Recently, the Prime Minister of Israel announced that Intel will invest $25 billion in building a semiconductor wafer fab in Israel.

What does $25 billion mean? In 2022, Israel’s GDP was $522.5 billion for the entire year, so this investment represents approximately 4.7% of Israel’s annual GDP.

However, upon closer examination of the news, it is revealed that Intel is not investing the entire amount at once. They announced a $10 billion investment in 2019 and are now adding $15 billion.

Regardless, it’s still a substantial investment, and the new wafer fab is expected to start operating in 2027 and remain in operation until at least 2035, employing thousands of people. Intel’s revenue performance in the past two years seems to have been less than satisfactory, with a significant loss in the first quarter of this year. Given this background, why is Intel investing a staggering $25 billion in Israel? Not only Intel but many other semiconductor giants have established research and development centers in Israel. What is the charm of this “tiny country,” and how did it become a “chip kingdom”?

01. Israel is Not a “Promised Land” for Semiconductors

Israel, with an area of less than one-third of Chongqing City in China, is covered by two-thirds of the desert and has a population of less than 10 million.

In such a small country with harsh conditions, it is home to nearly 200 semiconductor companies, attracting research and development centers of giants like Apple, Samsung, and Qualcomm. Through its high-tech industry, Israel has become the only developed country in the Middle East.

How did Israel achieve this? What has its semiconductor industry experienced?

Over 3,000 years ago, the prophet Moses led the Jewish people out of Egypt and into the land of Canaan, which stretches from the Nile River to the Euphrates River. They believed it was the “promised land” given to the Jewish nation by God, a land flowing with milk and honey.

After being conquered by the Roman Empire, the Jewish people began a wandering journey that lasted for over 2,000 years. Finally, in 1948, the State of Israel was established, providing a homeland for the Jewish people. They returned to their “promised land.”

However, Israel did not find a land flowing with milk and honey.

It is the only country in the Middle East without oil and natural gas. With an area of only 25,700 square kilometers, it has barren land, limited water resources, and unstable geopolitical conditions. The conflicts with surrounding Arab countries have never ceased. It can be said that Israel has no inherent advantages in its natural conditions.

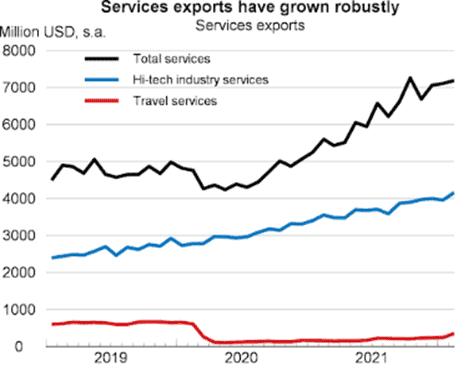

However, Israel is the only developed country in the Middle East, with a per capita GDP of $54,710 in 2022, ranking 14th in the world. A careful analysis of Israel’s industrial structure reveals that the tertiary sector accounted for a significant 70% of the GDP in 2022, with the high-tech service industry noticeably surpassing traditional services. In 2021, high-tech exports accounted for 54% of Israel’s total exports, making the high-tech industry the backbone of the Israeli economy. Among the high-tech products, the semiconductor industry, which accounts for 16% of high-tech exports, is particularly remarkable.

Israel’s semiconductor industry may not have had an early start, but it has experienced rapid development, quickly establishing itself as a leading region in the global semiconductor market.

In 1964, Motorola established its first semiconductor research and development center in Israel, marking the beginning of the country’s semiconductor industry.

In 1974, Intel, persuaded by its Israeli employees, set up its first research and development center outside the United States in Haifa, Israel. This event marked a turning point for Israel’s semiconductor industry, propelling its growth.

Over the years, Israel has been the birthplace of significant advancements in the semiconductor field. It produced the world’s first IBM personal computer with an 8088 processor based on the Microsoft operating system, Intel’s first Pentium CPU, TI’s Bluetooth chips, and more.

