Can you feel me with you?”

Directed by Spike Jonze and released in 2014, this line is spoken by the artificial intelligence operating system “Samantha” to the male lead in the sci-fi movie “Her.” As a film depicting love between humans and artificial intelligence, it almost foretells the current trend of major companies heavily investing in AI for social interaction.

Since the advent of ChatGPT, models capable of emotion recognition have rapidly progressed in the era of large models. The emotional and sentimental value provided by AI humanization is being explored. Major companies like Baidu, Douyin (TikTok), Tencent, and Meituan, among others, are returning to the social race through AI. Their common approach revolves around the interaction between real and virtual artificial intelligence.

Starting from when some large models officially opened their services to the public on August 31st, social interaction seems to be the second curve opened by major manufacturers targeting the consumer market, following the utility applications.

From the currently available tests like Baidu’s “Wanhua,” Douyin’s “Xinqing,” Meituan’s “WOW,” and other apps, AI socializing predominantly focuses on perceiving user emotions and providing emotional value through companionship in conversational forms. For instance, Kuaishou’s “AI Xiao Kuai” also provides familiar utility functions like text-to-image and text editing.

This implies that the products launched by various companies are highly homogeneous in design and functionality. This not only easily shifts competition to the hard-to-perceive level of model capability but may also lead to the dilemma where past social products “born in user acquisition, die in user retention.”

Currently, it seems that different players have relatively “uniform” understandings of their products and have not yet entered the mature stage of differentiation. Moreover, compared to the diverse gameplay of overseas AI socialization, the concentrated launch of tests hints at some rushed development. Claiming to reshape thousands of industries through AIGC into social interactions, what kind of story can be told?

01

Unraveling the Intricacies: AI’s Mutual Journey with Social Interaction

The social track has long entered a growth dilemma. In the strong-linked social field constructed by traditional IM (instant messaging), WeChat towers over others with a user base of 1.327 billion. As for stranger-based social platforms built around LBS (location-based services), gaming, live streaming, and other forms of entertainment, only a few survivors like Soul and Yingke have entered a period of refined operations due to sluggish user growth.

Even relatively concentrated traffic gateways like Alipay, Xiaohongshu (Red), and Douyin (TikTok) mainly add social functionalities as an adjunct.

Taking ByteDance as an example, “Duoshan,” rapidly gaining momentum leveraging Douyin’s traffic pool, couldn’t escape the fate of “much ado about nothing.” After downplaying its video features in September this year and shifting toward socializing among acquaintances, it’s now absent from the overall free iOS charts, ranking beyond the top 100 in social free charts.

“The coming and going of people” is a common dilemma in the social track. Relying on linking tools no longer guarantees retention, an industry consensus. Developing new gameplay is imperative.

Since linking is ineffective, let’s set it aside for now. Burning money is unsustainable, so let’s rely on innovative gameplay to attract new users. The core of AI companionship lies in pre-set or user-designed Chat Bots. Unlike AI algorithms that were once introduced into the track, AIGC’s inclusion doesn’t aim to consolidate or enhance social functionalities like long-distance matching or interest-based socializing. Instead, it fundamentally disrupts the linkages – the very essence of socializing.

At first glance, today’s AI socialization appears to be the new growth point the social industry is trying to explore amidst the waning mobile internet dividend. In reality, AIGC needs the grand stage of socializing due to the lack of concrete C-end scenarios.

