistics, global PC market shipments only declined by 12% in the second quarter, which is much smaller compared to the over 30% decline in the previous two quarters. Canalys Chief Analyst Ishan Dutt pointed out that there are signs indicating the resolution of many issues that have been impacting the PC industry.

In the data center server segment, while traditional applications have shown weak growth, the demand for AI chips remains strong, especially with the rapid development of generative artificial intelligence (AIGC), driving the growth of related processors, particularly GPUs.

TrendForce estimates that the shipment volume of AI servers (equipped with main chips such as GPUs, FPGAs, ASICs, etc.) will reach nearly 1.2 million units in 2023, with a year-on-year growth of 38.4%, accounting for 9% of the total server shipments. This will drive a significant increase in the shipment volume of AI processors, with an expected growth rate of 46%. The five major electronic contract manufacturers in Taiwan (Foxconn, Quanta, Compal, Wistron, and Inventec) all have a positive outlook on the AI server market in the second half of the year. Among them, Foxconn (with over 40% global server market share) expects 100% growth in its AI server business in the second half of the year.

In the chip sector, let’s continue with the example of memory. In the second quarter, although the market remained sluggish, there was some improvement on a sequential basis, with low-inventory customers starting to place orders. In terms of specific applications, PC demand was better than in the first quarter, and with the driving force of AI servers on memory chips, there is a more optimistic outlook for the second half of the year. Micron Technology mentioned that prices for DRAM and NAND Flash will continue to decline, but the rate of decline is slowing down. Memory module manufacturer ADATA stated that the price decline for memory in the third quarter will significantly narrow, and prices are expected to bottom out before the fourth quarter. Given the higher inventory levels for NAND Flash, DRAM prices are expected to bottom out before NAND Flash, with the latter potentially rebounding by the end of 2023 or the first quarter of 2024.

TrendForce estimates that the average price decline for DRAM in the third quarter of this year will narrow to 0-5%. However, due to high inventory levels among suppliers, it is difficult to predict whether DRAM prices will reach the bottom and rebound in 2023.

Overall, among all applications and chip types, the market conditions for memory are the least optimistic. Even if there is some improvement in the second half of the year, it is not expected to be significant.

Now let’s take a look at the upstream wafer foundries and the closely related IC design industry.

In certain niche application areas, relevant IC design companies have already observed signs of recovery. One notable example is the display panel driver ICs. MediaTek believes that the growth momentum seen in the second quarter will continue in the second half of the year, driven by new products and the increasing market share of AMOLED panels. ICs related to laptops are also experiencing a recovery. Elan, a touchpad manufacturer, has already seen a rebound in shipment volume and has positive expectations for MOSFETs and high-speed transmission interface chips in the third quarter. In the power management IC (PMIC) sector, some companies have indicated that their revenue will grow in the third quarter, and the supply chain is expected to clear inventory in the second half of the year.

Major wafer foundry company UMC expects the capacity utilization rate for the 28nm process to rise above 90% in the coming months. Their 28nm production line focuses on manufacturing OLED driver ICs, digital TV ICs, as well as products such as Wi-Fi 6 and 6E. SMIC (Semiconductor Manufacturing International Corporation) has stated that the capacity utilization rate for the 28nm/40nm process has already recovered to 100%, mainly producing new products such as smartphone display driver ICs (DDICs) and surveillance DDICs.

Overall, driver ICs are a focal point for the second half of the year and represent the industry’s biggest hope for recovery.

Conclusion

Overall, the first half of the year has been challenging, and the difficulties are expected to persist in the second half. However, there are signs of recovery in the entire electronic semiconductor industry, which instills confidence that the second half of this year can lay the foundation for overall growth in 2024.

1. This article is compiled from online sources. If there is any infringement, please contact us for removal.

2. The published content represents the views of the author and not the position of DiskMFR.

3. Recommended Reading: Decoding German Auto Industry Chain: A Complete Overview

4. Recommended Reading: Semiconductor Market: Micron’s Product Prices Surge by 2025

5. Recommended Reading: Continuous Rise in 2024 DRAM Prices: 4-Month Upward Trend

6. Recommended Reading: NAND Flash Industry Bounces Back: Profits Soar in 2024!

7. Recommended Reading: NVIDIA CEO: The Next Industrial Revolution Begins