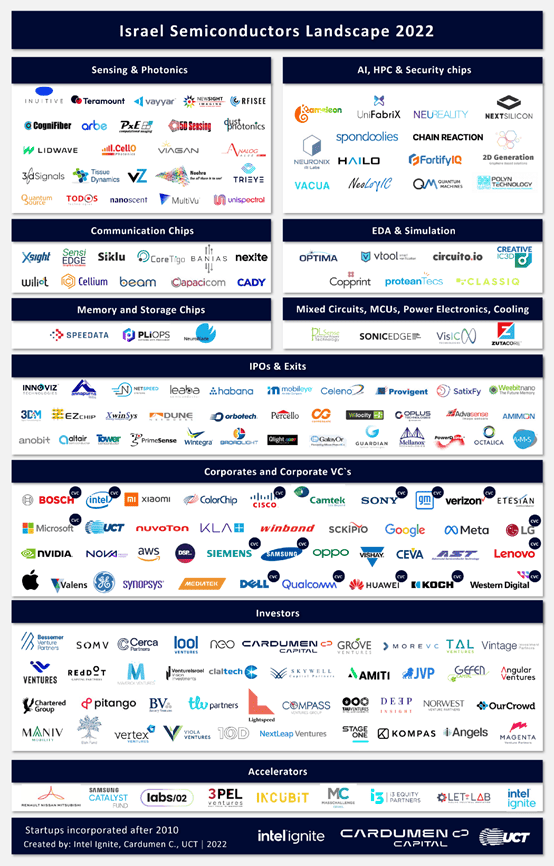

Today, Israel’s semiconductor industry has become a formidable force. With a population of less than 10 million, it boasts over 30,000 chip engineers and nearly 200 semiconductor companies. Major players such as Apple, Broadcom, Qualcomm, Samsung, Huawei, Texas Instruments, LG, Hitachi, Marvell, KLA-Tencor, and others conduct research and development activities in Israel.

The earliest batch to settle in Israel, Intel has now become the largest “patron” of Israel.

Currently, Israel has five semiconductor manufacturing plants (Fabs). Three of them belong to Intel, and two belong to Tower Semiconductor. Considering that Intel’s acquisition of Tower Semiconductor is already in progress, Israel’s fabs will be under Intel’s dominion in the future. In addition to the announced investment in the new plant, it is expected that Israel will have six fabs belonging to Intel in the future.

Under this vast layout, Intel has, directly and indirectly, employed more than 50,000 people in Israel. On average, nearly 6 out of every 1,000 Israelis have a direct or indirect connection with Intel.

In 2022, Intel’s exports in Israel reached $8.7 billion, accounting for 1.75% of Israel’s GDP and 5.5% of its high-tech exports. Some even say, “Intel is Israel, and Israel is Intel.”

This dominant influence is reminiscent of a similar situation in East Asia. Intel’s relationship with Israel is like that of TSMC (Taiwan Semiconductor Manufacturing Company) with Taiwan, China.

02. The Semiconductor Kingdom of Startups Lacks Local Giants

The land area of Israel is small, covered in deserts, and lacks resources. It is not a resource-rich country and cannot produce semiconductor materials. Due to geographical constraints, Israel’s semiconductor industry has unique characteristics: firstly, it focuses on chip design; secondly, it consists mostly of small and medium-sized enterprises without any local giants; thirdly, it navigates between China and the United States and is dedicated to doing business.

The reason for the emphasis on chip design is easily understandable. Without resources, one must rely on the intelligent minds of the Israeli people to pursue a high-end design path.

Chip design is the soul of Israel’s semiconductor industry. According to statistics, Israel possesses approximately 8% of the world’s chip design talent and research and development companies. Additionally, in 2021, there were a total of 37 multinational companies operating in the semiconductor industry in Israel. Major enterprises such as Apple, Broadcom, Qualcomm, Samsung, Huawei, and Texas Instruments are engaged in research and development activities in Israel.

Although Israel has fewer manufacturing facilities, it does not mean there are none. Currently, Israel has five wafer fabrication plants, mostly dominated by Intel. In terms of semiconductor equipment, there are multinational companies such as Applied Materials and Kulicke & Soffa, as well as local companies like Orbotech, Sela, and Jordan Valley.

Therefore, the current composition of Israel’s chip industry mainly consists of fabless chip design companies, multinational company research centers, semiconductor equipment enterprises, and a small number of wafer fabrication plants.

However, with so many chip giants establishing a presence in Israel, why hasn’t a local giant emerged?

The main reason for this is related to the operational model preferred by Israeli companies.

Israel is a highly entrepreneurial country. It is home to over 7,000 innovative technology companies, making it the most concentrated region for startups globally. There is approximately 1 entrepreneur for every 1,400 people in Israel, an unmatched startup ratio.