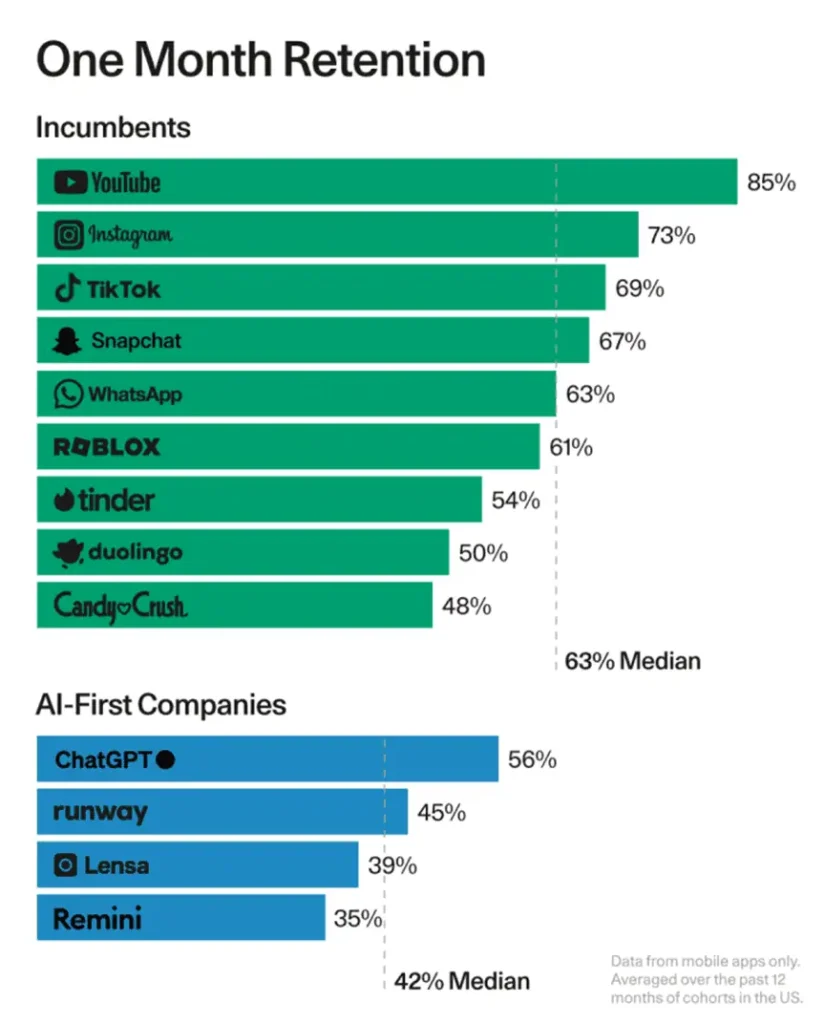

According to Sequoia Capital’s “Generative AI Act II” data, AIGC applications, including ChatGPT, have been significantly outperformed by well-known mobile applications in terms of user retention and activity. Taking the first-month retention as an example, even OpenAI has failed to reach the median of mobile applications._

Please note that this translation is a direct and accurate representation of the original Chinese text, without additional explanations or interpretations.

The social track, with its high stickiness, high barriers, and high ceiling, naturally couples with emerging technologies, as evidenced during the rise of the metaverse in 2021. At a time when AIGC lacks a “foothold,” social interaction naturally becomes the target of many.

Unlike the current “two-way running,” the relationship between AI and social interaction used to be more of a one-sided affair for the latter.

AI Labs established by tech giants like Tencent, NetEase, Alibaba, and the AI “Four Little Dragons” among unicorns have not invested too much attention in social interaction. Their focus lies more on technological breakthroughs and transforming their businesses.

After all, back then, AI had not yet demonstrated its universality through GPT-like applications. The scenario for conversational bots leaned more toward customer service. The industry spotlight on AI commercialization was primarily focused on the broader “search and promotion” in the mobile internet business—AI served as a means to deepen business engagement with users rather than being the business itself.

It’s now time for both sides to rescue each other.

02

Accelerating AI Socialization: Let’s Ripen Together

According to public information and the Photon Planet experience summary, current AI social products are still in the collective testing phase, and there are subtle differences in their strategies.

Players with social genes tend to integrate AI socializing into existing applications, essentially reconstructing the apps with AI. Examples include Tencent Music’s “Wei Ban,” Douyin’s “Xinqing,” and Weibo’s “AI Emotion Companion for Celebrities.” Companies like Baidu and Meituan, which didn’t establish a social presence in the mobile internet era, have launched standalone apps. Baidu, in particular, has introduced four applications to form a matrix.

The former relies on existing products, facilitating the sedimentation of user relationship chains. The latter starts from scratch, missing the first-mover advantage but leaning more towards AI-native approaches. Currently, it’s difficult to assert which approach is superior.

Regarding the products themselves, differences between players have started to narrow down, mostly revolving around the fine-grained functionality of AI virtual characters.

Douyin’s Xinqing is positioned as an emotional care robot, manifested through the direct messaging function of Douyin accounts. Before formal use, users need to confirm a disclaimer stating that it “cannot replace psychological counseling.” While it serves the purpose of comforting emotions, its functionality is limited, somewhat akin to the early days of anonymous online forums in the mobile internet era. Presently, the potential for linking real human interaction and commercialization is not visible.

Zhuimiandao, under the control of China Reading Limited, is based on AI to create an AI-native UGC (user-generated content) community primarily catering to users’ entertainment needs. Users can input and create virtual characters. Moreover, they’ve launched the “Little Theater” gameplay feature where users collaboratively create character stories and settings.

As an application that was introduced relatively early, Zhuimiandao’s content is relatively more comprehensive, and its progress in commercialization is more advanced. It gifts users 400 “starlight points” daily, allowing AI characters to respond 400 times, after which users must pay to continue the conversation. Additionally, paid content includes upgrades for the character’s memory focus ability and chat bubbles. However, the limit of 400 replies might be inaccessible for non-heavy users, and the paid chat bubbles seem conventional, showcasing their cautious approach towards commercialization.