In the semiconductor industry, Israel ranked second globally in terms of the number of semiconductor startups in 2020, just behind the United States.

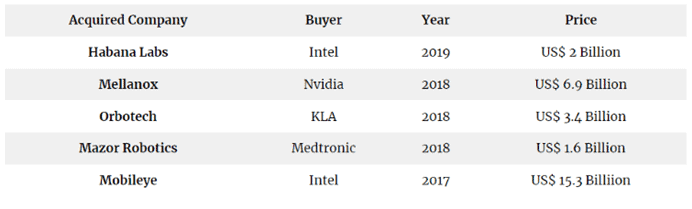

Due to their love for innovation and the “new adventure,” when the semiconductor elites in Israel establish their own semiconductor companies, their goal is not necessarily to become or surpass the local chip giants but rather to seek an acquisition. Therefore, the typical path for most Israeli semiconductor companies is as follows: establish a startup company, achieve a breakthrough in a certain field, get acquired by a giant corporation, and then embark on the next entrepreneurial journey.

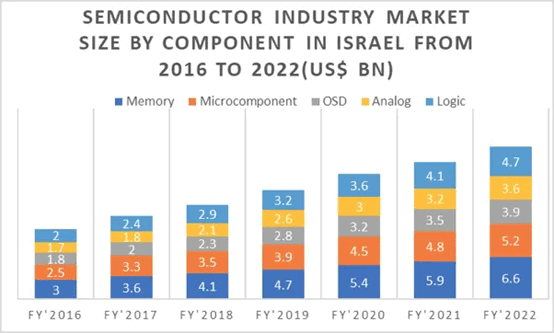

Due to this, most of the hundreds of Israeli semiconductor startups focus primarily on honing their technology rather than commercial and operational aspects. Furthermore, let’s take a closer look at the Israeli semiconductor market. Storage occupies the largest share in the Israeli semiconductor market, followed by power management ICs, logic chips, OSD (Screen Display), and analog chips.

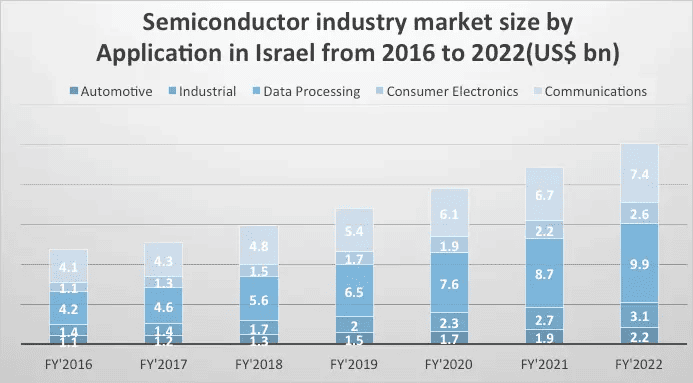

The Israeli semiconductor market can be further segmented as follows: the largest market is data processing, followed by communication, industrial, consumer electronics, and autonomous driving.

Once Israel found its path in the semiconductor industry, it experienced steady growth year after year. It is projected that the revenue of the Israeli semiconductor market can reach $114 million in 2023. It’s worth mentioning that China is the largest consumer market for Israeli semiconductors.

Israel has mastered the art of doing business and, in the current geopolitical instability, it chooses to navigate between China and the United States, benefiting from both sides.

In 2018, during the escalation of tensions between China and the United States, Israel witnessed an 80% surge in semiconductor exports to China. Semiconductors quickly became an important part of the economic relationship between China and Israel. The latest data shows that in 2021, China remained the largest export destination for Israeli chips.

How does the United States feel about Israel doing business with China in the semiconductor industry? Well, Israel treads carefully, staying within the boundaries of the “periphery” of the Wassenaar Arrangement. They may test the limits on certain regulations but avoid confrontation with the United States.

By not offending either side, this business thrives.

03. Abundant Talent and Financial Support for the Israeli Semiconductor Industry

Despite the challenging “inherent conditions” in Israel, how did it manage to develop into a semiconductor kingdom?

In a nutshell: Money and talent.

Regardless of the industry, funding is always a crucial factor in a company’s development, especially in the semiconductor industry.

Semiconductors are capital-intensive and involve continuous investment, with no guarantee of success. It is a high-risk, high-reward industry. Surviving as a semiconductor startup is not easy, as even a minor mistake can lead to failure with little room for error.