In comparison, Meituan’s WOW seems relatively inexperienced. Our experience revealed that WOW supports voice chat and allows users to create characters. However, the voice lacks human emotions, and the limited preset sections result in UGC characters being somewhat unstable. More importantly, the basic “recommend-search-experience” chain in the UGC platform is not well-established. Users looking to converse with new characters can only rely on chance encounters in the discovery column by swiping left and right. Commercialization is currently not a topic of discussion.

Based on these three applications, it’s evident that despite the curtains being drawn for AI socialization, it seems that all products from different companies are still catching their breath.

AI-driven social applications, built upon large models, inherently possess limitations due to their capabilities. For instance, Zhuimiandao relies primarily on China Reading’s copyrighted novels as its corpus, leading in character realism and detail, possibly rotating its data wheel. Other companies might be slower in this regard, hence the urgency to swiftly introduce their products to acquire user-side data, which has become the rush for major companies to swarm into the AI social track recently. This rush also serves as evidence that their products need refinement and might have been developed hastily.

Given this scenario, it’s understandable that the pace of commercialization is relatively slow. Considering the context of user payment scenarios in the domestic consumer market, AI applications at a scale before their scaling-up struggle to find a smooth path to commercialization. Even as products gradually improve, AI socialization might still lack sufficient commercial space.

Taking Character.AI, one of the highest globally downloaded AI social products in the past six months, as an example, it stands as one of the most successful consumer applications overseas. Its functionalities include AI characters leaning towards intelligent agents, assistants, psychologists, celebrities, virtual personalities, customized UGC, and even AI group chat modes. It also features an original UGC community with rating and evaluation functions.

From its functionalities, we can easily discern traces that Chinese AI social applications might imitate. However, despite Character.AI’s popularity, its primary commercial path being subscription-based hasn’t been entirely smooth. This unicorn company has not disclosed revenue to date but has undertaken multiple funding rounds to expand its scale. Reports also suggest their intention to explore B2B business after scaling up their team.

WeChat’s founder, Allen Zhang, once posted in Fanfou’s diary, stating, “Every company launching a Weibo is an act that divides users’ attention.” It’s foreseeable that AI socialization might replicate the Weibo warfare of the mobile internet from a decade ago.

Even considering the increasingly crowded track and the urgency of the time window, relying solely on “functionality” as a product standard is insufficient.

03

From Companionship to Connection: Bridging the Gap

Communication methods such as pen and paper, mobile phones, emails, and IM, among others, have evolved with software and hardware advancements, but the unchanging factor remains their basic function of connecting people.

Traditional IM tools are iterated to provide communication for existing relationship chains, while stranger-based social platforms based on LBS serve as a conventional means to rapidly establish and solidify new relationship chains. Content communities and platforms offer a “showcase” for UGC content, solidifying fan relationship chains. It’s evident that a comprehensive social product currently remains within the confines of conventional norms.

Strictly speaking, AI social products can be considered as a niche category within the AI track rather than falling directly within the social track. This classification might stem from the hope of companies that missed out on the social cake during the era of mobile internet, aspiring to create an entry-level product akin to WeChat or Weibo in the AI era.

However, it’s also plausible that the interaction between humans and AI could evolve into a form of future relationship chains.

Looking at the current UGC content density and the bias towards public domain display in AI social, compared to WeChat, AI social leans more towards Weibo. Moreover, unlike Weibo where relationships formed between celebrities and ordinary users tend to be one-way after the celebrities join, the relationship chain between AI characters and users is two-way. This suggests a higher quality of interaction and potential for high stickiness.

Additionally, AI entities fine-tuned from large models are highly versatile. They can serve as a viable entity catering to users’ real needs by handling complex tasks and self-learning. There’s potential in exploring AI as the content for early stages while creating matching and connections between individuals in subsequent stages, all while maintaining the basic functionalities of virtual characters.

For instance, platforms like Character.AI currently offer virtual characters as fitness coaches, counselors, etc., providing users with more immersive information services. The latter approach requires companies to guide users through the journey from self-companion chats to connections in the product design.

Nevertheless, whether AI social products can make a significant impact in the domestic market as they do in the overseas market remains uncertain. Despite being a boon for socially anxious individuals, various product categories cater to this demand. Not to mention, the willingness of Chinese consumers to pay for software services and the stricter scrutiny AI applications face in the domestic regulatory environment.

“Socializing is just an investor’s dream of a blue ocean,” reminds Renren’s founder, Chen Yizhou. With IM, LBS, interests, AI, and various segmented tracks emerging over time, the social track remains “ever-evolving.” Perhaps, loneliness truly is an eternal human conundrum.