This is where the role of venture capital (VC) becomes vital. VC refers to financially capable investors who provide funding and take on the risks associated with supporting entrepreneurs with specialized technology and promising market prospects but lacking initial capital.

The success of Silicon Valley, the cradle of global technology, lies in its mature VC ecosystem, which significantly increases the tolerance for entrepreneurial failures and provides shelter for startups, offering a supportive environment.

Tel Aviv, the capital of Israel, has emerged as a hub for venture capital and startup activity. It ranks second only to Silicon Valley in terms of deal flow in the technology sector. Reports indicate that 11% of global VC investments in the field of Industry 4.0 have gone to Israeli companies. In 2021, Israeli venture capital reached $10.8 billion, with per capita venture capital investment being 28 times that of the United States. Although there was a slight decline in venture capital investment in Israel in 2022, it still amounted to a significant $8.1 billion.

In addition to the influx of capital, the Israeli government provides legal protection and funding for startups. As early as 1984, Israel enacted the “Encouragement of Industrial Research and Development Law” (R&D Law) to support and incentivize research and development activities.

These factors, including abundant funding from venture capital firms, a culture of risk-taking and entrepreneurship, and government support through laws and funding programs, have contributed to the development of Israel as a semiconductor powerhouse.

Under this law, research and development (R&D) projects that meet specific criteria and are approved by the Office of the Chief Scientist (OCS) Research Committee are eligible for up to 50% funding of approved expenses. In exchange, the recipient is required to pay royalties to the OCS. The recipient must submit regular reports on the payment of royalties, and the OCS has the right to inspect the recipient’s books.

In terms of taxation, Israel also provides favorable policies for high-tech companies. In 1985, the corporate tax rate in Israel was 61%, which has been reduced to 23% by 2022. Israel also has a dedicated “Angels Law” that offers tax benefits to private investors in young companies, especially those with R&D capabilities.

Israel has specific laws in place to encourage R&D innovation and monitor the allocation of funds and the effectiveness of projects. By generously providing funds and ensuring that money is spent effectively, the government maximizes the impact of its support.

The government’s generous subsidies, along with a thriving venture capital industry, ensure that Israeli semiconductor companies are well-funded.

Apart from having sufficient funding, having talented individuals is crucial.

More than 70% of Israel’s population is Jewish. When it comes to Jewish people, the stereotype of their high intelligence often comes to mind. It’s hard to definitively attribute exceptional genetic traits to Jewish individuals, but they indeed have a significant number of highly educated individuals.

According to data from China’s Ministry of Commerce, Israeli researchers account for 6% of the country’s population, with 135 scientists and engineers per 10,000 people, surpassing the United States figure of 85 and ranking first in the world. Seventy-seven percent of the Israeli population has received education for 12 years or more, and 20% hold university degrees, with nearly 200,000 university students in the country.

In addition to nurturing a large pool of talented individuals through education, Israel has also attracted a substantial number of highly educated immigrants.

Jewish people have their unique “Ingathering of Exiles” vision, and after the establishment of Israel, the Law of Return was enacted, granting Israeli citizenship to any Jew from around the world who immigrated to Israel.

Jewish immigrants from developed countries and the former Soviet Union have brought a wealth of scientific and technological expertise to Israel, significantly contributing to its innovation. These immigrants often have higher levels of education and include many outstanding engineers, playing an indispensable role in the development of Israel’s high-tech industry.

04. Conclusion

In the ancient land of Canaan, the fabled “Promised Land,” the reality of Israel was a land with almost nothing.

Amid the desert-ridden Middle East, the tiny nation of Israel has overcome its natural disadvantages and inherent limitations through strategies such as innovation and capital, catapulting itself to the forefront of the global semiconductor industry in a short period. The myth of Israel’s semiconductor success is not a result of divine promises but rather the collective efforts of countless individuals, akin to Moses and his descendants.

References:

[1] Development Experience and Enlightenment of Israel’s Semiconductor Industry, China Cybertech Institute

[2] Why Israel Doesn’t Have a Semiconductor Giant, semi-engineering

[3] Israel, the Tech Kingdom in the Desert, SiliconWadi

[4] This article is compiled from online sources. If there is any infringement, please contact us for removal.

[5] The published content represents the views of the author and not the position of DiskMFR

Recommended Reading: